[ad_1]

Foreign investment in emerging market stocks and bonds outside China has come to an abrupt halt over fears that many economies will not recover from the pandemic next year, their prospects worsened by the Omicron coronavirus variant and expectations of higher US interest rates.

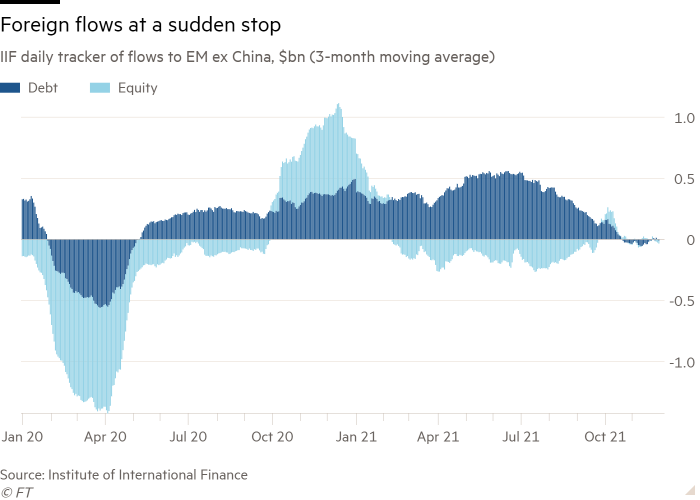

In late November, non-resident flows to EM assets excluding China turned negative for the first time since the coronavirus-induced market ructions of March 2020, according to data from the Institute of International Finance.

“We’ve seen the willingness of investors to engage with emerging markets dry up,” said Robin Brooks, chief economist at the IIF.

“This is not only about isolated cases like Turkey,” where the currency has collapsed in recent weeks after the central bank persisted in cutting interest rates despite a steep rise in inflation, he added. “Turkey is a symptom of something much more broad based across emerging markets, and that is a lack of growth.”

The IIF separates China from the rest of EM data because China’s inflows are so large they obscure any other trends that might be evident in the figures.

The emergence of the Omicron coronavirus variant in recent weeks will have more of an effect on countries with lower vaccination rates, and most emerging market countries have a vaccination rate under the 70-80 per cent herd immunity level, according to S&P research.

Many emerging economies, especially large, middle-income countries such as Brazil, South Africa and India, have also borrowed heavily on international and domestic markets to fund their pandemic response.

For much of the past year, said Luiz Peixoto, emerging markets economist at BNP Paribas, concerns over the fiscal impact of rising debts “were suspended in the air, as if 10 percentage point increases in debt ratios meant nothing”.

But the weak outlook for growth meant such concerns had now returned, he said. “Whether you are funded by local or foreign markets, it doesn’t matter because everywhere we are seeing interest rates rise,” he said.

As a result, 10 major emerging markets, including Chile, Mexico, Poland and India, were at risk of a credit rating downgrade, Peixoto warned.

Compounding investors’ concerns is the recent pivot to a more hawkish stance by Jay Powell, chair of the US Federal Reserve, in response to rising inflation. Powell’s openness to a quicker-than-expected withdrawal of the Fed’s huge asset purchase programme raised the prospect of earlier US interest rate rises next year and exacerbated a sell-off in risky assets.

A strengthening US dollar could destabilise the economies of countries such as Turkey, which borrow heavily in dollars, as well as the likes of Brazil, South Africa and India, which tend to borrow in their own currencies but depend largely on foreigners for inflows.

As the greenback strengthens, returns for international holders of EM stocks and bonds are eroded. MSCI’s index of EM equities has slipped 4 per cent this year in US dollar terms, trailing far behind the 19 per cent gain for the index provider’s broad gauge of equities in developed markets.

Bonds have also come under pressure, with the JPMorgan global GBI-EM index tracking EM debt issued in local currency off 4.5 per cent for the year to date on a total return and US dollar basis.

During the early months of the coronavirus pandemic the value of the dollar depreciated, lifting emerging market assets. But as vaccination rates increased and the US economy began to recover this summer, the dollar has risen.

The Fed’s cautious signalling of its intention to withdraw stimulus and tighten policy meant markets had been spared a repeat of the 2013 “taper tantrum”, when an abrupt change in the Fed’s messaging prompted a sudden sell-off in risky assets including emerging market stocks and bonds, said Brooks at the IIF.

But the combination of weak growth and a strengthening US dollar could still provoke a sell-off, he warned, particularly given persistent uncertainty over the pandemic and rising tensions between the US and both China and Russia.

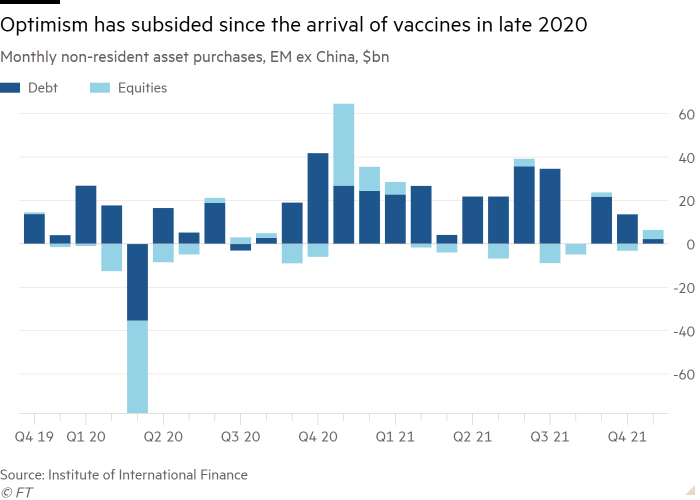

The IIF data show that foreign inflows into EM stocks and bonds peaked in the fourth quarter of 2020, right before vaccine access became widespread in advanced economies. The subsequent recovery of the US — and other developed market economies — has hurt EM assets since then.

But inflows had not halted until this quarter, when the Fed began the process of tightening monetary policy. The tapering of the Fed’s $120bn monthly asset purchases supports the dollar because it indicates the Fed is closer to raising interest rates, a big driver of currency valuations worldwide.

That pressure has only intensified since the so-called Powell pivot on November 30, when the Fed chair said he no longer believed that inflationary pressures were transitory and signalled that the central bank was open to accelerating its monetary tightening.

“The Powell pivot has exacerbated an already difficult adjustment for many developing countries. While relative yields in EM local currency bonds are attractive, investors may now face further pressures from rate hikes and currency weakness,” said Samy Muaddi, a portfolio manager at T Rowe Price.

[ad_2]

Source link