[ad_1]

Sponsored by

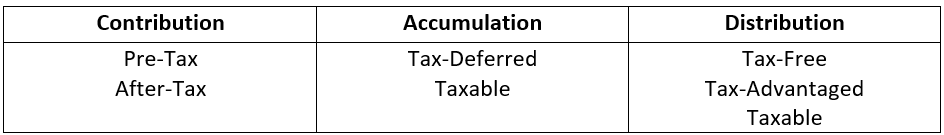

Income tax diversification can be achieved by taking advantage of retirement plans and other financial vehicles that offer different income tax advantages during the stages of the retirement accumulation and income process, which include:

- Saving for retirement (Contribution).

- Growing their savings (Accumulation).

- Using their savings to provide retirement income (Distribution).

Choosing options that offer tax advantages during each stage of the process may help your clients accumulate more for retirement and reduce their tax burden during retirement. The following table outlines the types of income-tax advantages that they should be considering:

In addition to the tax regimes, there are some other considerations. One is the IRS Required Minimum Distribution (RMD) rules, which require minimum withdrawals from certain types of retirement plans after the plan participant reaches age 73 (in 2023 and later). In addition, certain types of plans and products are subject to a 10% penalty tax on withdrawals made prior to the participants age 59½, unless certain conditions are met.

The following is an overview of retirement saving options that your clients may want to consider based on the income tax regimes and rules that apply to each.

Personal Savings and Investment Accounts

In general, the earnings on savings accounts, certificates of deposit, money market funds and investment accounts are subject to ordinary income taxes or capital gains taxes. However, these types of saving are important as they offer a ready after-tax source of funds during retirement, if needed.

Municipal Bonds

Many individuals with substantial taxable incomes invest in municipal bonds or bond funds, as the interest earnings are not subject to federal taxes. There are no limitations on how much a client can invest. However, state and local taxes may apply to the interest income, and capital gains taxes may be due if bonds are sold prior to maturity.

Traditional Qualified Retirement Savings Plans

These include plans like 401(k) and 403(b) plans, individual retirement accounts and other qualified defined contribution plans. They are the mainstay of retirement savings in America. These plans offer an attractive combination of tax advantages that include pre-tax contributions and tax-deferred accumulation.

Income distributions are taxable as ordinary income. Most employer sponsored plans offer matching contributions (which are tax-deferred), up to a certain percentage of salary. As a result, there is a strong incentive to contribute at least up to the percentage that is matched.

These plans are also subject to both the early distribution rules and RMD rules outlined earlier. Overall, the tax regime that governs these plans is designed to encourage saving that will be used to provide income during retirement.

Roth Retirement Plans

Participant contributions to these accounts are made with after-tax dollars. However, both account earnings and distributions are income tax free if the owner is 59½ and has had the account for five years or longer.

Contributions to Roth IRA accounts are limited, and those earning more than a certain income level cannot contribute. Roth 401(k) plans have no income restrictions but are subject to the overall 401(k) contribution limits.

Roth accounts are generally not subject to the RMD rules and can accumulate until the death of the account owner. However, a Roth account that passes to a beneficiary will be subject to RMD requirements based on the age of the beneficiary. A Roth account can provide a ready source tax-free income and may allow retirees to better manage their taxable income during retirement.

Annuities (Non-Qualified)

Annuities can be an effective way to accumulate additional funds for retirement and/or provide a guaranteed retirement income stream. There are many different types of annuity products to choose from that offer different investment platforms and product features.

Annuity deposits are generally made with after-tax dollars and earnings accumulate tax deferred. There are no statutory limits on how much after-tax money can be used to fund an annuity. If annuity income payments are elected at retirement, and there are tax-deferred earnings, an equal portion of each annuity payment will be taxed as ordinary income and the remainder will be considered a tax-free return of the cost basis.

Annuities are subject to the early distribution tax penalty. However, there are no RMDs. An annuity can accumulate until the death of the owner/annuitant. However, if the annuity owner dies it will pass to the named beneficiary with an income-tax liability. Overall, annuities offer certain advantages that make them attractive to clients who want to accumulate additional funds for retirement on a tax-deferred basis that are not subject to the RMD rules.

Permanent Life Insurance

Most clients are not aware of the role that life insurance can play in their retirement. Permanent life insurance offers a combination of lifetime death benefit protection, accumulation and income-tax advantages that can make it valuable in retirement income planning. The policy death benefit is generally paid income-tax free, the cash or account value accumulates tax-deferred and the policyowner has the option to access the value in the contract on a tax-advantaged basis. Premiums are generally paid with after-tax dollars, and your clients can purchase a policy that is guaranteed to be paid-up at or before retirement – so no additional premiums will be due.

The tax-free death benefit can help replace reductions in income to a surviving spouse from Social Security, annuities or pensions that occur at death. In addition, having paid-up income tax-free life insurance in place may also give your clients the confidence to spend their other retirement savings more freely. The policyowner can take tax-free partial withdrawals or surrenders up to the cost-basis (premiums paid) in the policy. In addition, policy loans are available at any time and for any purpose and are not taxable while the policy remains in force. If the insured dies prior to repaying a loan it will be repaid by a portion of the income tax-free death benefit.

It is important for clients to understand that taking partial surrenders, withdrawals or loans from a policy will reduce the policy death benefit. And excessive borrowing can cause a policy to lapse, which may result in adverse income tax consequences. If the policy is a Modified Endowment Contract, policy loans and/or distributions are taxable to the extent of gain and are subject to a 10 percent tax penalty if the policyowner is under age 59½. They should be judicious in how and when they access the policy value. The early distribution and RMD rules do not apply to life insurance (non-MEC), which adds to its versatility as a retirement income planning product.

Many policies available today offer death benefit acceleration riders that provide income tax-free benefits to help pay for chronic illness or long term care expenses. And life insurance is a tax-efficient way to provide a financial legacy to children, grandchildren or a cause your client wants to support. Overall, life insurance may be an important part of your clients’ retirement income planning.

Summing It Up

The tax diversification strategy that will make sense for a specific client will depend on his or her age, income level and financial objectives. Your job as a financial professional is to help them understand the options available to them and the potential benefits of including them in their overall financial strategy.

Life insurance products issued by Massachusetts Mutual Life Insurance Company (MassMutual) and its subsidiaries, C.M. Life Insurance Company (C. M. Life) and MML Bay State Life Insurance Company (MML Bay State), Springfield, MA 01111-0001. C.M. Life and MML Bay State are non-admitted in New York.

MM202601-303977

[ad_2]

Source link