[ad_1]

One scoop to start: Insight Investment, one of the UK pension industry’s biggest asset managers, abandoned mark-to-market pricing on funds reeling from the country’s government bond crisis last year, instead choosing higher values that presented a rosier picture of its position.

Welcome to FT Asset Management, our weekly newsletter on the movers and shakers behind a multitrillion-dollar global industry. This article is an on-site version of the newsletter. Sign up here to get it sent straight to your inbox every Monday.

Does the format, content and tone work for you? Let me know: harriet.agnew@ft.com

Welcome back to FT Asset Management. I’m Harriet Agnew, Asset Management Editor, back in the hot seat from Argentina, where I spent a month-long crash course on black market currency trading and living with hyperinflation sabbatical. More on that in a later edition of this newsletter.

Tiger outlines valuations methodology

It was one of last year’s most high-profile casualties of the regime shift in markets.

And now Chase Coleman’s Tiger Global, the technology-focused hedge fund, has been forced to defend the way it values its $40bn portfolio of privately held “growth” companies because investors are increasingly uneasy over how much such unlisted investments are worth.

In its annual letter to investors, Tiger outlined its methodology for valuing some of its biggest private holdings, including China’s ByteDance, payments company Stripe and US software group Databricks.

Tiger’s intervention comes after a number of private companies had to raise money at valuations that were well below previous investment rounds, knocking the portfolios of investors with heavy exposure to unlisted technology groups and fuelling fears of more writedowns to come.

“We believe our private portfolio accurately approximates fair value,” said Tiger, which also noted that it had marked down its private portfolio every month of the year to reflect the fact that the companies had underperformed expectations as well as “substantial multiple compression” in the valuations of publicly listed rivals. “Our largest private holdings are generally capital-efficient or profitable market leaders awaiting an opportune window to complete public listings,” it said.

Tiger expanded into private company investments under the watch of private equity head Scott Shleifer, who had success making early bets on Chinese technology groups such as Alibaba and JD.com. Over the past decade, its private portfolio has grown to account for the bulk of Tiger’s more than $60bn in assets. As of early October, those investments were valued at $45bn.

Putin has ‘lost the energy war,’ Andurand claims

There are not many hedge funds that can claim to have made a return of 650 per cent over the past three years.

But during both the raging bull market of the early stages of the coronavirus pandemic, and then in last year’s painful bear market, Pierre Andurand was able to post huge gains thanks to his energy bets. Most notably, that included a correct call that the oil price would turn negative in 2020.

Now, in an interview with my colleagues Laurence Fletcher and David Sheppard, the French kick-boxing enthusiast and former champion swimmer makes two more big calls.

Firstly, he believes that the European energy crisis in natural gas and power is behind us and that Vladimir Putin has “lost the energy war”. A “massive miscalculation” by the president has lost Russia its biggest customer. With Europe getting used to living without Russian gas, “why would they ever go back?”

If true, that would spell the end for a lucrative trade for hedge funds that rode the wild moves in the gas market over the past two years. As Andurand says, “there’s no story at all for natural gas right now”.

Secondly, oil is a very different story. Prices could surge to $140. This may seem high compared with current prices of around $80, but it isn’t so big when compared with the all-time high of $147 that was hit 15 years ago if it’s adjusted for inflation, he argues.

The key is not focusing on restrictions on Russian supply, which left many traders “disappointed” last year, but on the reopening of China from harsh lockdowns, which is a big boost to demand.

Andurand, whose firm Andurand Capital manages $1.4bn in assets, spent part of his childhood on the island of Reunion off the coast of Madagascar and who now lives in Malta. A former Goldman Sachs and Vitol energy trader, he is known for his punchy bets. At times they have cost him, and last year he gave back some profits by being too bullish. But few can dispute that when he gets it right, he really gets it right.

In the spotlight: Alexandre de Rothschild

Alexandre de Rothschild’s early experiences of the family bank were of visiting its cigar-smoke-filled offices in Paris as a child in the 1980s. Now more than 30 years later he is the seventh-generation leader of Rothschild & Co and has just made his highest stakes move since taking over the helm five years ago. The 42-year-old is the driving force behind a €3.7bn deal to take the Anglo-French institution private, bucking a trend among its boutique investment banking peers.

“You can’t be half pregnant,” he said in an interview. “It was clear that we had reached the limit and full potential of the listing. Our DNA is much better suited to being a private company.”

On Monday de Rothschild will announce details of the take-private transaction, which is set to be backed by the Peugeot and Dassault families. Stay tuned to see if minority shareholders try to squeeze more money out of the Rothschild clan.

Chart of the week

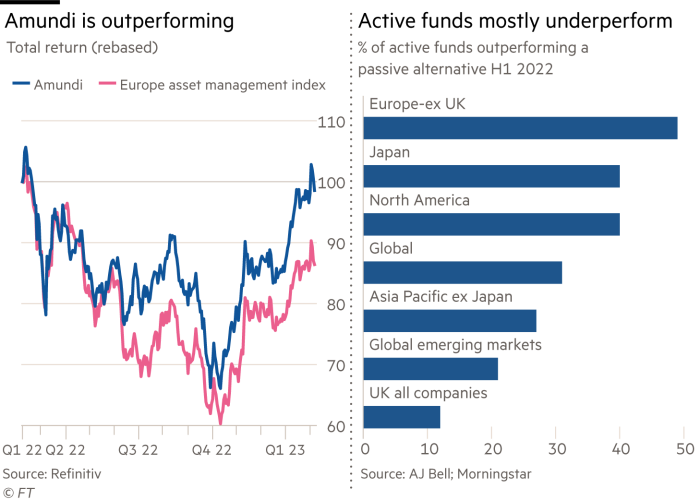

Amundi’s shares have tracked stock markets lower over the past year. But crucially, returns have outperformed European peers by about 15 per cent over that time. That reflects strife in the industry as well as Amundi’s scale, writes Lex. The asset management subsidiary of French bank Crédit Agricole is keeping Europe in the race for passive scale — an unstoppable secular trend in fund management that has been propelled by US leviathans BlackRock and Vanguard.

Smaller managers have to go big, go home or go specialist to justify steeper fees. The middle ground, which once yielded easy livings for active managers, has become a No Man’s Land. Meanwhile low-cost, index-based investments are luring trillions of dollars.

Amundi, which acquired Lyxor for €825mn in 2021 to become a market leader in European exchange traded funds, is one of the few able to go big. It managed €1.9tn (£1.68tn) of assets at the end of last year, €160bn less than at the end of 2021. Like most fund managers it has suffered from slumps in global stock markets. Unlike many rivals, Amundi still managed to attract net new fund flows, of €7bn for the year.

Five unmissable stories this week

If you only read one thing this week, make sure it’s my colleague Joshua Oliver’s riveting account of the bizarre and brutal final hours of FTX. It’s the definitive inside story of how Sam Bankman-Fried and his band of millennial millionaires lost a $40bn crypto empire.

Seth Klarman has told investors in his hedge fund Baupost Group that the Federal Reserve’s response to the 2008 financial crisis and the ensuing decade-plus of low interest rates had helped “erect a financial fantasyland”.

Carlyle Group has hired former Goldman Sachs executive Harvey Schwartz to be the private equity firm’s next chief executive. Don’t miss this FT profile of the “street fighter” charged with restoring confidence after protracted turmoi.

Activist investor Nelson Peltz has called off his fight against Walt Disney a day after the company unveiled a restructuring plan involving the loss of 7,000 jobs, ending one of the biggest corporate battles in recent years.

Virginie Morgon, one of the rare female leaders of a private equity group, has been ousted from the helm of France’s Eurazeo after losing the support of its two largest shareholders, JCDecaux Holding and the David-Weill family.

And finally

A touch of la dolce vita has arrived in Kensington, in the form of Jacuzzi, the Big Mamma group’s first trattoria in West London. I’ll be turning to the creamy truffle spaghetti served in a giant pecorino wheel to see me through the rest of winter. Here’s an interview I did with Big Mamma co-founder Victor Lugger back in 2017. He and Tigrane Seydoux spent two years travelling around Italy sourcing the best products. Sounds like a real hardship.

FT Live event: Future of Asset Management Asia

The Future of Asset Management Asia is taking place for the first time in-person on 11 May at the Westin Singapore and will bring together Asia’s leading asset managers, service providers and regulators including, Asian Development Bank, The Stock Exchange of Thailand (SET), Allianz Global Investors and many more. For a limited time, save up to 20% off on your in-person or digital pass and uncover the industry’s top trends and opportunities. Register now

Thanks for reading. If you have friends or colleagues who might enjoy this newsletter, please forward it to them. Sign up here

We would love to hear your feedback and comments about this newsletter. Email me at harriet.agnew@ft.com

[ad_2]

Source link