[ad_1]

Stay informed with free updates

Simply sign up to the UK house prices myFT Digest — delivered directly to your inbox.

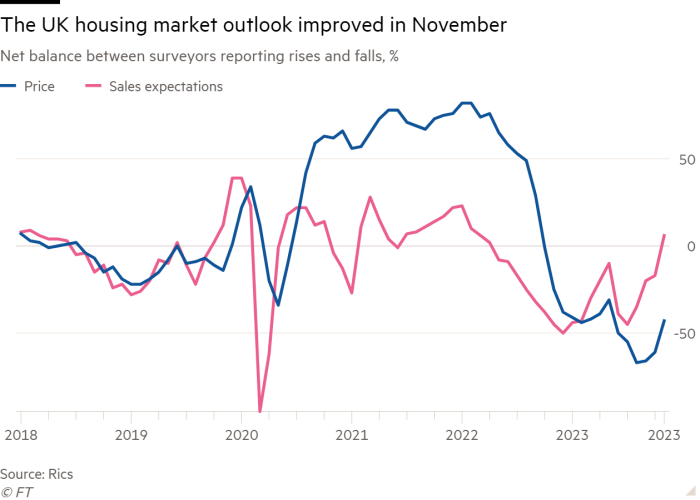

The outlook for the UK housing market improved in November as mortgage rates eased, marking the first expansion of sales expectations since early 2022, according to a property survey.

The Royal Institution of Chartered Surveyors said on Thursday that its measure of forecasted sales over the next three months rose to six in November, up from minus 17 in October. It was the first positive reading since April 2022.

The survey measures the difference between the percentage of UK surveyors registering rises and falls in home sales.

The report was published hours ahead of the latest decision by the Bank of England’s Monetary Policy Committee, which is expected to leave interest rates unchanged at a 15-year high of 5.25 per cent.

The Rics data suggested the improvements in the market, reflected in rising house prices and mortgage approvals, would continue into the months ahead as mortgage rates fall back further from their summer peak.

Simon Rubinsohn, Rics chief economist, said the improvement had been “aided by increased confidence that the interest rate cycle has peaked, which is reflected in somewhat more competitive mortgage products coming to the market”.

Two-year fixed mortgage rates with a 60 per cent loan-to-value ratio eased from 6.2 per cent in July to 5.5 per cent in October, while rates on five-year deals have also declined since the summer, according to the BoE.

Analysts said the market had been boosted by expectations of a further fall in interest rates.

Tom Bill, head of UK residential research at Knight Frank, said: “Speculation is turning to the timing of a bank rate cut rather than the size of the next rise, providing a boost to sentiment that means transaction volumes should be higher over the next six months than the last six.”

Estate agents’ sales expectations over the next 12 months rose to 24 in November, from zero in the previous month, and were their most upbeat since January 2022.

Their assessment for house prices over the past three months remained negative at minus 43. This marked a sharp improvement from the minus 61 registered in October.

House price expectations for the year ahead also picked up to minus 10 in November from minus 43 in the previous month.

Rental prices, which have surged this year because of strong demand from households that cannot afford a mortgage, also showed signs of stabilising.

The survey reported a reduction in tenant demand and price expectations even as the number of new landlords’ instructions to agents remained in decline.

John Halman, chair at Gascoigne Halman estate agents, said the end of the year had ushered in a slight increase in activity compared with previous expectations. “It appears interest rates may have peaked, which is helping.”

Separate data this week showed that mortgage arrears had increased to their highest rate in six years in September, according to Bank of England data. The increased reflected the effect of higher interest rates on household finances.

[ad_2]

Source link