[ad_1]

Stay informed with free updates

Simply sign up to the Global Economy myFT Digest — delivered directly to your inbox.

This article is an on-site version of our FirstFT newsletter. Sign up to our Asia, Europe/Africa or Americas edition to get it sent straight to your inbox every weekday morning

Good morning. Binance chief executive Changpeng Zhao has resigned as he pleaded guilty to a US criminal charge of failure to protect against money laundering, as federal prosecutors unveiled a sweeping case against the world’s largest cryptocurrency exchange.

The crypto venue also pleaded guilty to a host of criminal charges related to money laundering and breaching international financial sanctions, agreeing to pay more than $4.3bn in penalties, US authorities said yesterday.

The crypto sector’s links to terror financing have been under renewed scrutiny following Hamas’s attack on Israel last month. In the aftermath of the attack, Israel shut more than 100 Binance accounts, the FT has reported.

The US Treasury department said the exchange failed to report “well over 100,000 suspicious transactions” linked to ransomware attacks, child sexual abuse, large-scale hacks, the narcotics trade and terrorist groups including al-Qaeda and Isis.

“In part because of the crimes committed, Binance became the largest cryptocurrency exchange in the world,” said US attorney-general Merrick Garland. Read the full story.

Here’s what else I’m keeping tabs on today:

-

UK-South Korea relations: Prime Minister Rishi Sunak is scheduled to meet South Korean President Yoon Suk Yeol.

-

Merger: US chipmaker Broadcom will complete its acquisition of cloud software company VMware after Beijing approved the $69bn deal, in a sign that China is working to ease trade tensions with the US.

Five more top stories

1. Israel’s government was meeting on Tuesday evening to vote on a deal that could free dozens of civilian hostages held in Gaza in return for a pause in hostilities and the release of Palestinian women and children from Israeli prisons. US President Joe Biden said Israel and Hamas were “very close” to an agreement.

2. OpenAI’s directors are in talks with Sam Altman to allow him to re-join the board, four days after their decision to sack him plunged the generative artificial intelligence start-up into turmoil. A deal to bring back Altman is one of a number of options being discussed to unify the company. Read the latest on the tumult at the ChatGPT maker.

-

The Sam Altman effect: There was a cult-like following for the OpenAI chief within the company, according to staff, evidenced by the internal revolt over his firing.

3. The US and the Philippines have started joint air and sea patrols in the South China Sea. The move comes as Manila and Beijing are embroiled in an increasingly heated stand-off over the Philippine military’s resupply missions to its outpost on the Second Thomas Shoal, a sandbank in the South China Sea that is also claimed by China.

4. Chinese authorities are putting pressure on state banks to accelerate lending to private property developers, as they strengthen efforts to support the struggling groups at the heart of the country’s real estate crisis. The directions were conveyed to China’s biggest lenders at a recent gathering in Beijing with senior government officials.

5. Federal Reserve officials expressed little urgency to raise interest rates again at their most recent meeting, even as they reiterated their willingness to tighten monetary policy further if warranted by new data. Here’s what else the minutes from the US central bank’s November meeting said.

The Big Read

Bob Iger’s dramatic comeback at Disney a year ago was celebrated by staff and Hollywood at large. But he has found himself leading the company in a far less forgiving environment than the one he left in 2020. The era of low interest rates that made billions in streaming losses seem palatable is over and the hit machine that was its studios business is running out of steam. Can Disney rediscover the magic?

We’re also reading . . .

-

Indonesia: The country is still trailing behind its south-east Asian peers when it comes to exploiting the diversification of global supply chains away from China. Mercedes Ruehl explains why.

-

Biden can’t spin his way to re-election: The fundamental Democratic offering, not a failure to communicate, is the party’s problem, writes Janan Ganesh.

-

Fiscal crises: Martin Wolf explores whether a public debt disaster is looming, and what the consequences would be for the global economy.

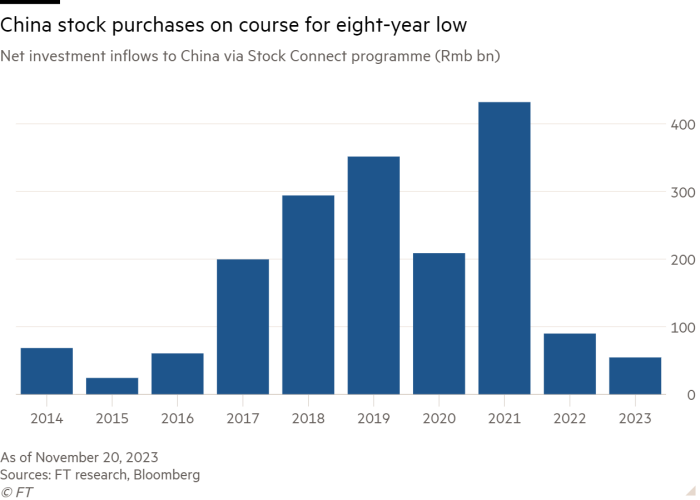

Chart of the day

More than three-quarters of the foreign money that flowed into China’s stock market in the first seven months of the year has left. Global investors have dumped more than $25bn worth of shares, putting net purchases by offshore investors on course for the smallest annual total since 2015.

Take a break from the news

How do you navigate one of the world’s great — and at times overwhelming — mega-museums? FT arts editor Jan Dalley reveals her favourite works to seek out in the Prado museum in Madrid.

Additional contributions from Grace Ramos, Gordon Smith and Euan Healy

[ad_2]

Source link