[ad_1]

Receive free Global Economy updates

We’ll send you a myFT Daily Digest email rounding up the latest Global Economy news every morning.

This article is an on-site version of our Disrupted Times newsletter. Sign up here to get the newsletter sent straight to your inbox three times a week

Today’s top stories

For up-to-the-minute news updates, visit our live blog

Good evening.

It’s been quite the day for UK environmental policy. Ministers have been trumpeting plans to expand carbon capture and storage while simultaneously announcing the “maxing out” of North Sea drilling and, as revealed by the Financial Times, making it cheaper for companies to pollute.

Prime Minister Rishi Sunak said plans to store carbon dioxide under the North Sea would help Britain make the move to a net zero economy by 2050 and support up to 50,000 jobs. The announcement should bolster confidence in a fledgling industry that has suffered many false starts in recent years, the FT’s Lex column says.

The commitment to issue more drilling licences, however, puts the government at odds with environmentalists and the opposition Labour party, which plans a moratorium on new exploration.

The move builds on Sunak’s new “proportionate and pragmatic” approach to tackling climate change following his party’s unexpected win in the Uxbridge and South Ruislip by-election, which focused heavily on campaigning against the extension of London’s ultra-low emissions zone for motorists.

Accusations of backtracking on green commitments were fuelled separately by quiet government changes to carbon pricing.

Like its EU equivalent, the UK emissions trading scheme, launched after Brexit in 2021, puts a price on emitting a tonne of CO₂. Large emitters and electricity generators get allowances to cover some of their emissions, with a cap and trade system giving incentives to cut emissions rather than pay to buy more. The changes announced this month offer more allowances than expected to polluting industries, sparking warnings that it will undermine green investments and increase fossil fuel use.

“The changes to the carbon market have largely passed under the radar in the UK, but will have the biggest impact of any policy on the UK’s emissions path,” said James Huckstepp, an analyst at BNP Paribas.

Meanwhile, a parliamentary report hit out at the UK’s ambitions for nuclear power, arguing that the target to more than triple generation capacity by 2050 lacked detail on how it planned to get there in order to encourage investment. (The US is also experiencing difficulties in nuclear funding).

As the period of super profits relating to the war in Ukraine comes to a close, oil majors too are facing scrutiny over their plans for cleaner energy. The pressure to water down proposals is particularly strong in the US, where opposition Republicans have attacked asset managers’ support for environmentally friendly policies.

An FT Big Read tackles another problem for the clean energy transition: will there be enough cables? Demand for interconnectors and other infrastructure such as wind turbines is growing rapidly, straining supply chains for the electricity cables and converter stations needed for connection to the grid.

The head of one of the largest cablemakers said Europe was entering “the third electrical infrastructure revolution”, referring to previous growth spurts at the turn of the 20th century and after the second world war.

Need to know: UK and Europe economy

UK mortgage approvals rose unexpectedly in June despite increases in interest rates. Analysts had expected the housing market to slow while lenders repriced mortgage deals.

One of the leading candidates to become the eurozone’s next chief banking supervisor called for a more “critical mindset” in overseeing the sector. Stress tests showed EU banks were “robust” with just three lenders falling below minimum capital requirements under the most severe economic conditions.

Need to know: global economy

Japanese government bond yields jumped as global debt, currency and equity markets began to absorb a landmark shift by the Bank of Japan to allow yields to rise more freely, unwinding decades of ultra-accommodative monetary policy.

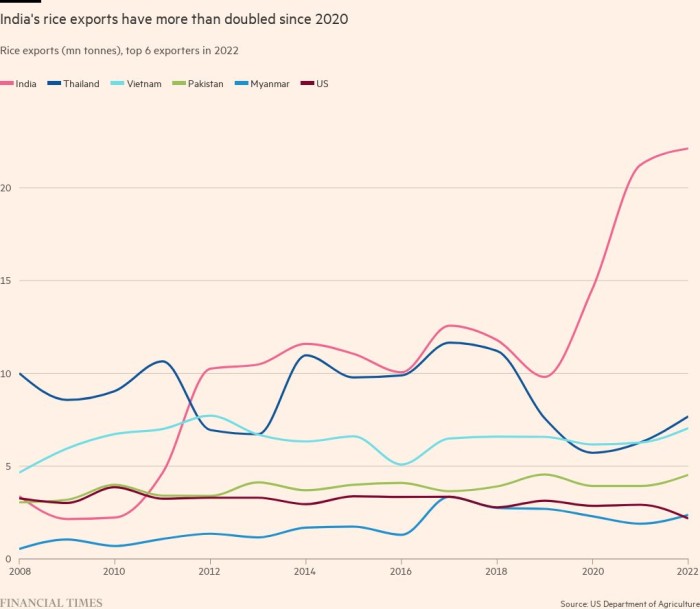

The surge in food price inflation is becoming a serious concern in India which has banned exports of several rice varieties after public anger over high prices. The move has sent shocks around the globe: India is the world’s largest rice exporter, and many countries depend on it for shipments.

South America is bracing itself for the impact of the El Niño weather event, with flooding and droughts intensified by climate change forecast to deliver a $300bn hit to growth for the region’s economies, which are particularly dependent on agricultural exports.

Need to know: business

The UK competition watchdog reopened its consultation on Microsoft’s proposed $75bn acquisition of Activision Blizzard, potentially reversing its decision to stop the blockbuster deal. Microsoft has asked the Competition and Markets Authority to take into account its recent agreement with Brussels about the takeover, a new licensing agreement with Sony for Activision’s Call of Duty game and other evidence that led a US judge to overturn the US regulator’s attempts to block the deal.

Heineken, the world’s second-largest brewer, cut its profit growth forecasts after a slowdown in Asia and the reluctance of US and European drinkers to pay higher beer prices. Operating profits fell a more than expected 22 per cent in the first half of the year.

French finance minister Bruno Le Maire said the country’s new automotive subsidies were “paving the way” for Europe’s car industry to withstand the threat of cheaper Chinese electric vehicle imports. The government will only pay subsidies for new EVs based on the emissions of their producers, hitting manufacturers from China, where the industry relies on electricity largely powered by coal.

A new Big Read examines how Silicon Valley start-ups are helping the US military take advantage of evolving technology such as artificial intelligence that could transform modern warfare.

It’s bye-bye to “revenge buying”. The post-pandemic luxury boom, driven by exceptional growth in China and the US, where pent-up demand and financial stimulus generated new shoppers in droves, looks to be over. One notable exception is Hermès which reported a 22 per cent rise in sales in the first half of the year.

For premium subscribers, our Trade Secrets newsletter looks back at the year so far in globalisation. In short, not great for those who want open markets, but could have been worse.

The world of work

Three years after millions of workers were ordered home, the question of where and when staff work remains a live issue, writes columnist Pilita Clark. For one thing, it is becoming clearer that remote work does not necessarily harm productivity, she says.

Scrutiny has made it harder to be an overt old-style bully but subtler forms of harassment can be as destructive. The modern bully convincingly mimics the traits of the sought-after empathetic leader but ignores and isolates colleagues they do not rate.

The UK is trying to widen access to occupational health services and meet increased demand for them at a time when unusually high numbers of people are out of work due to ill health. Read more in our Health at Work special report.

Some good news

International Tiger Day on Saturday was marked by announcements of significant increases in tiger populations in India and Bhutan. India recorded an average total of 3,682 — making it the home of 75 per cent of the world’s wild tigers.

Thanks for reading Disrupted Times. If this newsletter has been forwarded to you, please sign up here to receive future issues. And please share your feedback with us at disruptedtimes@ft.com. Thank you

[ad_2]

Source link