Sponsored by

Led by the Federal Reserve’s campaign of increasingly large hikes, interest rates have risen meaningfully year-to-date. Conventional wisdom would guide investors to sell fixed income — a reflection of one of the most fundamental relationships in the investment world: as rates go up, their investments go down. Add on top of this the potential risk of higher corporate default rates in a subsequent possible recession…it’s easy to come to the conclusion of selling.

However, such sweeping genericisms can cause investors to miss opportunities with certain types of debt investments that, perhaps surprisingly, can provide compelling risk-adjusted returns through periods of rising rates, economic volatility and even subsequent recessionary periods.

Through our in-depth research on the topic, Ares has found that Floating Rate Direct Loans can help drive returns that are resilient and relatively protective of downside risk, resulting in a potentially attractive investment in a rising rate environment, both during and after potential market dislocations. We summarize what you need to know in our latest Private Markets Insights newsletter.

Floating Rate Direct Loans Defined

The type of debt discussed here will be termed “Floating Rate Direct Loans,” meaning loans that have the following characteristics:

1. Issued directly by a non-bank lender, not a traditional financial institution, and not part of the liquid credit market (this makes it “direct” as opposed to “publicly traded” or “syndicated” by a bank)

2. Makes coupon payments based on a rate that fluctuates with short-term interest rates (this makes it “floating rate” as opposed to “fixed rate”)

3. Lent to middle sized companies, not large companies or an individual or government entity

Let’s look at how each of these characteristics contributes to returns that are both resilient and historically have been relatively protective of downside risk, resulting in a potentially attractive investment in a rising rate environment or even dislocated markets.

Resilient Returns

Floating > Fixed

The floating rate feature is the most critical in a rising rate environment because it mitigates the two largest reasons investors traditionally don’t like fixed income investments when rates are low and rising: 1) low, fixed coupon payments and 2) loss of principal.

Rate Resets

By definition, floating coupon rates are reset to a reference interest rate every 30 to 90 days. So as rates increase, incrementally more income – the core component of return – is generated for the investor.

Diminishing Duration

By pegging the coupon rate to the market, sensitivity of the price to changes in interest rates is nullified, holding all else equal. In addition, Floating Rate Direct Loans often have shorter contractual maturities of 5-7 years with a weighted average life of ~3-4 years compared to long-dated corporate bonds. Another way to say this is that the effective duration is low. This means these assets can deliver incrementally higher investment returns and current income as base rates increase without a corresponding reduction in the value of the debt (assuming credit spreads remain constant).

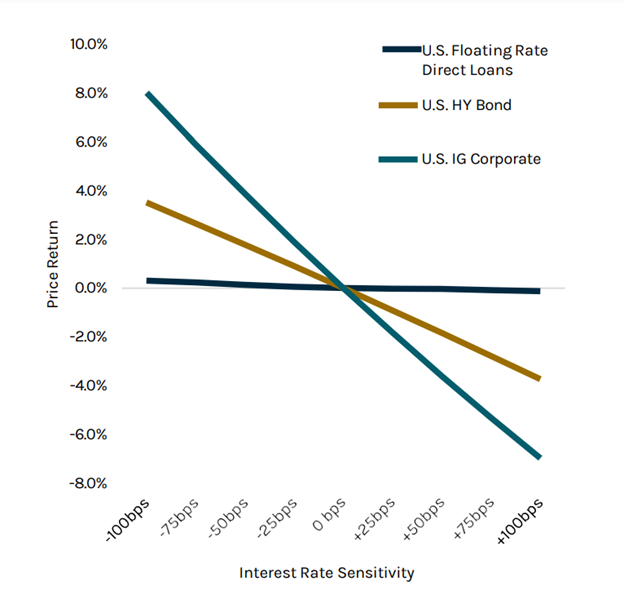

Price Sensitivity Direct Lending vs. High Yield and Investment Grade Corporates

Holding other variables constant1, a 100bps increase in rates has a much greater impact on High Yield (HY) and Investment Grade (IG) bond prices compared to U.S Floating Rate Direct Loans2

Past performance is not a guarantee of future results

Volume & Velocity

When it comes to loans of this kind, another core component of return is the “upfront economics” of the transaction. This is the structuring fee that the lender receives up front for structuring and completing the transaction. Therefore, higher transaction volume leads to more upfront fees passed on to the investor.

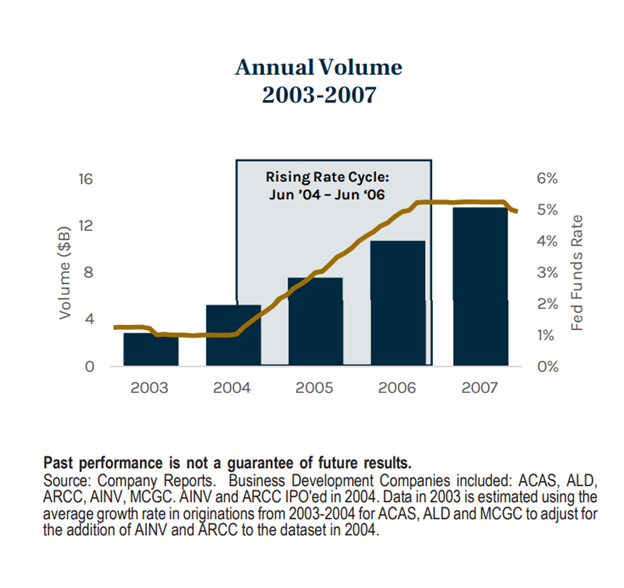

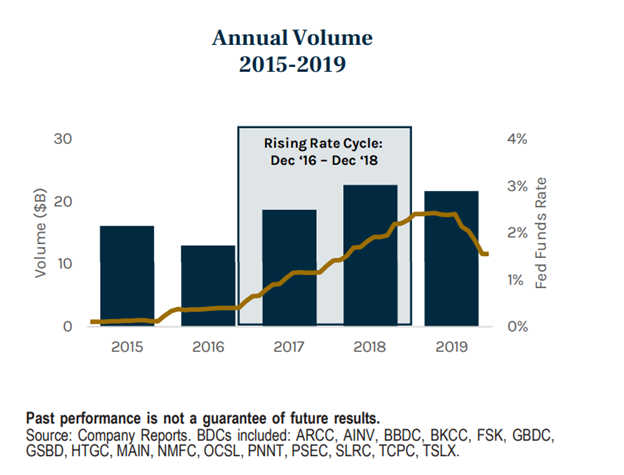

One might intuit that in a period of rising rates, fewer loans are being issued as it costs more for companies to borrow. Lower volume would mean lower upfront fees, and therefore lower expected return. However, research shows that Floating Rate Direct Loan volumes during past periods of rising interest rates have actually increased due to the combination of strong economic tailwinds and investment capital flowing to floating rate opportunities. This is illustrated in the figures below.

Private Protection

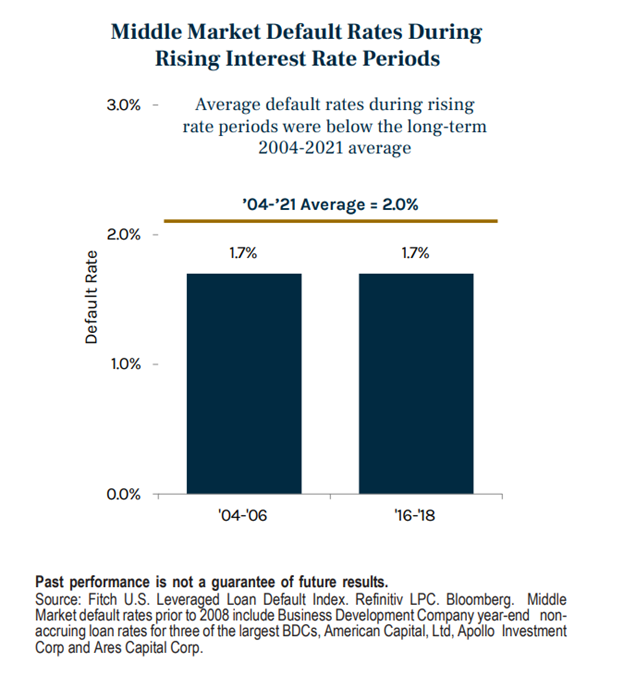

Because Floating Rate Direct Loans require borrowers to pay higher interest as rates increase, credit risk is the most prevalent and important risk to manage. In our analysis of the last two of the Fed’s rate tightening cycles, we observed very limited impact to direct loan default rates during these periods.

Fundamentals Matter

These low default rate trends are due largely to relatively strong underlying economic and corporate fundamentals. The Fed is typically tightening monetary policy when the economy is exhibiting stronger fundamental trends. During these two periods of rising interest rates, default rates of middle market companies have averaged below the long-term average annual default rate. This is largely attributable to improving economic fundamentals, which muted the impact of a gradual rise in interest expense on interest coverage ratios.

Careful Covenants

In addition to strong fundamentals, private credit investors are protected by lending practices and documentation, which is arguably more stringent than those found in the syndicated loan or high yield markets. In the past, it has been difficult for the Fed to engineer a soft landing (i.e., no recession) after a rate tightening cycle. While a recession is a possible scenario during the current tightening cycle, we believe middle market direct lending assets remain well positioned relative to other public market assets (stocks, bonds, etc.). This is due to their seniority in the capital structure, covenant protections and long-term, flexible capital that often enable the lender to mitigate defaults during periods of credit deterioration.

We break this down even further below:

- Position in Capital Structure. Last year, over 90% of private credit loans were structurally senior secured loans, meaning the company would have to experience significant deterioration in value before it compromises the loan repayment.

- Tighter terms. Private loans often have covenants, including a financial maintenance covenant, typically a leverage covenant. These are considered important as they permit lenders to “get to the table” early and proactively address problems with the company before they become a crisis, ultimately protecting the investor.

- More robust underwriting and monitoring. Private credit lenders invest in the loan with the intention of holding it to maturity, not repackaging and selling to others. Therefore, they are more likely to conduct more extensive business and legal diligence before investing in the company. Additionally, they may actively monitor the performance of the company.

- Aligned motivations. Most private credit loans are made to private-equity-sponsor-backed nonpublic companies that have deep relationships with their lenders, which is important in a troubled loan situation. As private lenders likely represent a borrower’s most senior creditors, they are motivated to ensure the borrower’s business survives and the loan is repaid.3

While never fully mitigating credit risk, the combination of greater control over terms and access to nonpublic creditor information provides a sourcing and pricing advantage. This can add a measure of investor protection from default.4

To continue reading, download now.

Comments are closed, but trackbacks and pingbacks are open.