[ad_1]

In the current economy, advisors may be struggling to find returns that can keep up with record inflation rates. With inflation over 9% as of this writing, the usual 1% to 3% may not be cutting it.

What Are Structured Solutions?

Structured solutions have long been used by certain advisors to seek a variety of different objectives, some of which include:

- Aiming to mitigate equity volatility;

- Targeting absolute returns; and/or

- Incorporating potential yield-enhancing strategies.

Structured solutions are not necessarily an asset class, rather they can be used: 1) as an allocation tool for portfolios; 2) tailored to express a particular view on the markets; and/or 3) to supplement existing portfolios with the potential for yield, growth, or protection.

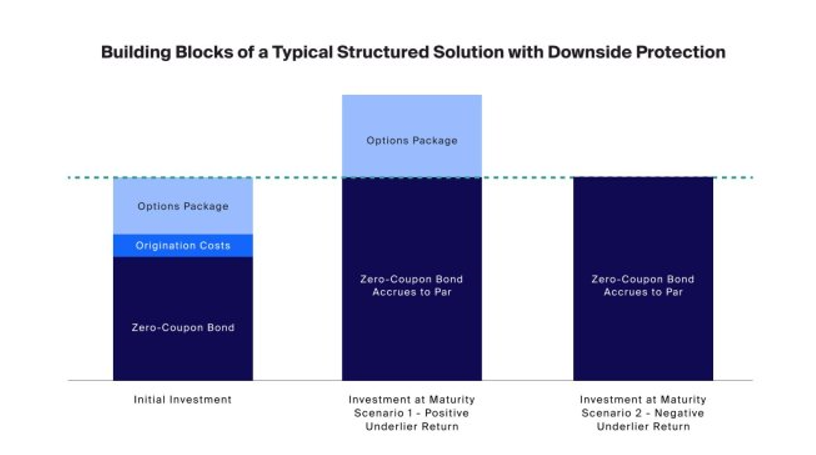

For those who may not be familiar, structured solutions (commonly known as structured investments, structured notes, or structured products) generally include senior unsecured debt obligations of an issuer, that are typically constructed of a zero-coupon bond with an options package along with built in origination costs to create a single security. Such a structured solution seeks to enable investors to achieve a defined payout that may be linked to an index, a stock, or even the price of gold.

Below is an illustration of a structured solution with downside protection, whose payout could be similar to a combination of a zero-coupon bond with a package of options linked to an underlier. In addition, origination fees are generally built into the initial price of the investment. At maturity, the zero-coupon bond generally accrues to its par value and the investor would be left with its principal and any market appreciation of the underlying asset. As with all structured solutions, there are inherent credit risks and investors may lose some or even all of their investment.

In the US, more than $94 billion was issued in structured solutions in 2021–which was approximately 14% of the total global issuance. As the structured solutions market becomes more accessible, independent wealth managers now have an opportunity to customize structured solutions to a given client’s risk appetite and expectations.

Types of Structured Solutions

Structured solutions can generally be broken down into three broader product categories focused on:

- Growth;

- Yield; or

- Protection.

While interest rates remained at historically low levels over the past two years, some investors had to “reach” for yield by attempting to sacrifice either credit quality or liquidity or moving down the capital structure.

As a result, advisors on the CAIS platform began facilitating purchases of “yield notes” as a strategic sleeve in their clients’ asset allocation as a part of their alternative investment or high yield bucket – right next to private credit, real state or high yield fixed-income. Many structured solutions that involve coupon payments tend to have more attractive pricing terms during periods of elevated market volatility, as the core pricing components of these investments conventionally involve selling put options, and heightened volatility generally increase option prices. However, many advisors will caution against trying to “time the market” for volatility spikes versus strategically allocating either quarterly or monthly on a consistent basis to avoid being stuck with cash on the sidelines.

The Fed is currently trying to quell inflation through monetary policies, which results in increased interest rates. As interest rates increase, zero-coupon bonds are generally priced at more of a discount to produce a yield to maturity that is competitive in the market. Zero-coupon bonds are traditionally a large component of a structured solution and higher discounted zero-coupon bonds provide issuers more room to purchase options when forming the structured solution. This may give issuers more flexibility to offer products with the potential for greater returns and protection.

Some Risks of Structured Solutions

Structured solutions aren’t all fun and games. Just like any investment, they come with their fair share of risks.

Since structured solutions are expected to be held until they reach maturity, you must trust that the issuing bank will still be around when that day comes. If they close, then they don’t have to pay. It may sound far-fetched but tell that to Lehman Brothers, which, before filing for bankruptcy in 2008 after 161 years in business, was the fourth largest investment bank in the US.

In addition, structured solutions are effectively an illiquid investment with little to no way of getting out early without the possibility of taking heavy loss. If you need to sell before full maturity, you’re basically beholden to whatever the original issuer is willing to pay.

An investor considering an investment in structured solutions should carefully consider any related materials describing such a product, and its risks, including but not limited to the following specific risks: market risk, call and reinvestment risk, credit risk, interest rate risk, illiquidity risk, FDIC insurance subject to limitations, capped return, no direct ownership of the underlying assets, returns may underperform broader market, tax considerations and origination costs.

Structured solutions are increasing in popularity, but that doesn’t necessarily mean they’re for everyone. Take your time, do your research and figure out what makes the most sense for your clients.

Marc Premselaar is Head of Structured solutions for CAIS.

[ad_2]

Source link