[ad_1]

This article is an on-site version of Martin Sandbu’s Free Lunch newsletter. Sign up here to get the newsletter sent straight to your inbox every Thursday

I wrote last week that the IMF has often been at the forefront of the economic paradigm shifts of the past 10 to 15 years. But this week’s IMF/World Bank annual meetings show that the fund can also be right in the middle of the unreconstructed mainstream. One message that has been coming through very clearly from the IMF this week is that while the economic outlook is very uncertain, central banks must act aggressively against inflation. The fact that the aggressive monetary tightening under way is about to end one of the strongest labour markets in living memory, as I wrote in my column this week, does not carry much weight in Washington. And the fund goes beyond just calling for central banks to “stay the course” — it also wants fiscal policy to support them in restricting aggregate demand.

Reasonable people can disagree on the right macroeconomic stance, but I want to address some lazy arguments for tightening that I have heard over the past week. Here are four:

First, it is claimed that monetary policy is still at stimulative levels rather than neutral, let alone restrictive. This claim is lazy because it simply presupposes that because absolute levels of central bank interest rates remain low by historical standards, that means monetary policy is loose.

This ignores that the rates targeted by central banks affect the economy by influencing the overall financial conditions facing businesses and households. Ultimately it is these conditions that have to be appropriate for meeting the central banks’ policy goals, which is why good central banks should adjust their own instruments to what financial markets are doing on their own. For example, if a moderate tightening is seen as necessary, and financial market conditions get tougher for other reasons, there is no need to raise central bank interest rates (unless the market tightening happened merely in expectation of such a move).

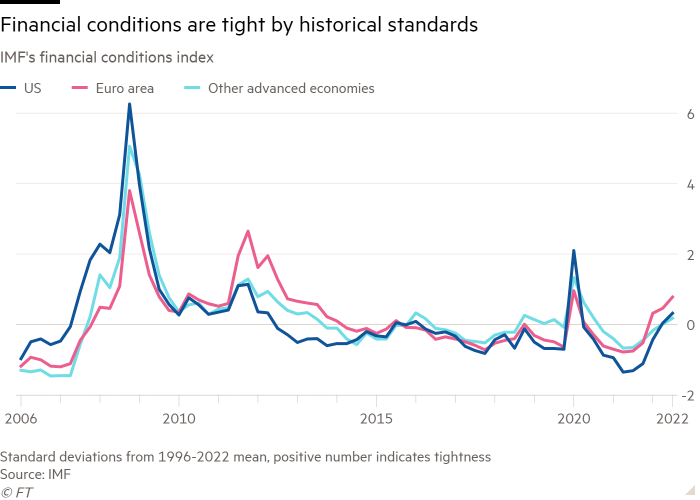

More generally, a low central bank interest rate should not be seen as stimulative, if it permits overall financial conditions that are contractionary. And that is the case today. The IMF’s Global Financial Stability Report, out this week, documents that financial conditions in all the advanced economies are a little tighter than their 25-year average, and quite a lot tighter than they have been at any point in the past decade except at the start of the pandemic.

Another lazy argument is that because inflation has gone up, real central bank policy rates have gone down. So central banks must run just to stand still, and raising rates may not even amount to tightening. But again, central banks have an impact through their influence on the behaviour of people throughout the economy. Nobody chooses an investment on the basis of the “instantaneous” real interest rate (the shortest-term central bank rate minus this month’s inflation). They assess the real rate over the lifetime of their assessment. And on any time horizon that matters in the real economy, real rates have gone up by a lot.

The fund’s own GFSR finds that real rates have gone up by about 1 percentage point since April for five- and 10-year government borrowing in the US, and nearer to 1.5 points for the eurozone. That also implies that the “five-year, five-year” real rate — the cost of borrowing over five years starting five years from now — has risen by about the same. Someone planning to buy, say, energy efficiency equipment — a heat pump? an electric vehicle? — in the coming years now faces significantly higher financing costs after inflation. And as it happens, the fund reports that even one-year real interest rates have risen significantly (see the chart below).

The third lazy argument is that central banks cannot target long-term interest rates, a policy known as “yield curve control” (YCC). It would destroy their credibility as inflation fighters by making them look like they are taking orders from profligate finance ministers to lower public borrowing costs. Therefore, YCC would complicate the monetary tightening most central banks now think (wrongly, in my view) they need to undertake.

Set aside the obvious problem that the one central bank that practises YCC is the one with the least inflationary pressure (the Bank of Japan). The bigger issue is that this objection to YCC is based on two confusions. The simpler one is the intellectual error of conflating the idea of targeting long-term rates with the risk of targeting it at the wrong (too low) level. But there is nothing that stops a yield curve-controlling bank in the mood to tighten from jacking up the long rates to whatever level tightens financial conditions enough.

That, however, points to the second and much more substantive confusion. The Bank of England’s emergency interventions in the past two weeks show that while it is very keen to say it does not want to steer the UK government’s long-term borrowing cost, in practice it has very strong opinions about gilt yields. It clearly found that gilt yields rose too fast and too high after the government’s “mini” Budget (otherwise why intervene?). So there is a contradiction between what it wants and what it says it wants. But there is also a contradiction between the different things it wants — contained gilt yields for financial stability reasons, higher ones for monetary policy reasons. But because it does not formally target longer-term gilt yields, it has not been forced to make up its mind. No wonder markets are seesawing.

The Old Lady of Threadneedle Street is just the most extreme example. Other central banks risk the same confusion. The original sin here may have been to opt for quantitative easing (QE) — buying government bonds — instead of yield curve control in the global financial crisis: central banks chose a policy whose objective was clearly to bring yields down but refused to say where they think the yields should be brought down to. It is telling that the BoJ, which started QE long before anybody else, is the one central bank that has opted for YCC and stuck with it. Others will find that this confusion from treating long-term yields as values that Must Not Be Named will only get worse as QE turns to quantitative tightening — as the BoE’s forced postponement of bond sales this month shows. I argued last year that the European Central Bank should adopt yield curve control; the argument holds for other central banks too.

What, finally, to make of the IMF’s insistence that fiscal policy should not work at “cross-purposes” with monetary policy? This view — not at all unique to the fund — breaks with tradition in two important ways. One is intellectual. Part of how central bank independence was supposed to work was a division of labour with finance ministries. Elected politicians would take the political decisions of fiscal policy, about who pays and who gets what — which surely includes how to distribute spending and taxes between current and future generations of taxpayers, also known as the deficit. Monetary technocrats would then use interest rates to stabilise the economic cycle. Now, it seems, fiscal decisions should be subordinated to monetary ones.

The more recent tradition is hardly two years old: it is not so long ago that governments around the world were launching recovery plans to rebuild their economies from the pandemic (even “building them back better”). But now it seems the priority is to restrain growth. Telling fiscal policy to support monetary policy in containing aggregate demand only makes sense if the economy is above its sustainable potential, in other words, that there is no more growth damage from the pandemic left for macroeconomic policy to heal. So goodbye post-pandemic recovery, it was nice knowing you, however briefly.

Other readables

-

The Nobel Prize in economics was awarded for work that remains depressingly relevant: why there are runs on banks and how badly they damage the economy.

-

Gábor Mészáros and Kim Lane Scheppele convincingly demolish any illusions about Hungary’s rush to set up an “integrity authority” to avoid being cut off from EU funds on the grounds of defective rule of law.

-

My explanation two weeks ago of the turmoil following Britain’s “mini” Budget was the realisation that the government genuinely believes in a neo-Thatcherite theory of what creates economic growth which market participants have long since rejected as false. My colleague Helen Thomas has an excellent column on how the same alienation is taking place in the business community.

-

The FT’s special report on Women in Business is out.

Numbers news

-

There is a 10 per cent risk of the global economy contracting, according to the IMF’s Global Financial Stability Report.

-

Behind the numbers, FT readers share how the cost of living crisis affects them.

Recommended newsletters for you

The Lex Newsletter — Catch up with a letter from Lex’s centres around the world each Wednesday, and a review of the week’s best commentary every Friday. Sign up here

Unhedged — Robert Armstrong dissects the most important market trends and discusses how Wall Street’s best minds respond to them. Sign up here

[ad_2]

Source link