[ad_1]

Hello, I’m Emma Dunkley on the Asset Management team and I’m filling in for Harriet today.

One scoop to start: Hedge funds and other parts of the shadow banking system should face greater scrutiny after last month’s sharp move in US Treasuries, according to the Securities and Exchange Commission. The chair of the US’s top markets regulator, Gary Gensler, told the Financial Times that taming risks from speculative funds was now “more important than ever”. Read more here.

Welcome to FT Asset Management, our weekly newsletter on the movers and shakers behind a multitrillion-dollar global industry. This article is an on-site version of the newsletter. Sign up here to get it sent straight to your inbox every Monday.

Does the format, content and tone work for you? Let me know: harriet.agnew@ft.com

Cracks in European commercial real estate

Rising interest rates and the recent banking crisis are shaking the foundations of commercial real estate, with significant ramifications for asset managers.

Offices were already having a tough time: the shift to hybrid working during the pandemic led many companies to shrink their real estate portfolio while tenants downsized and vacated their premises.

But commercial property owners are now having to battle a sharp increase in borrowing costs as central banks raise rates to combat inflation. The collapse of Silicon Valley Bank and Credit Suisse sent shockwaves through the banking sector and has stoked fears that credit will become less available and more expensive.

As my colleague Joshua Oliver reports, Europe’s commercial property sector is showing signs of strain, just as property prices are slumping. Analysts at Citi have warned that European real estate values could fall by up to 40 per cent by the end of 2024.

European commercial property prices fall

Pressure on commercial real estate has repercussions for the asset management sector. A number of funds have over the past year been forced to delay withdrawal requests from institutions in order to offload the underlying assets in a timely manner. While many continue to defer redemption orders, BlackRock has started to repay some investors who attempted to redeem their investment as far back as a year ago.

Regulators are keeping a close eye on the sector, especially the liquidity mismatch between open-ended funds that offer investors instant access to their money and property assets, which take time to sell. Earlier this month, the European Central Bank called for a crackdown on commercial property funds to prevent a liquidity crunch if more investors head for the exit.

Even though offices — the largest part of the commercial property industry — are still struggling, some companies are keen to see more staff back in the workplace. Last week, JPMorgan Chase called on its managing directors to return to the office five days a week, warning other employees not to fall short of their “in-office attendance expectations”.

Still, these buildings could become a burden for banks and investors, against a backdrop of rising costs and broader changes across the workplace.

Fink on the prowl for deals

BlackRock’s chair and chief executive Larry Fink is ready to pounce on deal opportunities.

Even though the world’s largest asset manager has not been immune to the difficult market environment of late, Fink reckons the recent banking crisis could pave the way for an acquisition.

“If there is an opportunity to do something transformational, we are going to be prepared to do it,” Fink told analysts on Friday. “How can we double down on what we’re doing with . . . technology? How can we build out our footprint globally at this time?”

The collapse of Silicon Valley Bank last month triggered concerns in the US about regional lenders and potential losses in their loan books. Soon after, Credit Suisse was rescued by rival Swiss bank UBS.

BlackRock looked at buying part of Credit Suisse before the UBS deal was struck. Fink said “to be in the game, we must play the game. And so we’re in the game.”

His comments come as BlackRock reported a surge in assets under management to $9.1tn, up $500bn on the previous quarter and higher than analysts had expected. The increase was fuelled by the market’s slight recovery in the wake of last year’s turbulence, although BlackRock also reported $110bn of inflows from customers.

However, BlackRock’s net income still took a hit in the first quarter, dropping by a fifth year-on-year to $1.1bn. Revenue was also down by a tenth to $4.2bn, partly dragged down by a 40 per cent fall in performance fees relating to its hedge funds and alternative products.

The money manager faces other headwinds. Republican state treasurers have withdrawn more than $4bn of government pension and treasury funds from the company on the grounds that it “boycotts” fossil fuel. BlackRock denied those claims and noted that it invests money the way its clients want.

Chart of the week

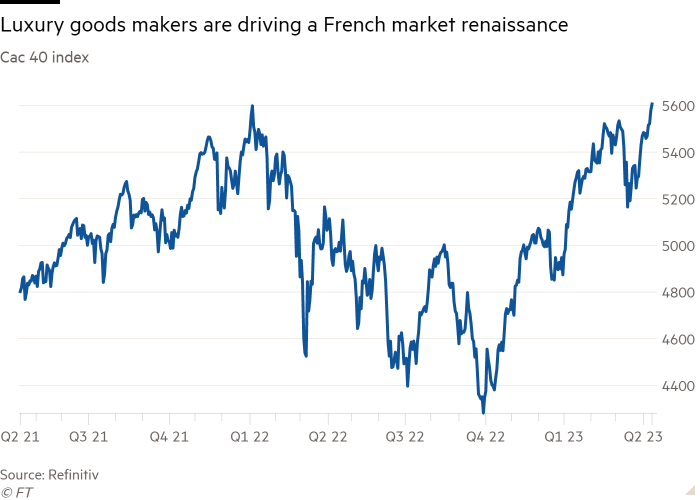

France’s stock market has surged to a series of record highs as investors pile into luxury goods groups on hopes of a sustained rebound in Chinese demand for high-end brands.

The Cac 40 has risen 16 per cent so far this year and by more than 30 per cent since a low at the end of September, outperforming Europe’s region-wide Stoxx 600 and the US S&P 500 over the same period.

Shares in Cac-listed cyclical stocks including chipmaker STMicroelectronics, carmaker Stellantis and oil and gas group TotalEnergies have all climbed sharply in recent months.

Yet roughly one-third of the market’s rally since the start of the fourth quarter last year stems from burgeoning investor interest in Hermès, Kering, LVMH and L’Oréal.

Shares in the four companies have risen 61 per cent, 25 per cent, 45 per cent and 28 per cent respectively since then, with LVMH and Hermès hitting record highs. Beijing’s abrupt dismantling of its zero-Covid restrictions late last year accounts for much of the wider luxury goods sector’s recent success, according to analysts.

China is “the most important market” for European luxury names, according to Morgan Stanley, with about two-thirds of Chinese consumers’ personal spending on expensive accessories taking place abroad before the pandemic began. Prices for luxury goods can be up to 30 per cent lower in Europe than in China, the bank said.

“Luxury stocks tick many boxes at the moment”, said Emmanuel Cau, head of European equity strategy at Barclays. “Some global investors likely find indirect exposure to China via European stocks, and luxury in particular, easier, more liquid and less risky than direct investment in Chinese shares”.

Five unmissable stories this week

Inside the financial engineering that allowed the billionaire Issa brothers and their private equity partners TDR Capital to stump up just £200mn for their 2020 deal to buy Asda, the UK supermarket chain valued at £6.8bn — the UK’s biggest leveraged buyout in a decade.

Silicon Valley venture capital firms are touring the Middle East in search of funding. The worst funding crunch for venture capital firms in almost a decade is leading inventors such as Andreessen Horowitz, Tiger Global and IVP to sovereign wealth funds in Saudi Arabia, Qatar and UAE.

WisdomTree’s biggest shareholder is attempting to seize control of the board of the $90.7bn US asset manager with the aim of ousting both the chief executive and chair in an increasingly acrimonious dispute over strategy.

One of Charles Schwab’s largest investors, GQG Partners, sold its entire $1.4bn stake in the brokerage giant during last month’s banking turmoil over fears of paper losses on its bond portfolio.

UK wealth manager St James’s Place has poached its new chief investment officer from rival Legal & General Investment Management as competition heats up and the industry braces itself for consolidation. Justin Onuekwusi joins the FTSE 100 group in October.

And finally

The artist Dindga McCannon is showcasing her work at London’s Pippy Houldsworth Gallery, in a display spanning five decades. Born in Harlem, McCannon focuses on the lives of black women in her art, which takes the form of paintings, quilts, prints and sculpture. She shines a light on the inequalities faced by black women in America and unearths the stories of forgotten figures.

FT Live event: Future of Asset Management Asia

The Future of Asset Management Asia is taking place for the first time in-person on 11 May at the Westin Singapore and will bring together Asia’s leading asset managers, service providers and regulators including, Asian Development Bank, The Stock Exchange of Thailand (SET), Allianz Global Investors and many more. For a limited time, save up to 20% off on your in-person or digital pass and uncover the industry’s top trends and opportunities. Register now

Thanks for reading. If you have friends or colleagues who might enjoy this newsletter, please forward it to them. Sign up here

We would love to hear your feedback and comments about this newsletter. Email me at harriet.agnew@ft.com

[ad_2]

Source link