[ad_1]

Challenger bank N26 is launching a new trading feature in its app — N26 Crypto. Users will be able to easily trade crypto assets using money in their N26 account. Behind the scenes, N26 is partnering with Bitpanda to handle trading and custody.

N26 is going to slowly roll out N26 Crypto across Europe. At first, only some users in Austria will be able to access the new feature. Other countries should get the feature at some point over the next six months.

N26 will let you buy, sell and hold 100 different crypto assets. The startup plans to add another 94 crypto assets later down the road. And I’m sure the company will expand to stocks and other asset classes soon.

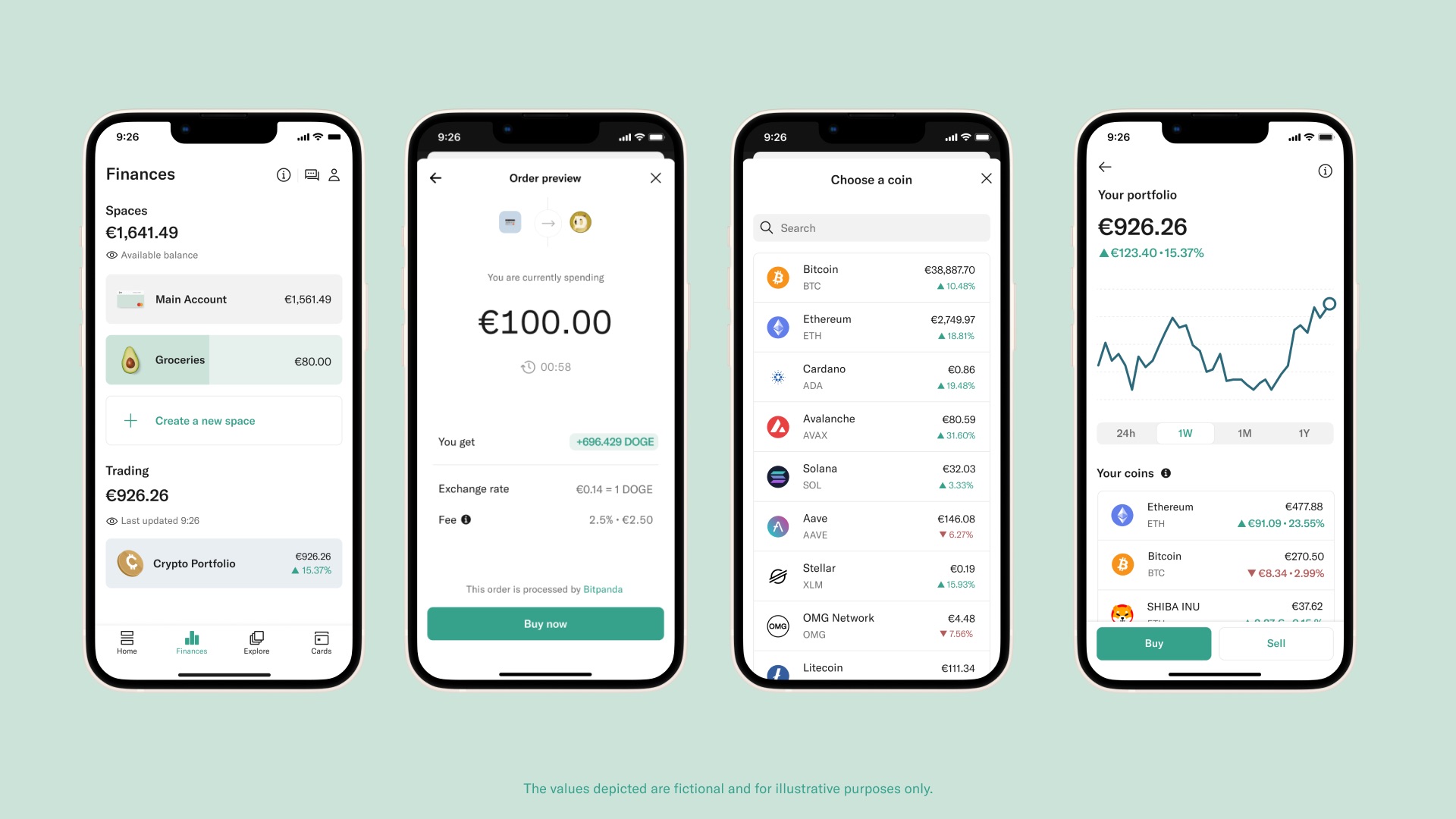

N26 Crypto will be accessible from the second tab, which has been renamed “Finances”. From this screen, you will find your spaces — those are sub-accounts that you can use to set some money aside in a different pocket of money. Spaces can also be used as shared accounts with someone else.

Below your list of spaces, there is a new “Trading” section with your crypto portfolio. N26 lists all your crypto assets, the value of your positions and how they have changed over the last 24 hours, week, month or year.

Whenever users want to buy or sell some cryptocurrencies, they can hit the buy or sell button, choose a crypto asset (or search for it) and enter an amount. N26 displays both the exchange rate and how much you will pay in fees.

Image Credits: N26

N26 plans to charge 1.5% for bitcoin trades and 2.5% for all other cryptocurrencies. That’s the same fee that users pay in Bitpanda’s own app. Users who pay €16.90 per month for N26 Metal will pay 1% and 2% in transaction fees on bitcoin and other cryptocurrencies respectively.

The main advantage with N26 Crypto is that it is directly tied with your existing bank account. You don’t have to upload money to a different trading account, switch to the Bitpanda app (ot another app) and then start trading. Similarly, when you cash out with N26 Crypto, you will get EUR in your main N26 account — no need to transfer money back to your bank account.

N26 isn’t the first fintech startup that builds a deep integration with Bitpanda. French payment app Lydia also partnered with Bitpanda to introduce the ability to trade stock, precious metals, cryptocurrencies and ETFs in its app last year. In my experience, it works really well.

Last week, N26 shared its 2021 financial results. While gross revenue grew by 50% to reach more than €180 million, its operating costs also grew at a rapid pace, resulting in a €170 million net loss.

Of course, N26 has also raised hundreds of millions of euros. Thanks to these deep pockets, the company has plenty of time to figure out how to get more revenue from its users while keeping its operating costs under control. As N26 and Bitpanda have likely agreed to share revenue coming from N26 Crypto, the new feature should contribute to the company’s bottom line.

[ad_2]

Source link