[ad_1]

Welcome to FT Asset Management, our weekly newsletter on the movers and shakers behind a multitrillion-dollar global industry. This article is an on-site version of the newsletter. Sign up here to get it sent straight to your inbox every Monday.

Does the format, content and tone work for you? Let me know: harriet.agnew@ft.com

One thing to start: It was great to see so many of you at our Future of Asset Management North America event last week in New York. Thank you to all who attended.

Inside the ‘basis trade’ on the Treasuries market

Over the past month, the Bank for International Settlements, a convening body for the world’s central banks, and US Federal Reserve researchers have pointed to a rapid build-up in hedge fund bets in the $25tn US government bond market.

The so-called basis trade involves playing two very similar debt prices against each other — selling futures and buying bonds. The difference between the two is small, often just a few fractions of a percentage point, so the return is minuscule.

But hedge funds — among them Citadel, Millennium Management and Rokos Capital Management — can magnify their bets that the gap will close by using borrowed money to fund the trade. The head of one fund that has engaged in this trade says traders have in the past been able to lever up to 500 times.

In this must-read Big Read by my colleagues Kate Duguid, Costas Mourselas and Ortenca Aliaj, they explore why the Fed believes the strategy poses a “financial stability vulnerability” while the BIS has said it has the potential to “dislocate” trading.

Such risks matter because the US Treasury market underpins the global financial system. The yield on federal government debt represents the so-called risk-free rate that is the benchmark for every asset class.

And the bet on the Treasury market has one thing in common with the UK’s liability-driven investment meltdown last year: the collision of heavy leverage with sudden and unexpected market movements, and the speed with which that can cause potentially serious problems.

Analysts, experts and investors argue that the Fed’s interventions in the Treasury market in September 2019 and March 2020, among others, have led to a belief that the Fed will intervene in any instance of extreme market instability, implicitly backstopping speculative trading.

“I do think moral hazard is very real here,” says Morgan Ricks, a professor at Vanderbilt Law School, where he specialises in financial regulation. “So I don’t think it’s unreasonable to think that the Fed’s implicit backstop of this trade is encouraging more of the trade to happen.”

But hedge funds retort that they are now vital providers of liquidity in this sector. “The market needs arbitrageurs,” says Philippe Jordan, president of Capital Fund Management, a hedge fund with $10bn in assets. “Without them it’s going to be more expensive for the government to issue paper, and more expensive for pension funds to trade. There is a reason this ecosystem exists.”

Read the full story here

Regulators turn up heat on showdown banks

A few years ago regulators’ thinking on non-financial bank risks was on whether to designate individual non bank institutions — such as major asset managers — as “too big to fail”, just as global regulators do with systemically important banks.

But according to Ashley Alder, a veteran international markets regulator who now chairs the UK’s Financial Conduct Authority, a “turning point” was the March 2020 “dash for cash”, when bond markets went into freefall in the early pandemic, forcing central banks to intervene.

Now policymakers have shifted to identifying risks across the shadow banking sector as a whole, Alder said. Together, the non-banks on regulators’ radar account for 50 per cent of global financial services assets.

Global financial regulators are preparing a clampdown on shadow banking as they confront the unintended consequences of previous waves reform that pushed risks into hidden corners of the financial system, write my colleagues Laura Noonan and Katie Martin in London.

Policymakers have been warning all year — with mounting alarm — about the risks and sizes of bets taken by some hedge funds and private equity houses. But now, fears that rising interest rates could derail some of their mammoth bets is turning that talk into action.

Last week, we revealed that the UK’s Financial Conduct Authority is preparing to launch a sweeping review of valuations in private markets, amid growing fears over the impact of higher borrowing costs on the sector. Meanwhile the Bank of England has declared such “non-banks” to be so important that policymakers should create a new facility to lend directly to them in times of crises.

Global watchdogs at the Financial Stability Board have launched a new review that could limit hedge fund leverage and increase transparency on their borrowings. In the US, the Securities and Exchange Commission has brought forward policies on fund transparency so stringent that some are threatening lawsuits.

“Clearly there is work we still need to do,” Klaas Knot, chair of the FSB, told the Financial Times. “We are moving from policy development to policy implementation,” he said.

As well as the bond market turmoil in March 2020 and the spectacular near-death experience of pension fund hedging strategies in the UK a year ago, several other causes for alarm have arisen. The implosion of family office Archegos bit a hole into several banks’ balance sheets in March 2021. The nickel market malfunctioned in March 2022. And this year, an outsized burst higher in US government bond prices following the demise of Silicon Valley Bank drew regulatory concern over hedge funds’ bets.

The causes of these breakouts were different, but the key protagonists were all part of the shadow banking universe, and each had been a risk lying in plain sight.

Read the full story here, in which Katie and Laura explore the potential unintended consequences of an overly heavy hand, the need for policymakers to balance allowing investors to take their own risks and global stability, and why for some market participants, the action on shadow banks isn’t coming fast enough.

Chart of the week

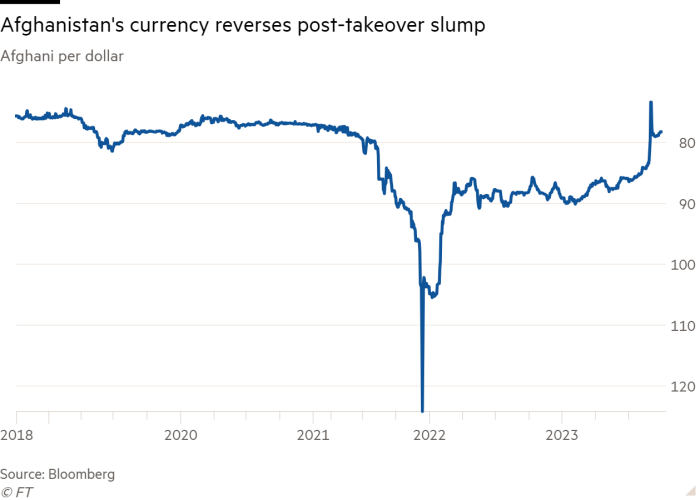

Afghanistan’s currency has finished the third quarter as the best-performing currency in the world as foreign aid and strict capital controls have helped the afghani recover from historic lows touched after the Taliban’s takeover two years ago.

The almost 10 per cent climb for the afghani also makes it the third-best performing currency this year behind the Colombian peso and Sri Lankan rupee, write Hudson Lockett in Hong Kong and Benjamin Parkin in New Delhi. This is helping to bolster the Taliban’s finances as the regime struggles to cope with widespread unemployment.

Its takeover from the US-backed government in 2021 triggered a historic economic collapse, with the country’s gross domestic product immediately contracting by a fifth as international powers withdrew support and imposed sanctions.

The gains this quarter have erased the currency’s post-takeover slump, but the country is now among “the poorest two or three countries in the world”, according to the UN Development Programme.

Afghanistan’s economy has nonetheless shown signs of stabilisation, as the Taliban has consolidated control and taken steps to support the afghani, which initially fell precipitously after the takeover.

Inflows of dollars from the UN and other aid from international donors have helped to stabilise the afghani, as have currency controls imposed by the Taliban restricting ordinary Afghans’ access to foreign exchange transactions.

“They’ve put quite strict capital controls on so you can’t exchange afghanis for dollars now,” said Gareth Leather, a senior economist focused on emerging markets at Capital Economics. “That, together with the aid money, is supporting the currency.”

The prospects for the country are nonetheless bleak. The central bank’s overseas reserves have been frozen by the US, depriving authorities of a vital source of foreign currency. And the UN has so far only raised about 25 per cent of more than $3bn in humanitarian aid it estimates the country needs this year.

Five unmissable stories this week

Jo Taylor, chief executive of the Ontario Teachers’ Pension Plan, says the scheme is in “risk off” mode and is expecting a recession in the US, Canada and Europe in the next six months. Speaking at the FT FOAM event in New York, he warned that geopolitical tensions are making life increasingly difficult for international investors to navigate.

Klaas Knot, chair of the Financial Stability Board, says the world’s financial stability watchdog is launching a probe of the build-up of debt outside traditional banks, as it seeks to limit hedge funds’ borrowing and boost transparency.

Singaporean sovereign wealth fund GIC, one of the world’s most influential investors, sold its stake in a Vista Equity Partners fund after the buyout firm’s founder Robert Smith was embroiled in a tax scandal.

Ken Griffin, founder of Citadel hedge fund, has joined a consortium of investors led by Sir Paul Marshall to prepare a bid for the Telegraph Group, which would mark the first time the US billionaire has personally invested in media.

Wells Fargo has partnered with asset manager Centerbridge to launch a $5bn private credit fund that will lend to midsized US companies, as banks race to find a toehold in the rapidly growing private credit industry.

And finally

The New River Path is neither a new nor a river. But it is a charming walk, along the aqueduct that was designed in the 17th century to bring fresh water from its source in Hertfordshire to London. I started at Alexandra Palace and walked the path to its original end in Islington, stopping for a delicious lunch at The Dusty Knuckle café in Harringay, and taking in the Woodberry Wetlands nature reserve and Clissold Park. To explore a network of 250 routes across the UK, check out the British Pilgrimage Trust.

Thanks for reading. If you have friends or colleagues who might enjoy this newsletter, please forward it to them. Sign up here

We would love to hear your feedback and comments about this newsletter. Email me at harriet.agnew@ft.com

[ad_2]

Source link