Stay informed with free updates

Simply sign up to the Global Economy myFT Digest — delivered directly to your inbox.

This article is an on-site version of our FirstFT newsletter. Sign up to our Asia, Europe/Africa or Americas edition to get it sent straight to your inbox every weekday morning

Good morning. China’s manufacturing activity contracted for the second month in November, indicating weakening momentum in the world’s second-largest economy.

The country’s official manufacturing purchasing managers’ index came in at 49.4 this month, lower than a median forecast of 49.8 in a Bloomberg poll and slightly below a reading of 49.5 in October. A reading below 50 marks contraction from the previous month.

The non-manufacturing PMI came in at 50.2, remaining in positive territory but marking the lowest reading since China was swept by Covid last December. The services industry activity component of non-manufacturing PMI registered a contraction at 49.3 points compared with a reading of 50.1 the previous month.

The declines followed better than expected gross domestic product growth of 4.9 per cent year on year in the third quarter, which had raised hopes that China’s economy, slow to recover after the pandemic, was turning a corner.

“That’s a bit of a setback I think because of course the services sector — particularly private consumption demand, services demand — was supposed to be a pillar of strength and lost momentum into November,” said Frederic Neumann, chief Asia economist at HSBC. Here’s why analysts are expecting China’s economy to “dip” again at the end of this year and into 2024.

-

More economic data: Inflation in the eurozone has fallen far more than expected to 2.4 per cent in November, the slowest annual pace since July 2021

Here’s what else I’m keeping tabs on today:

-

COP28: The UN’s annual climate summit continues in Dubai, where host nation the United Arab Emirates is preparing to launch a $30bn climate-related investment fund with BlackRock, TPG and Brookfield.

-

Economic data: S&P Global/Cips final November manufacturing purchasing managers’ index is due for the EU, France, Germany, Italy, Japan, UK and US.

-

G20: Brazil takes over the rotating one-year presidency of the group of leading economies.

How well did you keep up with the news this week? Take our quiz.

Five more top stories

1. Hamas yesterday released six women and two children held in Gaza as the delicate exchange of Palestinian prisoners for Israeli hostages entered its sixth day. In return, Israel was to free another 30 Palestinian women and children from its prisons, according to the Qatari foreign ministry. US secretary of state Antony Blinken met Israeli and Palestinian leaders to push for an extension of the temporary ceasefire, which is set to expire today at 7am local time.

2. PwC has been fined $7mn after a US regulator found that more than 1,000 of its audit staff in China and Hong Kong cheated on internal training exams designed to get them up to speed on US standards. The Public Company Accounting Oversight Board said that PwC staff improperly shared test answers over the course of at least two years up to 2020.

3. Activist investor Nelson Peltz has launched a second proxy battle at Walt Disney after the entertainment group rejected his push to join the board. People familiar with Peltz’s thinking said his main issues were with Disney’s share price and its margins as well as the board’s decision in July to extend chief executive Bob Iger’s tenure as chief by two years to the end of 2026.

4. Opec+ members have agreed to make additional voluntary cuts to oil production in 2024 in an increasingly fraught attempt to bolster the market. Crude prices fell after the unusual move owing to signs of ongoing strains in the group.

5. The Taliban have carried out hundreds of floggings over the past year as the hardline regime consolidates its control over Afghanistan. The Taliban-controlled Supreme Court has imposed the punishment for crimes ranging from adultery and sodomy to robbery. All were flogged except for two people who were executed for murder, according to an analysis by open-source project Afghan Witness shared with the FT.

The Big Read

In late 2020, Huawei was fighting for its survival after the Trump administration hit the Chinese mobile phone maker with crippling sanctions, cutting it off from global semiconductor supply chains. Yet nearly three years later, Huawei unveiled a new device, the Mate 60 series phone, powered by a cutting-edge chip made in China. Interviews with dozens of industry insiders offer the closest look yet at how Huawei was able to overcome sanctions and surprise Washington.

We’re also reading . . .

Chart of the day

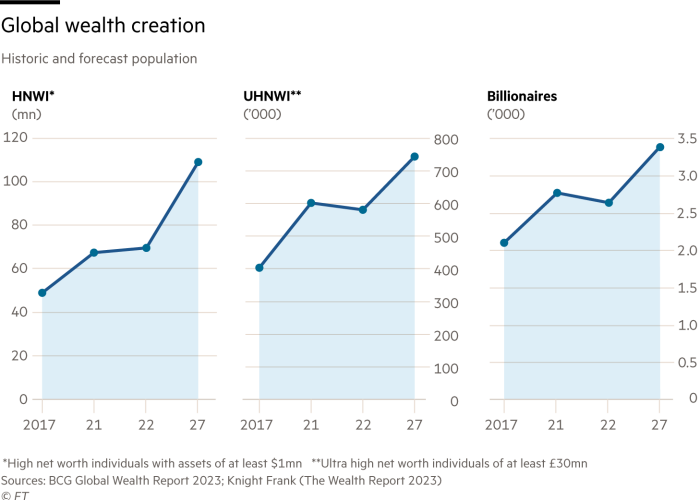

New members of the global super-rich gained more of their assets through inheritance than through wealth creation this year — the first time that this has been recorded by Swiss bank UBS in its nine years of surveying global billionaires. The study found that the number of billionaires worldwide rose from 2,376 to 2,544 in the 12 months to April 2023.

Take a break from the news

Influence — the power to persuade, advocate for change and imagine better ways of doing things — takes many forms. Nowhere is this more clear than in the FT’s 25 most influential women of the year. Meet the women at the helm of the world’s most profound transformations.

Additional contributions from Grace Ramos and Euan Healy

Comments are closed, but trackbacks and pingbacks are open.