[ad_1]

This article is an on-site version of our Unhedged newsletter. Sign up here to get the newsletter sent straight to your inbox every weekday

Good morning. Ethan is sleeping off his jet lag, so the indefatigable bond expert Kate Duguid has stepped in to help explain the wild doings in long Treasuries yields — arguably the most important prices in the world. If there are parts of the story we’ve missed, email us: robert.armstrong@ft.com and kate.duguid@ft.com.

Long rates gone wild

It tells you something about economics and finance as scientific endeavours that very basic variables can change significantly and experts in the field disagree about the causes. So it is with the big move in long-term interest rates in September.

The 10-year Treasury yield rose by about half a percentage point last month, to 4.6 per cent. There were several months in 2022 during which rates rose as fast or even a bit faster, but it was easier to understand back then, when the Fed was raising rates at 75-basis point slugs and inflation was rising. The Fed paused rates in September, and core inflation is flatlining. So what gives?

A little context at the outset helps. Here’s a chart of the 10-year yield, the fed funds rate, and 10-year break-even inflation (the 10-year yield minus the 10-year inflation indexed yield) since early 2020. Just concentrates on the yield, in pink, for now:

A look at this chart serves to caution against reading too much into the recent move, as dramatic and surprising as it has been. In a three-year view, the month’s move looks like a blip. In a few years time, it will probably disappear into a broad narrative describing the current growth-inflation-policy-rates cycle. That narrative will probably say something like: “there was a pandemic that shocked both supply and demand, followed by massive monetary and fiscal stimulus, which led to massive deficits and loads of Treasury issuance; inflation rose, followed by both short and long term rates.” The exact order in which those things happened may be waived away as noise.

That said, for those of us who are trying to figure out what the market is telling us right now, the move could not be more important. It is not even clear where we are in the business cycle, and we are never going to figure that out unless we know why interest rates are moving as they are. Rates are the true north in whatever inadequate market compass we may have.

So, what explains the September spike? There are three main theories:

Long rates are signalling “higher for longer” monetary policy. This is probably the consensus view, if there is one. Last Friday, the FT’s market report started out like this:

US stocks registered their first negative quarter of 2023 on Friday, ruling off on a bumpy three months for equities and bonds as investors shifted to the likelihood that although inflationary pressures may be easing, interest rates will probably remain higher for longer.

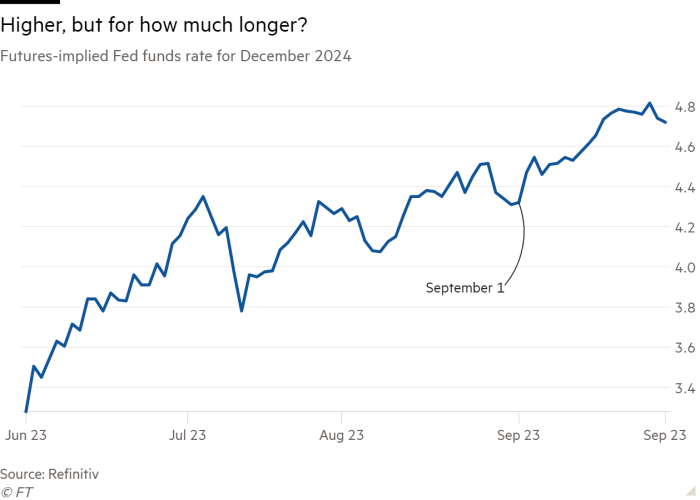

Simplicity makes this theory attractive. It also gets at least partial support from the markets estimates of what the Fed is going to do. Here is the evolution of the futures market’s estimate of the policy rate at the end of 2024:

Since the start of September, the market has erased almost two 25-basis point rate cuts it had been anticipating. That should put some upward pressure on long rates. But yields also moved up sharply last week, when end-2024 Fed fund expectations fell.

Other market signals are a poor fit with higher for longer, too. The rate-sensitive two-year yield has moved about half as much as the 10 year in September, which is an odd fit with the higher-for-longer story. Furthermore, as the rates team at the Netherlands’ Rabobank point out,

If the market did expect rates to be higher for longer, would one not expect this to result in a flatter curve — this as cuts are priced out and the longer run outlook for growth and inflation is adjusted downward? Long-run inflation expectations are, in actual fact, holding fairly steady

You can see inflation expectations going sideways in the first chart, above. What is driving long rates up is not inflation expectations, but real interest rates. One might also expect higher for longer to show up in wider credit spreads, too, as higher rates apply pressure to floating rate business borrowers. But spreads are mostly unchanged recently.

Long rates are signalling higher growth expectations. This is the preferred theory of Unhedged rates svengali Ed Al-Hussainy of Columbia Threadneedle. “Higher growth expectations are feeding into the long end. That is corroborated by higher oil prices and a higher dollar. This smells like a soft landing. It may be that markets are catching up to that idea,” said Al-Hussainy. It fits with the move in real rates rather than break-evens, too, and the strong news we have had from business investment. But, as we have written, the growth news has been good, but remains uneven and ambiguous, especially when one looks at the rest of the world.

Long rates reflect a higher term premium. The term premium — the additional yield at the long end over and above the expected path of short rates — has been low for a while. On the New York Fed’s estimate, it’s been reliably negative since 2017. Maybe investors are adding to the premium, pricing in some more risk to their estimates of where raters are headed?

Michael Howell of CrossBorder Capital thinks term premia are rising, but not because of higher expected volatility; measures of expected volatility have been falling. He thinks, instead, the supply-demand balance for long Treasuries has changed for the worse. There are more Treasuries and less appetite for them, as the US budget outlook weakens and QT continues (The resulting lower Treasury values are bad for risk asset liquidity and prices, because Treasuries are a crucial form of trading collateral).

Jay Barry of JPMorgan agrees with Howell that economic fundamentals and policy expectations can’t explain all of the September spike, making a supply/demand driven spike in the term premium an obvious explanation. He rejects the idea, though, arguing that the increase in supply is not yet acute enough to drive a fast increase in the term premium; he thinks it is a story for 2024. His chart:

Barry puts the spike down to technical factors, instead, such as changes in investor positioning and jitters from the impending government shutdown.

Barry is right at least this far: the increase in supply has been long telegraphed. When the Treasury announced their borrowing plans for the quarter, they boosted supply in 10- and 30- year bonds. But the extra supply has been long expected, and the auctions have gone smoothly.

What we think. The higher for longer theory seems wrong. The preponderance of data doesn’t seem to back it. The growth theory is more promising, but would be a lot stronger if the economic data was less equivocal. Given the mixed economic data, it is very likely the term premium is rising, but we don’t quite see the evidence for a surprise Treasury supply glut as of yet. So while a combination of the second and third theory is our best bet, we’re still a little puzzled.

One good read

A glimpse of the west’s future?

FT Unhedged podcast

Can’t get enough of Unhedged? Listen to our new podcast, hosted by Ethan Wu and Katie Martin, for a 15-minute dive into the latest markets news and financial headlines, twice a week. Catch up on past editions of the newsletter here.

[ad_2]

Source link