[ad_1]

Retail investors are piling into cash after a brutal sell-off in financial markets this year triggered trillions of dollars in losses, stamping out enthusiasm for riskier assets.

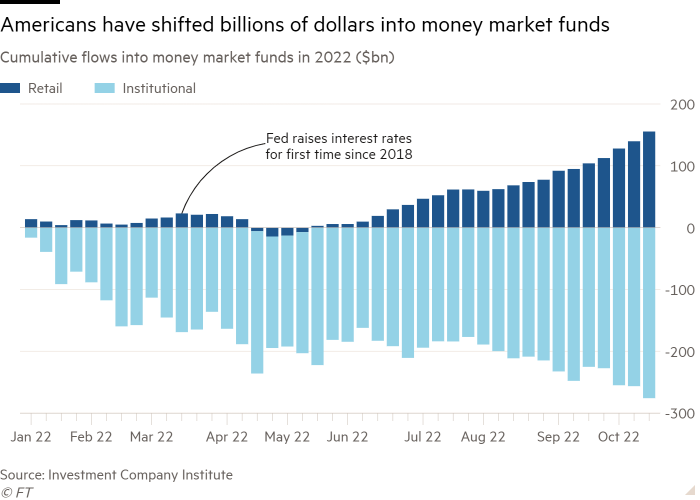

Nearly $140bn has poured into retail money market funds so far in 2022, according to the Investment Company Institute, taking the size of these vehicles to $1.55tn after 10 straight weeks of fresh investment. Inflows have totalled almost $36bn in the past three weeks alone.

That rush into cash follows a long and volatile sell-off in US equity markets this year, which has wiped nearly $15tn off the valuations of publicly traded companies. Wall Street’s benchmark S&P 500 index last month closed out its longest streak of quarterly losses since the 2008 financial crisis.

The market turmoil — fuelled by high inflation and rising borrowing costs as the Federal Reserve turns the screws on monetary policy — has weighed heavily on investor and consumer confidence. A growing number of economists are now warning of recession in the coming year.

“It has been one of these years where everyone has gotten torched and it really is an environment where you feel like you don’t want to put your toes in the water,” said Joe D’Angelo, who runs asset manager PGIM Fixed Income’s money market business.

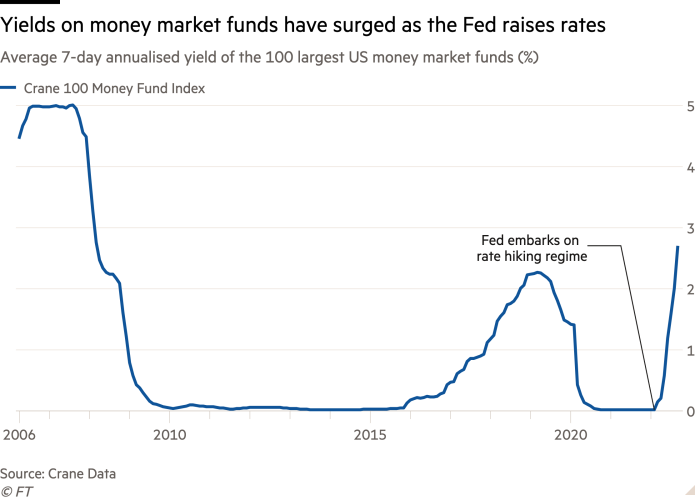

The higher returns available on money market funds — which have steadily increased since the Fed started raising interest rates in March — are also enticing everyday investors, particularly as interest rates on savings accounts at big banks such as JPMorgan Chase and Bank of America hover near zero.

Fidelity’s $240bn government money market fund now yields roughly 2.6 per cent, while the yield on Vanguard’s $218bn Federal money market fund rose to 2.83 per cent this month.

An index of the 100 largest money market funds run by Crane Data, which tracks the industry, shows yields have climbed on average to 2.77 per cent from 0.02 per cent at the start of the year.

“For individuals, for the first time in a long time, you can get some return,” Steve Sosnick, chief strategist at Interactive Brokers, said of the funds. “For years we’ve heard ‘there is no alternative’, but now there is an alternative.”

Retail investors have been joined by big asset managers as well, who are increasingly keeping money on the sidelines as they attempt to wait out the ructions in both equity and fixed income markets. A closely followed Bank of America survey this week showed asset managers in October were holding 6.3 per cent of their portfolios in cash, the highest level since April 2001.

But even as many seek refuge in cash, institutional money market funds have still been hit by $87.4bn of redemptions since the Fed started increasing interest rates this year, taking outflows for 2022 above $250bn.

The withdrawals have been driven in part by companies spending the excess they built up to weather the pandemic. Analysts at Goldman Sachs warned last month that “cash balances are back to pre-pandemic norms” for both blue-chip companies and riskier, junk-rated businesses.

“Corporate cash has been used to pay down debt, used to invest in their businesses and with inflation things are more expensive,” said Matt Jones, head of liquidity distribution at Western Asset Management. “Costs of running a business are higher than it was.”

Still, executives at three money market funds said the withdrawals by both companies and money managers did not signal less appetite for cash or cash-like investments. Instead, they had observed stiff competition from both domestic and non-US banks offering high interest rates to corporate clients in an attempt to attract deposits. Others, including some asset managers, have opted to manage that cash themselves.

“We saw more sophisticated clients go directly into markets themselves,” said John Tobin, chief investment officer of asset manager Dreyfus, adding that some clients invested in short-term instruments such as commercial paper, Treasury bills or bank certificates of deposit.

Tobin said such activity did not always work out for investors, given the Fed has raised rates faster than many investors anticipated. “They expected future Fed hikes were priced into the market . . . thinking they could outperform front end products,” he said. “In many cases they were incorrect because people did not expect the Fed to be as aggressive as [it is].”

The US central bank has raised interest rates by an extra-large 0.75 percentage points over each of its past three meetings, taking its target range to 3 to 3.25 per cent.

Money market funds by contrast have steadily shifted into shorter- maturing investments since the year began, with many tapping the Fed’s overnight reverse repo facility — a programme that only some banks and money managers have access to. That has allowed the funds to take advantage of higher rates as soon as the central bank lifts borrowing costs.

Appetite for cash will be tied to the Fed’s policies as well as broader volatility in financial markets, investors said. Some cautioned that if and when the Fed decides that it has a grip on inflation, cash may prove less enticing.

Money market funds have not been popular for long, but managers are wondering if their pre-eminence is set to continue, said John Croke, head of active fixed income products at Vanguard.

“If inflation stays high, it ensures that rates will stay positive for longer, and money market funds will retain their relevance for longer.”

[ad_2]

Source link