[ad_1]

Good morning. This article is an on-site version of our FirstFT newsletter. Sign up to our Asia, Europe/Africa or Americas edition to get it sent straight to your inbox every weekday morning

Rishi Sunak, former UK chancellor, has emerged as the early favourite to become Britain’s next prime minister, after Liz Truss terminated a 44-day premiership marked by economic and political turmoil.

Truss’s resignation made her the shortest-serving prime minister in Britain’s history; her time in Number 10 will be remembered for a disintegrating economic policy and a disastrous fall in Conservative party support.

Sunak is the “easy favourite,” said one cabinet minister. Bookmakers agreed that the 42-year-old is the frontrunner to become the country’s first non-white prime minister.

Truss was told to quit by senior party figures on Thursday. In a brief statement outside Downing Street she said she had notified King Charles she was standing down as Conservative leader so that a new party leader and prime minister could be chosen next week.

The new leader could be confirmed as early as Monday. Sir Graham Brady, chair of the 1922 committee of backbench Tory MPs, said if only one candidate won enough support, then the new leader would be confirmed when nominations close.

Otherwise, the leader will be chosen by Friday October 28, with MPs set to reduce the list to two and party members then voting online to determine the result.

Thank you for reading FirstFT Americas. Here is the rest of today’s news — Abby

Five more stories in the news

1. Investors expect the Fed to tighten interest rates further Investors now expect the Federal Reserve to raise interest rates to 5 per cent, up from 4.6 per cent that was expected before the latest inflation data was released late last week, according to futures markets that track the federal funds rate. Expectations had ratcheted up after September’s consumer price index report showed an alarming acceleration in monthly price pressures, suggesting the Fed will need to hammer the brakes on the economy harder than expected.

-

Go deeper US stocks fell on Thursday for the second straight session as traders scrutinised economic indicators that suggest monetary policy will continue to tighten. The S&P 500 index of blue-chip US stocks closed down 0.8 per cent, while the Nasdaq Composite gave up 0.6 per cent.

2. Germany concedes move to cap gas prices German chancellor Olaf Scholz dropped his opposition to an EU gas price cap after late-night summit talks, conceding: “It makes sense.” Germany’s earlier reluctance to embrace price caps stemmed from fear that they would risk diverting gas to other countries that offered a higher price, undermining European efforts to shore up supplies as Russia cuts exports to the bloc.

3. Grandmaster sues over chess cheating claims Hans Niemann, the 19-year-old chess grandmaster accused of cheating, filed a lawsuit in US federal court seeking at least $100mn in damages from defendants including reigning world champion Magnus Carlsen. The suit brings claims including slander, libel and civil conspiracy against Carlsen, Chess.com and Hikaru Nakamura, the American grandmaster and popular livestreamer.

4. Snap shares plunge on widening losses Snap’s revenue growth slowed and losses ballooned in the third quarter as the company undertakes a radical restructuring to confront challenges around targeted advertising and battles macroeconomic headwinds. The Los Angeles-based company reported on Thursday that revenue rose 6 per cent year on year to $1.13bn, slightly below analysts’ expectations of $1.14bn. It was the slowest pace of growth since the company went public in 2017.

5. Blackstone profits hit by rising rates and stock market sell-off The asset manager’s profits declined as tightening financial conditions and plunging stock market valuations caused it to dramatically slow its sale of investments. In third-quarter results released on Thursday, Blackstone sold just $15bn in assets, half the amount it sold in the previous quarter, cutting into the earnings it generated from selling investments for a profit.

The day ahead

American Express Investors will look for any signs of a slowdown in consumer spending when the credit card company reports third-quarter earnings against a backdrop of raging inflation that is leaving people more strapped for cash. Many Americans took advantage of the pandemic, with its low interest rate environment, stimulus cheques and lockdowns curbing discretionary spending on “experiences”, to save and reduce credit card debt. Those trends have reversed, with the jump in prices for many items potentially leading consumers to rely more on credit again. Rising interest rates could also mean consumers may have a harder time paying their credit card bills. That could prompt American Express to set aside loan loss provisions in preparation for a potential decline in consumer credit quality. The group’s revenue is anticipated to increase more than 22 per cent from a year ago to $13.5bn.

Other earnings oilfield services company Schlumberger and telecommunications group Verizon and will join American Express in reporting before the bell. Analysts expect Schlumberger to report a jump in revenue and will watch for any signals that oil producers might increase output after an Opec+ decision to cut production. Verizon is expected to report that revenue increased year on year in its latest quarter. Analysts await any commentary on price increases and holiday upgrade demand in its wireless division as customers prepare for a potential economic downturn.

Fedspeak New York Fed president John Williams will give opening remarks focused on skilling up local workers to take on in-demand careers at an event in Hudson, New York, co-hosted by local economic development corporations and a community college.

Economic data Mexico and Canada will both release retail sales figures for August. Mexico’s sales are expected to have ticked up by 0.3 per cent in August, increasing at a slower pace than July’s 0.9 per cent, for an annual rate of 6.1 per cent, according to analysts polled by Refinitv. Meanwhile, monthly Canadian retail sales are expected to gain 0.2 percentage points after declining by 2.5 per cent in July. Excluding auto sales, growth would be 0.4 per cent. Canada will also report data on pricing for new homes.

What else we’re reading

Peter Thiel’s venture capital-style political strategy yields low returns Peter Thiel entered the 2022 midterm season with a bang, writing two $10mn cheques to a pair of handpicked Senate candidates. Yet just three weeks before the elections, Thiel’s big experiment is in jeopardy, with one of his candidates struggling in the polls and both failing to match their Democratic opponents’ fundraising.

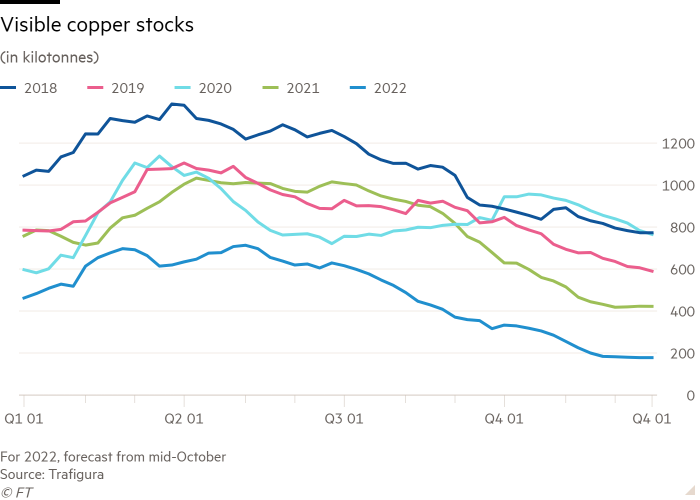

The world is running low on copper The copper market is today running with inventories that cover 4.9 days of global consumption and is expected to finish this year at 2.7 days, Kostas Bintas, co-head of metals and minerals trading at Trafigura said yesterday. Copper stocks are usually counted in weeks.

China’s GDP blackout Economic data from the country’s National Bureau of Statistics have been dwindling since Xi Jinping came to power in 2012. This week’s decision to indefinitely delay the publication of headline third-quarter economic indicators, including gross domestic product, continues a trend towards statistical opacity as China shifts from sustained high growth to more modest numbers.

Football tiptoes around social issues as World Cup draws near Teams and sponsors are seeking to navigate issues such as human rights in Qatar and conditions for migrants workers that have overshadowed the run-up to the tournament, but Fifa has not yet clarified whether the federations involved would be punished for breaking rules that prohibit political action on the pitch, while others point out limits to what can be achieved in the conservative Gulf country.

Close calls and eerie quietude Artist Sergiy Maidukov’s sketches of the war in Ukraine are explained through poignant entries in his diaries.

Travel

Explore Arashiyama, one of Kyoto’s top tourist destinations, with our new FT Globetrotter guide. Arashiyama is worth exploring for its lovely walks dotted with historic temples and gardens, as well as one of Japan’s most famous and iconic bridges. It also happens to be a mecca of Japanese classical literature.

Thank you for reading and remember you can add FirstFT to myFT. You can also elect to receive a FirstFT push notification every morning on the app. Send your recommendations and feedback to firstft@ft.com

[ad_2]

Source link