[ad_1]

Job cut announcements in big tech and banking have been relentless since the start of the year. Many thousands of UK workers and their families will be affected by global lay-offs at Google, Microsoft, Spotify, Amazon, Goldman Sachs, Morgan Stanley and elsewhere.

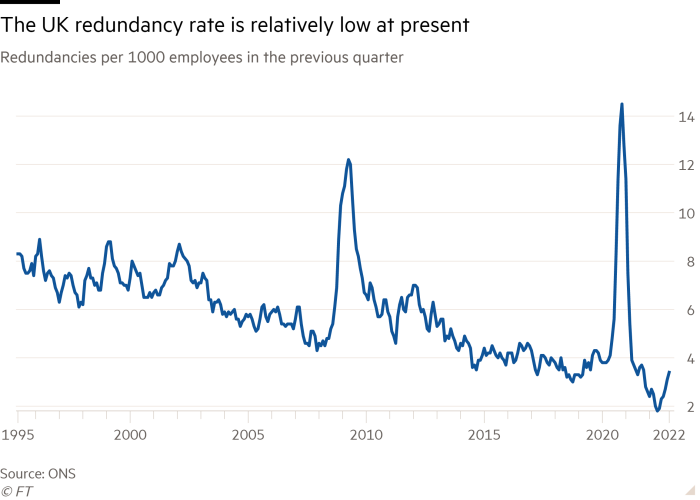

The UK redundancy rate is still relatively low, having increased to 3.4 per thousand employees in September to November 2022, according to the Office for National Statistics. However, some economists see stormier months ahead, with predictions of an economic recession and many more lay-offs.

And with even well-financed companies reviewing their strategies, job worries are not limited to those employed in struggling businesses. Wherever you are working, it’s best to have a financial plan.

“It’s better to be mentally prepared so you’re not blindsided by it, so it feels like a betrayal,” says Lizzy, 42, who has been through redundancy three times in her career in sales and events. “Taking it personally is where the danger comes from. We need to break the taboos around talking about redundancy, because it’s common and happens to a lot of people.”

FT Money looks at everything from severance payments and debt management to maximising pension benefits — and offers advice on how to limit the impact on your household finances.

Stick up for your rights

Redundancy hits hardest on people in low-paid jobs, with the greatest difficulties in finding new work and little or no money to fall back on. Around third of adults have £1,000 or less in savings, according to Financial Conduct Authority data.

But even those fortunate enough to have well-paid work and some rainy day cash need to think carefully when redundancy strikes. In one poll, nearly two-thirds of Britons said they could not survive three months out of work without borrowing money.

First, know the law. You may be entitled to a statutory redundancy payment, but only if you have accumulated two years’ service. Daniel Parker, associate at law firm Winckworth Sherwood, says: “Redundancy can be especially tough on individuals who do not have two years’ service, who can be dismissed without a particular process or a statutory redundancy payment [which] is not especially generous.”

He gives the example of a 35-year-old with their employer for just over two years and a salary of £50,000. They could currently expect a statutory payment of £1,142. The maximum weekly amount used to calculate statutory redundancy pay is £571 — even if your weekly wage is higher, with the maximum statutory redundancy pay just £17,130.

Many employees will leave with nothing. Since the average time to find a new job is three to six months, budgeting will be crucial. Check your weekly and monthly spending. Jonathan Watts-Lay, director of Wealth at Work, a financial wellbeing company, says: “Some costs might go down because you’re not working. You might not have to pay your train fare or buy lunch.”

But you may also have to decide if some spending, for example gym membership, is essential. If you’re not yet on the property ladder, you might be able to move to a cheaper location to cut rental costs. You may even end up preferring your new home.

Dimana Markova, 27, moved cities to save money when she was made redundant from her digital marketing job at the end of 2020 aged 24. Meanwhile, she negotiated with her employer to stay on as a freelancer, so she had a little income coming in.

She says: “They became a client rather than an employer. It was some income, but I still needed to think about expenses and being money savvy.

“I did have savings but I didn’t want to touch my rainy day fund. I also had a small investment portfolio in a Vanguard Isa and was very eager not to stop putting money in. So I decided to live with my old phone a bit longer to keep my investments going.”

Reserve in the tank

Liam, who is 35 and works in tech-based business lending, has been made redundant four times in the past five years. He is married with two children and has a mortgage, so cutting back on expenditure was key to surviving until the next job, though he was never between jobs for long.

He says: “Redundancy was always after one year to 18 months and I only once got a pay-off — of one month’s salary.

“The tech and fintech start-up world does come with a degree of risk. It has been easier every time. You get used to conversations with recruiters and the process. Nothing’s forever and I’ve become quite thick skinned. I’m always networking and keeping in touch with contacts.”

As Liam has had a pay rise in his current job, he’s saving up to get at least a month or two of income in reserve. “Having back-up money will not be a bad thing,” he says.

As well as cutting outgoings, look at debts. If you have classic credit card debt with a high interest charge, consider consolidating it into a cheaper form, or using redundancy payments to pay it down.

Watts-Lay says: “Mortgage debt is quite a chunky cost for most people — you can talk to your mortgage provider to ask for a holiday.”

Depending on your circumstances and previous payment history, you might be able to take a break of up to six months. But not all providers offer a mortgage payment holiday — with some requiring that you have previously made overpayments.

While you’re not making mortgage payments, you’re still racking up interest. So any outstanding mortgage balance and mortgage payments will end up higher. And note that payment holidays will show up on your credit file and affect your credit score.

Alternatively, if you have space, the Rent a Room Scheme could help tide you over. This allows you to earn up to £7,500 a year tax-free from letting out furnished accommodation in your home.

For some wealthier families, keeping up with private school fees might be a worry. You might have insurance for job loss. But it’s important to speak to the school’s bursar. The school may offer a temporary delay or cut to fees, but be prepared to pay interest later. Some schools may be able to offer financial help in exceptional circumstances.

Of course, you may be fortunate enough not to face a cash squeeze, at least not for many months because you are one of the many employees lucky or sensible enough to have an employment contract offering more than the statutory redundancy terms — perhaps far more.

Parker says: “Many larger employers offer discretionary enhanced packages. Often, employees need to sign settlement agreements in order to get an enhanced package.”

Tax take

The good news is that on all redundancy payments the first £30,000 is paid free of tax. What’s not so good is that the £30,000 tax-free limit has been frozen for well over three decades, since it was set in 1988. If inflation had been allowed for, it would stand today at £73,000. Effectively, many employers are hit with a stealth tax as they head out of their employer’s door.

Based on HMRC data and a freedom of information request, research from AJ Bell concluded that around one in four people pay tax on redundancy. So, despite the exemption on the first £30,000, paying tax is quite common.

Laura Suter, head of personal finance at AJ Bell, says: “Those who’ve lost their job will be faced with a far higher tax bill than they might expect. For a higher-rate taxpayer it means they will pay up to £17,200 more in income tax on any redundancy payout [than] if the allowance had risen with inflation.”

If you have a big payout and are walking into a new job, you may be tempted to buy a big-ticket item such as a dream car. Zoe Bailey, director of financial planning at Evelyn Partners, says: “It’s the same as any bonus. People mentally start spending it rather than saving it.”

But you might think you should be prudent. Remember, you can reduce any income tax bill by making a pension payment (see below). This can be a good decision for many, but it’s not the only sensible option. It’s better to stay calm, and don’t make any hasty decisions and perhaps take independent advice.

While you consider your longer term moves, you might think of topping up rainy day funds. There are plenty of one-year fixed rate bonds now offering 4 per cent annual interest.

Also think about overpaying on your mortgage. This is especially attractive if you’re one of the many homeowners who will see their fixed-rate deal end this year, meaning a big jump in monthly repayments. Most lenders allow you to overpay your mortgage by 10 per cent of the remaining balance each year penalty free.

And if you do receive a chunky payout, beware of scams. Unfortunately, fraudsters target people with redundancy payments with tempting offers.

If it’s too good to be true, it probably is. Watts-Lay warns: “Your vulnerability is an issue. Being off guard means you’re sucked in more easily.”

Prioritise your pension

If you can afford it, pay some of your redundancy payment into your pension to boost your retirement savings. The tax relief on pension contributions can reduce any income tax bill. But plan carefully.

Jonathan Watts-Lay of Wealth at Work, a financial wellbeing company, says: “There are limits on the tax relief you can receive from pension contributions each year, so it will be important to check these carefully first.”

Making a pension contribution could be an option for younger people who believe they will secure another job soon and can put away the surplus cash.

But if you are over 55 and don’t intend to return to work, you can use your pension to boost your income now — placing the taxable element into your pension fund and immediately converting 25 per cent of the taxable redundancy pay into tax-free income.

This option is available if you have not hit the lifetime allowance for pensions of £1.073mn, beyond which there may be punitive tax charges.

Rab Aitken, 65 (above), did so when he was made redundant the second time — from his managerial job at oil and gas company EnQuest at the start of the pandemic. He opened a separate self-invested personal pension (Sipp) for the balance over £30,000.

He says: “Nobody is expecting sympathy for a big pay-off but it’s also annoying that the government takes 40 per cent of it. I don’t need to touch my Sipp because my workplace pension is so good. So my Sipp is about avoiding inheritance tax.”

Using the pension becomes even more valuable if a redundancy package pushes you into a higher income tax bracket or puts you over the threshold where the annual £12,500 personal tax-free allowance tapers down.

Tim Laverick, 64, was made redundant in 2014 from his executive role at Unilever. Then 56, he put the excess money over the £30,000 tax-free limit into a pension scheme. He says: “It’s not rocket science. At the time I would have been paying tax at 45 per cent on the excess money. It was an obvious choice to put it into my pension.”

Evelyn Partners, a wealth advice firm, gives the example of someone earning £100,000 a year being offered a redundancy package of £100,000. The first £30,000 is tax free, but £70,000 will be taxable. You will be pushed into the additional rate tax bracket and will lose your personal allowance.

Making a pension contribution of £70,000 will restore your personal allowance. And 25 per cent of the pension contribution (£17,500) can now be drawn tax free above the existing tax-free £30,000.

Zoe Bailey, director of financial planning at Evelyn Partners, says: “Compulsory redundancy can be quick, sometimes just two weeks, so you might not have the chance to focus on pensions.”

In the example above, the pension contribution exceeds the standard pensions annual allowance of £40,000. But the pensions carry-forward rules normally allow use of any unused annual allowance from the three previous tax years.

To receive tax relief, you must have earned at least the amount you wish to contribute in the tax year you are contributing for. But Bailey says that in the right circumstances you could put £160,000 into a pension gross.

An employee and employer can also agree that all or part of a redundancy payment, above the £30,000 tax-free element, should be paid direct into a pension as an employer contribution. The employer could then claim corporation tax relief.

For example, someone earning £70,000 could agree with their employer to take tax-free redundancy pay of £30,000 with a £40,000 employer contribution being made direct into the personal pension. The employer saves on National Insurance contributions that would be payable on redundancy payments over £30,000.

Bailey says: “For anyone above 55 it’s a really clever tax-free tool. But employers sometimes don’t communicate it widely.”

With both sides — employer and employee — standing to benefit, it’s worth a discussion, so raise the option as early as you can.

[ad_2]

Source link