[ad_1]

The year 2022 was challenging for investors, both in the UK and internationally. Markets gyrated on news of Russia’s invasion of Ukraine, Chinese domestic policy, and Britain’s brief experiment with Trussonomics.

The dominant narrative driving markets throughout the year was central banks’ efforts to tame runaway inflation. The stagflationary environment of slowing growth and high inflation for much of the year hurt both equities and bonds. But it was bonds that suffered most, a result of the sharp rise in interest rates.

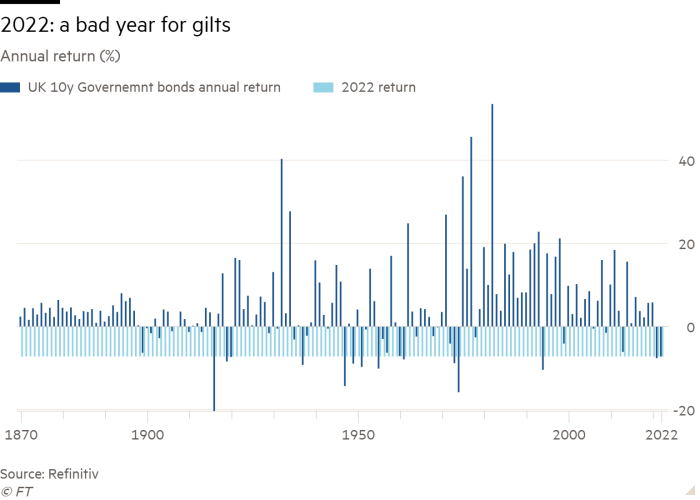

As things stand, UK government bonds — gilts — have returned one of their worst-ever years. And this is even after a recovery from the lows following Kwasi Kwarteng’s “mini” Budget.

However, we expect bonds to have a much better year in 2023. Inflation in the UK, as well as the US and Europe, looks set to fall considerably next year. Major central banks, including the Bank of England and, most importantly, the US Federal Reserve, will slow the breakneck pace of interest rate rises and will at some point stop hiking altogether.

This should allow bonds to perform much better than last year. What is more, high quality bonds should offer some protection to investors’ portfolios if equities come under pressure again next year.

The traditional 60/40 portfolio (where three-fifths of a portfolio is invested in equities with the rest into bonds) has been extremely successful in recent decades because equities and bonds have acted as diversifiers for each other through the economic cycle.

This relationship broke down in 2022. But the peak of inflation and soon interest rates means that bonds should once again provide diversification for riskier assets.

For equities, though, the outlook is not so rosy. The economic situation in the UK is extremely precarious. The UK and Europe are already in recession and we expect the US will soon follow suit. British consumers are already feeling the pinch of higher energy bills and this will only get worse, even with the announced government intervention. And with mortgage rates surging, the housing market, a key driver of sentiment in the UK, is likely to come under pressure this year.

UK equities have the benefit of being extremely cheap. However, the multitude of economic problems that the UK faces make us hesitant to recommend them though they may still outperform other regions due to cheaper valuations. On a broader level, even with more clarity on the direction of inflation and interest rates, we think a cautious approach to investing is prudent for now.

Investors should consider a lower than usual equity weighting and a higher than usual government bond weighting in their portfolios for the time being.

That said, we have a positive view of China. Strict Covid rules are being relaxed there, which should boost growth by the latter half of 2023. In addition, over the medium term, we think that US/China decoupling is here to stay. However, the extreme views surfacing as a result of Russia’s invasion of Ukraine are likely to be assessed more practically given China’s critical role in the global financial and economic system.

Goodbye, 60/40?

The resurgence of bonds could prove short lived, however. Although inflation will come down from its recent highs next year, we believe that the average level of inflation and interest rates is likely to be higher in future than in the previous decade.

Savers might welcome a 4 to 5 per cent interest rate on their cash accounts after years of virtually no interest payments at all. But the reality is that higher inflation and an end to the ever-declining interest rates of the past 40 years will lower the real returns of fixed-income assets such as cash and bonds.

The 60/40 portfolio has been a mainstay of investing for decades. While we believe it still has its place, the higher inflation world we are entering means investors should consider making alternative assets, such as real estate, infrastructure, and private equity and credit, a more significant part of their holdings given their different sensitivity to inflation.

For example, infrastructure projects often have guaranteed inflation-linked revenue streams.

Many institutional investors have already taken steps to enhance their portfolios by allocating funds to alternative assets, seeking to benefit from the uncorrelated and sometimes superior returns they can provide. Our analysis of some of the world’s largest pension funds found that some hold as much as a third of their assets in illiquid alternatives.

Many have also chosen to limit their government bond allocations to the minimum acceptable regulatory level, given the weak long-term real returns they are expected to provide.

For retail investors, access to private markets is harder. However, there are many alternative investment trusts listed on public exchange in which to park capital, including real estate and infrastructure, as well as some more niche areas such as shipping and music royalties.

Given the large range of options and the benefits alternative assets can provide, it is perhaps now appropriate to consider if a 50/30/20 of equity/fixed income/alternatives mix might be superior to a traditional 60/40 portfolio for some investors, especially those with long investment horizons.

We expect government bonds to play an important role in portfolios in 2023, both in terms of return and protection. But in the higher average inflation world which lies ahead, investors will be rewarded for thinking outside the box.

Salman Ahmed is global head of macro and strategic asset allocation at Fidelity International

[ad_2]

Source link