[ad_1]

Nestled between high-end estate agents and bakeries in Highgate, N Family Club is fast becoming one of north London’s most sought after daytime venues. Members enjoy three meals a day, a devoted creative space, landscaped gardens and tasteful Scandinavian interiors. And they are all under 5.

With backing from private equity investors Gresham House and Steyn Group, N Family Club is now one of the largest childcare providers in the UK, according to sector experts Nursery World. With an ambition to grow to 80 outlets by 2025, it is one of a number of fast-growing chains reshaping England’s fragmented and financially precarious early years sector.

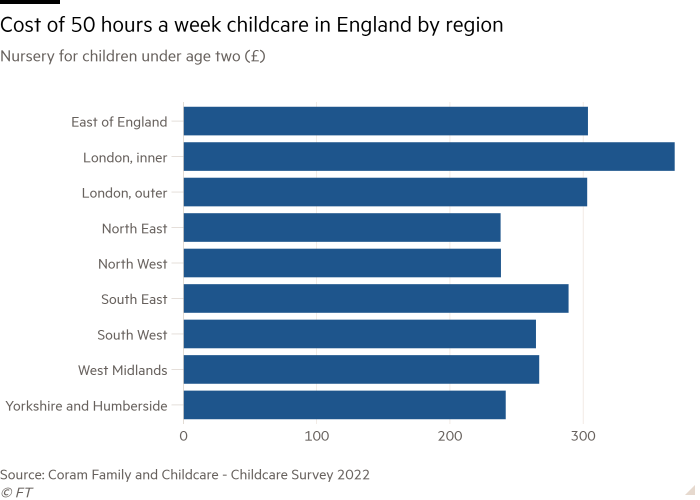

N’s growth comes in the midst of a childcare crisis. Slim government subsidies have left an unplanned market of providers struggling to stay afloat, staff wages low, and parents facing some of the highest childcare fees in Europe.

Yet large for-profit groups and private equity backers have spied an opportunity, increasing acquisitions and growing their share of a sector traditionally dominated by smaller chains. Investors say this will bring more cash, innovation and efficiency.

But some owners, parents and staff fear putting international, often highly leveraged companies in charge of childcare will increase costs, damage quality and close providers in deprived areas, while leaving nurseries in a precarious financial position.

“It’s the most worrying aspect of the fact we don’t have a managed market,” said Sam Freedman, a former adviser to the Department for Education and co-author of a recent paper on childcare by think-tank Institute for Public Policy Research. He fears expanded private ownership will divert funding to profit and debt servicing.

“We’re putting a lot of state money into the sector and they’re taking a lot of money out,” he said.

In the last five years there has been an uptick in acquisitions in the nursery sector, despite the UK’s economic turmoil. According to Christie & Co, a brokerage firm, there was a 50 per cent increase in nursery businesses sold in the first half of this year.

The largest chains, Bright Horizons and Busy Bees, have expanded to more than 300 nurseries apiece, becoming the country’s largest providers. Newer private-equity backed chains like N Family Club, Family First and Kids Planet, which nearly doubled in the past year to 142 settings, have grown rapidly, though out of a total of about 27,000 nationwide their total market share is still small.

The scale of opportunity is significant. The 20 largest nursery companies have increased their capacity by 37 per cent since 2016, but still make up just 15 per cent of the total market, said Arun Kanwar, an adviser at consultancy Cairneagle. Half of all nurseries are standalone “mom and pop” outlets.

Some private equity groups are deploying a ‘roll up’ strategy, in which buyout groups snap up small independent businesses, typically using debt, and pull them together into an industry behemoth with economies of scale. They hope they will ultimately be able to sell the enlarged group at a higher overall valuation.

Kanwar believes consolidation will improve quality, as bigger groups save on overhead costs, share resources and draw investment. “The UK has some of the best childcare in the world and arguably it wouldn’t have got there without the innovation and the investment of the private sector,” he said.

For others in the sector, however, the role of private equity in the consolidation of the sector requires closer scrutiny. A UCL report this year warned the nursery sector risked “being damaged” by large groups that did “not necessarily” create new places or reinvest more money, adding that high debt levels put providers “at risk of collapse”.

Cheryl Hadland, the founder of Tops Day Nurseries, which runs nearly 30 sites in south west England, said investors approach her “a couple of times a month”. But she has always declined sales, saying investment comes with an obligation to pay high levels of interest on debt — money that could be spent on staff or equipment.

“This expensive money means that already very slim profit margins are eroded, so you can’t invest in staff or maintenance,” she said. “They are ripping the guts out of the sector.”

Busy Bees nursery group has been passed between private equity and corporate owners for more than two decades. Now owned by the private equity arm of Ontario Teachers’ Pension Plan, its debt is about 7.5 times its earnings, according to a Moody’s report last month. The rating agency has graded the debt as B3 — “speculative and subject to high credit risk”.

Busy Bees said its leverage, calculated using different metrics, was 4.1 times earnings.

The debts left the group, whose core earnings in 2021 were £178mn, with a £29mn bill for interest repayments on bank loans and overdrafts.

Busy Bees said it was in a “strong financial position”, with a “comprehensive hedging strategy” that protected it from interest rate rises. Since OTPP bought the chain in 2014 the proportion of nurseries judged “outstanding” by Ofsted, the schools inspectorate had risen from 19 to 35 per cent.

“The scale and quality of our services have further improved through considerable investment of expertise and capital by OTPP,” it said.

Providers like Busy Bees operate in what Josh Hillman, education director at the Nuffield Foundation, called a “quasi market using public resources”. A patchwork of voluntary and private sector providers receive some government support via funded hours for three and four year olds. But this does not cover the true cost of a place, so nurseries rely on some parents paying more for younger children, additional hours or “extras” like lunch.

The problem, Hillman said, is in areas where families can’t afford these add-ons. While some voluntary providers support deprived nurseries with income from wealthier areas, a market dominated by for-profit groups is less likely to deliver places where there is need but no money. “Private equity doesn’t help to divert provision toward more disadvantaged kids,” Hillman pointed out. “It’s got no reason to do that.”

N Family Club targets more affluent parents, and just 5 per cent of its revenue income is now from government subsidies, said Peter Bachmann, managing director for sustainable investment at Gresham House. However the group aims to increase this proportion, while focusing on building new nurseries.

The group’s most recent accounts show it spent £1.8mn in finance costs and interest — equal to almost a fifth of its £10mn wage bill — and it recently took on new debt including a loan with a 10 per cent interest rate. Bachmann said this was to fund acquisitions, and N’s level of debt was “conservative”. The group has also launched a bursary scheme to offer fully-funded places for children identified as most in need by local authorities.

Kanwar believes the wide range of childcare providers will meet the market’s diverse demands — and that the private sector should be praised for bringing investment where the government has not.

But others remain sceptical. As private equity’s share of the market increases, Freedman believes there is limited time to pursue other options before large providers become embedded in the system.

“It feels like this is the moment where if we don’t act now it will get degraded,” he said. “We’d be better off doing that consolidation through the state.”

Additional reporting by Kaye Wiggins

[ad_2]

Source link