[ad_1]

Welcome to FT Asset Management, our weekly newsletter on the movers and shakers behind a multitrillion-dollar global industry. This article is an on-site version of the newsletter. Sign up here to get it sent straight to your inbox every Monday.

Does the format, content and tone work for you? Let us know: harriet.agnew@ft.com

Faltering campaign against ‘woke capitalism’

The results of this year’s US proxy season are mostly in and activists on both ends of the political spectrum have suffered disappointments.

Conservative groups waging war on what they call “woke capitalism” filed 36 proposals challenging corporate diversity and human capital policies, charitable giving and political spending at Russell 3000 companies this year.

But they found few supporters — the proposals garnered an average of 6 per cent support, according an analysis by The Conference Board of Esgauge data. By contrast 70 liberal proposals on the same subjects received an average of 29 per cent support.

The difference was particularly stark on the issue of racial equity: liberal proposals seeking racial audits that would lead to more investment in diversity efforts averaged 45 per cent support and six of them won majority support. Conservative items asking companies such as Bank of America, Johnson & Johnson and Twitter to do audits while considering the harm caused by diversity policies averaged 2 per cent support. All fell below the 5 per cent threshold that allows sponsors to propose them again next year.

Liberal groups “have been doing this for 40 years and they’re eating our lunch,” said Scott Shepard, of the National Center for Public Policy Research, which filed 22 of the conservative proposals. “We are certainly not going to stop. It’s not just filing shareholder proposals. It’s litigation and legislation and I expect that will happen before too long.”

Conservatives weren’t the only ones disappointed this proxy season. The same Conference Board research showed that environmental activists may have over-reached this proxy season after scoring big victories in 2021.

Overall support for environmental proposals dropped from 37 per cent in 2021 to 33 per cent this year. The big asset managers parted company with environmental activists over climate proposals that push companies to stop using fossil fuels or change their business plans to comply with the Paris goals.

BlackRock had warned that it would vote against shareholder resolutions it perceived as too prescriptive, and State Street Global Advisors said it had prioritised long-term financial value for its investors.

“It is really disappointing that these proposals were [considered] so prescriptive,” said Ben Cushing, who runs the Sierra Club’s Fossil-Free Finance Campaign, “. . . they will be coming back.”

Jim Chanos’ next ‘big short’

The past decade has been a tough time to be a short seller. Trillions of dollars of central bank stimulus have turbocharged a bull market for US equities and lifted asset prices indiscriminately across the board. This has made investors complacent.

Just ask Jim Chanos, whose assets have been on a slow decline from $7bn after a stellar run in 2008, to around $500mn today, writes Harriet Agnew in London. “One of the things that amazes me is how sanguine inventors are,” the renowned short seller said in an interview. “It’s a little bit baffling that no one seems to think they need financial insurance because it’s pretty cheap . . no one is beating down the door of short sellers these days.”

But Chanos, who remains best-known for predicting the collapse of energy group Enron two decades ago, is not throwing in the towel just yet. In fact, he revealed that he has a new “big short” in his sights: “legacy” data centres — vast warehouses of servers that power large swaths of the internet. He reckons that they now face growing competition from the trio of tech giants — Amazon, Google and Microsoft — that have been their biggest customers.

Now Chanos & Company, his investment firm formerly known as Kynikos Associates, is raising several hundred million dollars for a fund that will take short positions in US-listed real estate investment trusts. These could include companies such as Digital Realty Trust and Equinix.

Chanos says: “The story is that although the cloud is growing, the cloud is their enemy, not their business. Value is accruing to the cloud companies, not the bricks-and-mortar legacy data centres. The real problem for data centre Reits is technical obsolescence.”

The move comes as private equity players are increasing their hold on the data centre market. Last year Blackstone bought QTS Realty Trust for about $10bn, at the time the largest deal in data centre history. Would love to see Chanos debate this one out with Jon Gray, Blackstone’s real estate boss turned president of the $915bn alternatives manager.

Meanwhile, do take a look at Harriet’s Lunch with the FT interview with Chanos from two years ago, in which he talks about being a bear in a bull market, betting against Elon Musk and why he thinks “we are in a golden age of fraud.”

Chart of the week

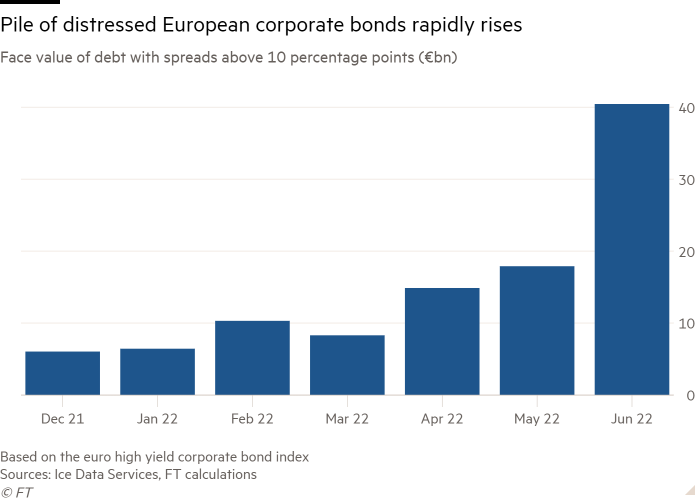

The worsening economic outlook in Europe has triggered rising angst about companies’ ability to pay their debts, and more €40bn in European corporate bonds are now trading at distressed levels, Ian Johnston writes.

The pile of euro-denominated corporate bonds flashing warning signs has jumped from €6bn at the end of 2021, according to Financial Times calculations based on Ice Data Services indices.

The stock of distressed corporate debt more than doubled from May 31 to June 30 alone, underscoring how quickly concerns are mounting that central banks’ decisions to tighten monetary policy could tilt major economies into recession. Investors are also fretting that high levels of inflation will increase companies’ cost of doing business.

“Credit markets have rapidly moved towards pricing in a recession,” European credit analysts at JPMorgan said on Friday.

10 unmissable stories this week

US hedge funds managers like Bridgewater and BlackRock star manager Alister Hibbert are betting that markets have further to fall, with the industry making its most cautious bets on stock prices in more than a decade.

DE Shaw and four of its top executives have been ordered to pay a record $52mn to former star money manager Dan Michalow by financial industry arbitrators who found the secretive hedge fund defamed him.

Crypto carnage continued this week with the bankruptcy of the Three Arrows Hedge Fund. But with one silver lining: the broader financial system has so far been spared. From Washington to Brussels, regulators downplay the contagion risks, and some have started to tentatively take a victory lap.

Jupiter Fund Management chief executive Andrew Formica is stepping down after only three years in the job, as midsized generalist active managers like the £55bn Jupiter have been squeezed between niche specialists and passive giants.

The Lex column argues that Formica’s successor, the former CIO, is a continuity candidate who could struggle to stem outflows.

The private assets sector is at a “transparency tipping point” over ESG, as billions flow in to managers like Brookfield Asset Management in a corner of the market that has struggled to produce adequate disclosure on its responsible investing claims.

Hedge funds are hunting for bargains in the beaten-down biotechnology sector, betting that a vicious sell-off has run its course and that lower valuations will breathe life back into deal flow.

Investors have been anxiously swapping predictions about whether Federal Reserve chair Jay Powell can pull off a “soft landing”, perfectly balanced between inflation and recession risks. Katie Martin argues the runway for Pilot Powell looks short and narrow, surrounded by shark-infested waters and beset by hurricanes.

Soaring inflation and rising interest rates are placing unprecedented liquidity strains on some of the UK biggest pension schemes, as a growing number of schemes have found themselves forced to sell liquid assets to raise cash to replenish collateral.

And finally

To New York, where the Costume Center at the Metropolitan Museum of Art is putting on an unusual and entertaining exhibit called In America: An Anthology of Fashion. Famous film directors including Martin Scorsese, Tom Ford and Sophia Coppola have staged vignettes in the museum’s American wing that deliberately challenge traditional viewer expectations of a costume exhibit. Claire McCardell puts 1930s sportswear in a mid 1800s Shaker room. And Autumn de Wilde’s early 19th century scene depicts a card party gone wrong with tipsy looking mannequins falling all over the period furniture.

If New York’s not in the cards, London’s Victoria and Albert Museum also has a clothing exhibit running. Fashioning Masculinities: The Art of Menswear will be on display until November.

Thanks for reading. If you have friends or colleagues who might enjoy this newsletter, please forward it to them. Sign up here

We would love to hear your feedback and comments about this newsletter. Email me at brooke.masters@ft.com or your regular host harriet.agnew@ft.com

[ad_2]

Source link