Russia’s invasion of Ukraine threatens to pile further pressure on chip manufacturing as a squeeze on the supply of rare gases critical to the production process adds to pandemic-related disruptions.

Ukraine supplies about 50 per cent of the world’s neon gas, analysts have said, a byproduct of Russia’s steel industry that is purified in the former Soviet republic and is indispensable in chip production.

Manufacturers have already been reeling from shortages of components, late deliveries and rising material costs, with companies that rely on chips, such as carmakers, facing production delays as a result.

Many companies, including US manufacturers Applied Materials and Intel, have said constraints would persist into 2023. Demand for raw materials is also expected to rise by more than a third in the next four years, as businesses such as the world’s biggest contract chipmaker Taiwan Semiconductor Manufacturing Company increase production, said consultancy Techcet.

“We are in great trouble. We have no rare gases to sell,” said Tsuneo Date, who runs Daito Medical Gas, a pressurised gas dealer north of Tokyo.

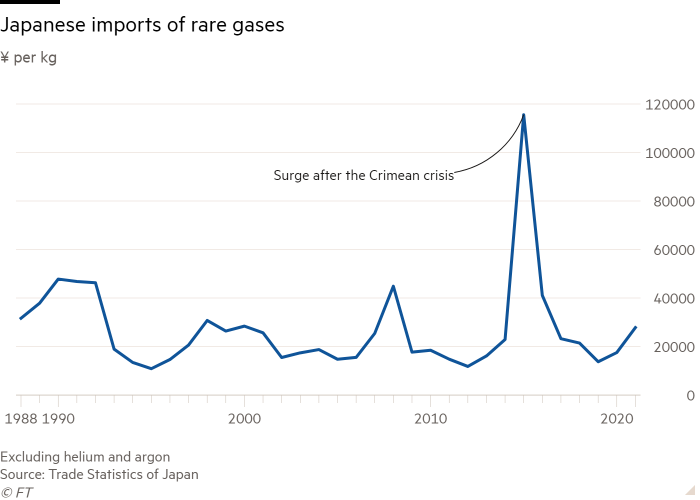

When Russia invaded Crimea in 2014, neon prices shot up by at least 600 per cent. Companies have said they can tap into reserves but the rush to find suppliers that are not in eastern Europe is causing shortages and price hikes, not only of neon but also other industrial gases such as xenon and krypton.

Forty per cent of the global supply of krypton comes from Ukraine. The price of the gas, which is used in semiconductor production, rose from ¥200-¥300 ($1.73-$2.59) per litre to nearly ¥1,000 ($8.64) per litre by the end of January, according to Date.

He added that prices had been rising before the war because of supply chain disruptions but said “the Russian invasion of Ukraine is making the situation worse” and that he had recently been forced to turn down orders from new customers.

Companies along the supply chain developed new technologies, diversified sources of neon gas and beefed up reserves after the Crimea crisis, which provided some breathing room. In 2016, the multinational industrial gas supplier Linde invested $250mn in a neon production facility in Texas as customers sought to diversify supplies.

Yoshiki Koizumi, president of trade publication Gas Review, said “the supply of neon, xenon and krypton is definitely getting tighter because chipmakers and trading houses are making more orders in expectation that in the future they won’t be able to get as much as they want”.

Ke Kuang-han, a semiconductor analyst at consultancy Techcet, said the reaction has been “immediate”, adding: “I’ve heard spot prices have jumped several-fold.”

Pricing for neon is agreed through individual long-term contracts with processors and chipmakers and some gas is also traded on the spot market. Several chipmakers and large gas companies in Japan declined to comment on current spot prices.

The mitigating efforts had given companies some capacity to manage the disruption in the short term and they hope the conflict would not be prolonged, he added.

Deutsche Bank said in a research note that inventory levels in the industry typically last around three to four weeks.

Kim Young-woo, a tech analyst at SK Securities in Seoul, said that while South Korean companies such as Samsung and SK Hynix could find replacements for some gases, “supply shortages could be serious for krypton and neon”.

Gas mixtures that include neon are used to power lasers for etching patterns into semiconductors. Shifting away from Ukraine is difficult because it has to be refined to a 99.99 per cent purity, a complex process that only a few companies around the world can do — including some based in the Ukrainian port of Odesa.

Underscoring the challenges, the White House has warned semiconductor makers to diversify their supply chains after Russia’s invasion. ASML, a Dutch company that makes machines used to manufacture chips, said it was looking for sources of neon outside of Ukraine.

Japanese chipmakers Renesas and Rohm said they either found supplies from other markets, such as China, or had stockpiled inventories of neon.

Samsung and SK Hynix, the world’s two largest memory chipmakers, “have plants in China so they will have little trouble getting the gases for chip production there”, Kim said. The companies said the war’s impact on their chip sales would be minimal in the short term.

But in a note published shortly before the invasion, analysts at TrendForce warned that even if alternative sources are secured “product certification will take several months or even more than half a year”, causing “scarcity”.

They warned that “the automotive industry, which requires large quantities of power management chips and power semiconductors, will face a new wave of material shortages”.

Akira Minamikawa of market research firm Omdia said that all products using chips would be affected because only the most cutting-edge semiconductors did not require neon in their production. “It’s not like neon is used in chips for cars but not for smartphones.”

Reporting by Antoni Slodkowski and Eri Sugiura in Tokyo, Song Jung-a and Edward White in Seoul and Eleanor Olcott in London

Comments are closed, but trackbacks and pingbacks are open.