[ad_1]

Latest news on ETFs

Visit our ETF Hub to find out more and to explore our in-depth data and comparison tools

The metaverse has become the hottest concept ever in the history of exchange traded funds — despite steady media coverage suggesting there has been little interest in the “sub-theme”.

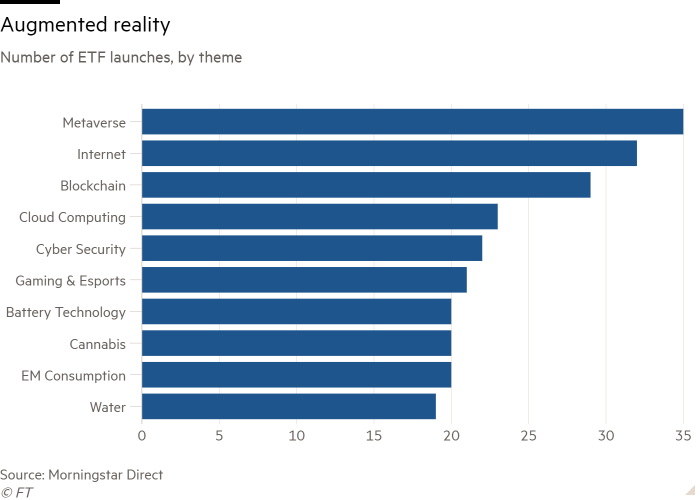

A total of 35 metaverse-badged ETFs have launched globally since the first rolled off the conveyor belt in June 2021, according to data from Morningstar.

This exceeds the number for any other “sub theme”, according to Morningstar classifications, ever, trumping the 32 for internet ETFs, 29 for blockchain ones, 23 for cloud computing and 22 for cyber security.

The avalanche of launches has come despite an embarrassing lack of traction for many early offerings in the metaverse — a futuristic immersive version of the internet enabled by virtual and augmented reality.

Even Meta Platforms, which was so enamoured by the concept that it changed its name from Facebook to “reflect its focus on building the metaverse”, has started to lay off workers associated with the project.

But when it comes to ETFs, “we have seen very, very fast uptake”, said Kenneth Lamont, senior fund analyst for passive strategies at Morningstar. “It’s the quickest ever.”

“We always imagined that there would be a multitude of other funds coming to market,” said Matthew Ball, a venture capitalist who created the index that underpins the first and largest metaverse fund, the $400mn Roundhill Ball Metaverse ETF (METV), which launched in June 2021.

“It has always been our view that the metaverse is a multitrillion dollar, multi-decade opportunity. There was no scenario in which we didn’t see a flood of other ETFs coming to market.”

In METV’s wake, a further 11 metaverse ETFs launched globally in the fourth quarter of 2021 alone, according to Morningstar’s database; 23 more have seen the light of day this year.

And the ETF industry is far from alone in licking its lips at the possibility of rapid growth. Citi forecast earlier this year that the metaverse could boast up to 5bn users and generate revenues of between $8tn and $13tn by 2030. Morgan Stanley foresees $8tn in each of the US and China, irrespective of the rest of the world, while Goldman Sachs talks of a $12.5tn opportunity.

Based on World Bank GDP growth forecasts, that means the metaverse will account for between 6 and 40 per cent of global economic growth over the next eight years, Ball said.

“It’s the next generation internet. I would call it a master theme in the decades to come,” he added.

Investors, as well as the hoped-for early-stage users, may be less convinced, however.

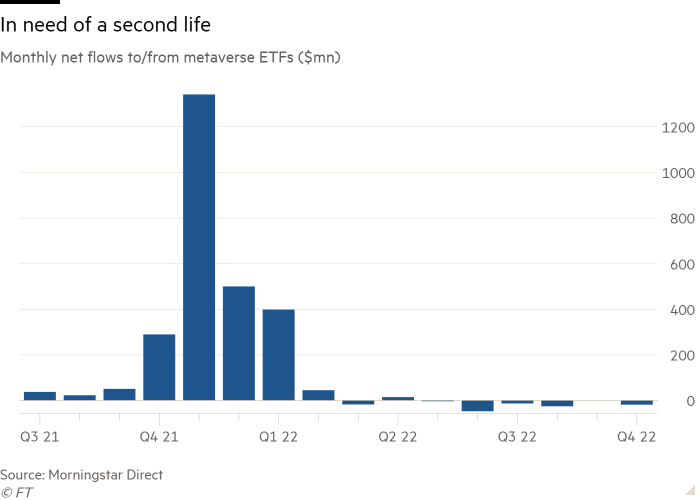

Net flows to metaverse ETFs totalled $2.6bn between October 2021 and February of this year, according to Morningstar. However, since then, they have turned negative, with $111mn being withdrawn.

Valuations of the underlying stocks have also been caught up in the wider technology sell-off, with total ETF assets sliding from a peak of $2.3bn in March to $1.3bn.

This reversal is unlikely to sap industry enthusiasm for long, though. “There are more players looking at the market, holding their surfboard waiting for the next wave,” Lamont said.

One obvious question, though, is what exactly the metaverse will be used for. Much of the initial coverage has focused on consumer uses, such as gaming and socialising.

However, Dina Ting, head of global index portfolio management at Franklin Templeton, which launched a metaverse ETF in September, believes its real potential lays in combining the digital and real worlds as an aide to industry, something we are “really at the cusp of”.

A company planning to build a new product could, for example, use virtual reality to perfect its manufacturing plan.

Ball agrees, pointing to early uses such as Johns Hopkins University neurosurgeons using augmented reality to perform spinal surgery, the US army buying Microsoft’s AR headsets and Tesla creating a simulation of San Francisco to test its self-driving systems.

“It’s about making the real world legible to software,” he said. “Most of the time it will complement reality, not replace it.”

Omar Moufti, product strategist for thematic and sector ETFs at BlackRock, which unveiled its debut metaverse ETF this month, was even more enthusiastic, saying: “We see the metaverse as the next leap forward in global communication and connectivity.”

However, given the metaverse’s rudimentary state, there appear to be few listed companies to invest in.

“The story may be there but the building blocks you can use at a public level may not be. There is definitely that tension,” Lamont said.

With the exception of Roblox, an online gaming and game creation platform, there are few obvious “pure play” holdings. Instead, many ETFs have big positions in larger tech companies such as Apple, Microsoft, Nvidia, Tencent and Taiwan Semiconductor Manufacturing Company, or their South Korean peers in the case of the many ETFs listed there.

“How much of the revenue of these companies is going to be from the metaverse?” asked Lamont.

Ball argued that matters are not always to clear-cut: “The average investor would probably underappreciate the importance of the metaverse theme at some of the large companies. They have the expectation of trillions of dollars of revenue in the years to come.”

Nevertheless Ball, who is also of the view that the metaverse does not really exist yet, expects “that the composition of the [underlying] index will change significantly over time”.

Despite the lack of metaverse companies, Ting argued that the benefit of investing now was that valuations for tech stocks “have been discounted quite a bit” and “the potential return can be 100 times”.

Lamont, however, was more circumspect. “There is no doubt [the metaverse concept] has been enthusiastically received, but I think we should be sceptical.”

“We shouldn’t be jumping on a bandwagon as soon as someone launches [an ETF]. The concept of the metaverse remains relatively nebulous.”

Click here to visit the ETF Hub

[ad_2]

Source link