Good morning. This article is an on-site version of our FirstFT newsletter. Sign up to our Asia, Europe/Africa or Americas edition to get it sent straight to your inbox every weekday morning

With US-China relations at their most tense for decades some of America’s leading business figures will travel to Beijing this weekend for a flagship investment conference.

Apple chief executive Tim Cook and investor Ray Dalio will be among more than one hundred overseas delegates attending the China Development Forum in Beijing which is being held in-person for the first time since before the global pandemic.

The focus of the event will be “Economic Recovery: Opportunities and Co-operation,” according to its organisers. But the forum opens with relations between the US and China at their most acrid since diplomatic ties between the two countries were established in 1979.

The latest example of that tension came yesterday as TikTok chief executive Shou Zi Chew faced questions about potential state intervention by China in his company’s operations from hostile Democratic and Republican lawmakers in a grilling that lasted more than five hours.

The meeting between presidents Xi Jinping and Vladimir Putin in Moscow this week underlined the geopolitical gap between the west and China which has also been exposed over Taiwan, technology and the Aukus defence arrangement between the US, UK and Australia.

But despite these difficulties, western businesses continue to invest in China where the ending of its strict Covid rules has spurred a rapid return to growth.

“China remains, arguably, the most attractive growth market in the world — for those companies able to anticipate rapid, fundamental change,” a recent report published by Deloitte said.

The Apple chief executive and other attendees at this weekend’s forum will certainly be hoping that assessment proves correct.

Here’s what else I’m keeping tabs on today and over the weekend:

-

Economic data: Durable goods orders as well as S&P’s flash manufacturing and services PMI data are released in the US. The latest consumer price index will be released in Brazil and Mexico’s national statistics agency releases January growth data.

-

Monetary policy: Federal Reserve Bank of St Louis president James Bullard is scheduled to give a presentation and participate in a fireside chat on the US economy and monetary policy.

-

Politics: Joe Biden is due to address lawmakers in Ottawa as part of his official visit to Canada. Former president Donald Trump holds his first rally of the 2024 presidential race in Waco, Texas tomorrow.

What did you think of today’s FirstFT? Let us know at firstft@ft.com. Thanks for reading.

Five more top stories

1. A symbolic state visit by King Charles III to France has today been cancelled following a week of violent protests in the country. The trip was due to include a visit by the British monarch to Bordeaux where demonstrators last night set fire to the town hall’s front door.

2. European bank shares are taking a hit today as worries about the health of the continent’s banking system return. Deutsche Bank, Germany’s largest lender, fell as much as 12 per cent, France’s Société Générale lost 7 per cent and Finland’s Nordea shed 9.8 per cent at the end of a week that began with the forced takeover of Credit Suisse.

3. Do Kwon, the crypto entrepreneur behind terraUSD and luna digital, was charged last night in the US with fraud. The South Korean was charged with eight criminal counts, including securities, commodities and wire fraud, hours after he was arrested in Montenegro.

4. EXCLUSIVE: Executive pay at Silicon Valley Bank soared after the bank embarked on a strategy to boost profitability by buying riskier assets exposed to rising interest rates, according to a Financial Times analysis of securities filings and people familiar with the matter.

5. Short seller Hindenberg Research accused Jack Dorsey’s payment group Block of artificially inflating its user numbers and facilitating fraudulent transactions. Block shares closed down nearly 15 per cent yesterday after the report was published.

How well did you keep up with the news this week? Take our quiz.

Weekend essay

With opposition to Emmanuel Macron’s controversial pension reforms showing no sign of abating, Simon Kuper asks is it time for a sixth Republic?

We’re also reading . . .

Chart of the day

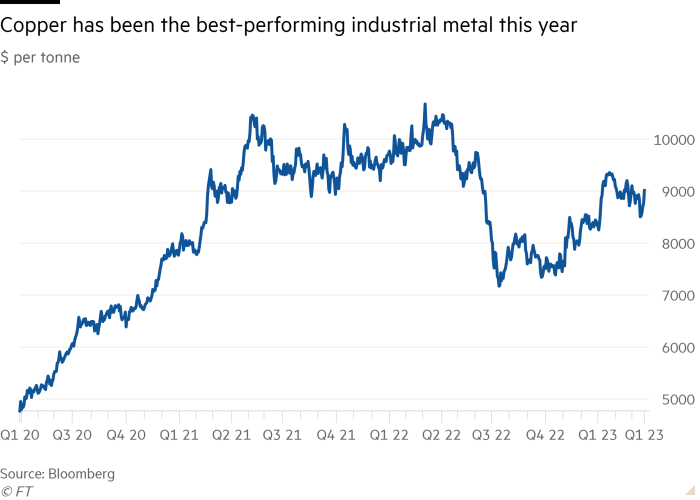

Global inventories of copper, which is used in everything from power cables and electric cars to buildings, have dropped rapidly in recent weeks to their lowest seasonal level since 2008. Kostas Bintas, co-head of metals and minerals at Trafigura, the Singapore-based trading house, told an FT conference that prices would surge to a record high this year.

Take a break from the news

Keanu Reeves’ return in the violent John Wick: Chapter 4 and a movie about the 1960s investigation into the Boston Strangler are among our reviewers’ top picks this week.

Additional contributions by Tee Zhuo and Emily Goldberg

Thank you for reading and remember you can add FirstFT to myFT. You can also elect to receive a FirstFT push notification every morning on the app. Send your recommendations and feedback to firstft@ft.com

Comments are closed, but trackbacks and pingbacks are open.