[ad_1]

Brenda McKinley has been selling homes in Ontario for more than two decades and even for a veteran, the past couple of years have been shocking.

Prices in her patch south of Toronto rose as much as 50 per cent during the pandemic. “Houses were selling almost before we could get the sign on the lawn,” she said. “It was not unusual to have 15 to 30 offers . . . there was a feeding frenzy.”

But in the past six weeks the market has flipped. McKinley estimates homes have shed 10 per cent of their value in the time it might take some buyers to complete their purchase.

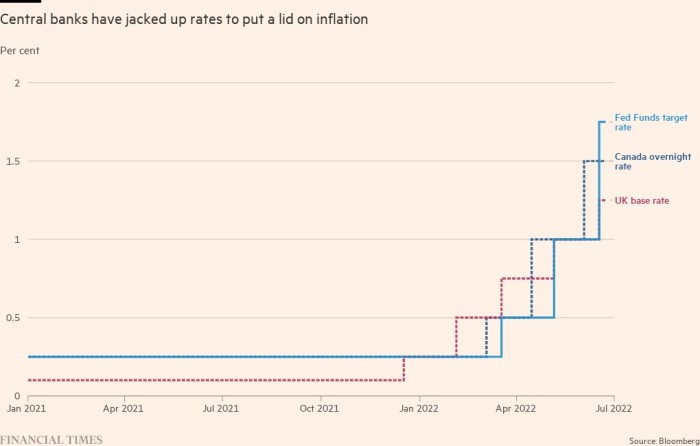

The phenomenon is not unique to Ontario nor the residential market. As central banks jack up interest rates to rein in runaway inflation, property investors, homeowners and commercial landlords around the world are all asking the same question: could a crash be coming?

“There is a marked slowdown everywhere,” said Chris Brett, head of capital markets for Europe, the Middle East and Africa at property agency CBRE. “The change in cost of debt is having a big impact on all markets, across everything. I don’t think anything is immune . . . the speed has taken us all by surprise.”

Listed property stocks, closely monitored by investors looking for clues about what might eventually happen to less liquid real assets, have tanked this year. The Dow Jones US Real Estate Index is down almost 25 per cent in the year to date. UK property stocks are down about 20 per cent over the same period, falling further and faster than their benchmark index.

The number of commercial buyers actively hunting for assets across the US, Asia and Europe has fallen sharply from a pandemic peak of 3,395 in the fourth quarter of last year to just 1,602 in the second quarter of 2022, according to MSCI data.

Pending deals in Europe have also dwindled, with €12bn in contract at the end of March against €17bn a year earlier, according to MSCI.

Deals already in train are being renegotiated. “Everyone selling everything is being [price] chipped by prospective buyers, or else [buyers] are walking away,” said Ronald Dickerman, president of Madison International Realty, a private equity firm investing in property. “Anyone underwriting [a building] is having to reappraise . . . I cannot over-emphasise the amount of repricing going on in real estate at the moment.”

The reason is simple. An investor willing to pay $100mn for a block of apartments two or three months ago could have taken a $60mn mortgage with borrowing costs of about 3 per cent. Today they might have to pay more than 5 per cent, wiping out any upside.

The move up in rates means investors must either accept lower overall returns or push the seller to lower the price.

“It’s not yet coming through in the agent data but there is a correction coming through, anecdotally,” said Justin Curlow, global head of research and strategy at Axa IM, one of the world’s largest asset managers.

The question for property investors and owners is how widespread and deep any correction might be.

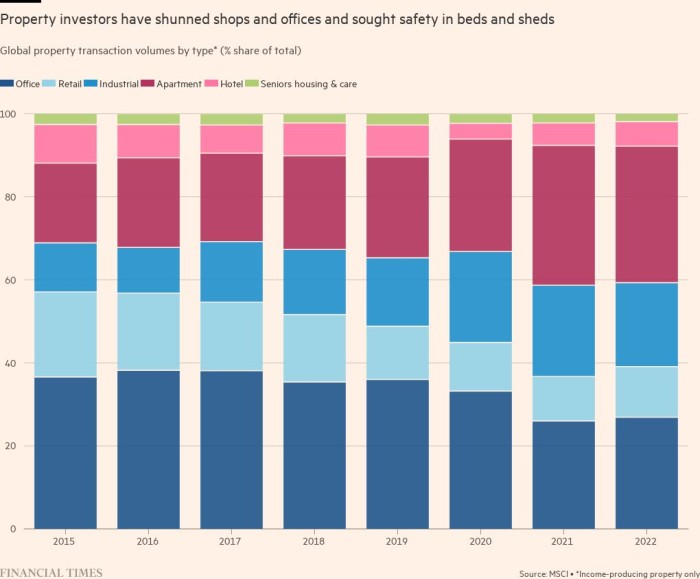

During the pandemic, institutional investors played defence, betting on sectors supported by stable, long-term demand. The price of warehouses, blocks of rental apartments and offices equipped for life sciences businesses duly soared amid fierce competition.

“All the big investors are singing from the same hymn sheet: they all want residential, urban logistics and high-quality offices; defensive assets,” said Tom Leahy, MSCI’s head of real assets research in Europe, the Middle East and Asia. “That’s the problem with real estate, you get a herd mentality.”

With cash sloshing into tight corners of the property market, there is a danger that assets were mispriced, leaving little margin to erode as rates rise.

For owners of “defensive” properties bought at the top of the market who now need to refinance, rate rises create the prospect of owners “paying more on the loan than they expect to earn on the property”, said Lea Overby, head of commercial mortgage-backed securities research at Barclays.

Before the Federal Reserve started raising rates this year, Overby estimated, “Zero per cent of the market” was affected by so-called negative leverage. “We don’t know how much it is now, but anecdotally its fairly widespread.”

Manus Clancy, a senior managing director at New York-based CMBS data provider Trepp, said that while values were unlikely to crater in the more defensive sectors, “there will be plenty of guys who say ‘wow we overpaid for this’.”

“They thought they could increase rents 10 per cent a year for 10 years and expenses would be flat but the consumer is being whacked with inflation and they can’t pass on costs,” he added.

If investments regarded as sure-fire just a few months ago look precarious; riskier bets now look toxic.

A rise in ecommerce and the shift to hybrid work during the pandemic left owners of offices and shops exposed. Rising rates now threaten to topple them.

A paper published this month, “Work from home and the office real estate apocalypse”, argued that the total value of New York’s offices would ultimately fall by almost a third — a cataclysm for owners including pension funds and the government bodies reliant on their tax revenues.

“Our view is that the entire office stock is worth 30 per cent less than it was in 2019. That’s a $500bn hit,” said Stijn Van Nieuwerburgh, a professor or real estate and finance at Columbia University and one of the report’s authors.

The decline has not yet registered “because there’s a very large segment of the office market — 80-85 per cent — which is not publicly listed, is very untransparent and where there’s been very little trade”, he added.

But when older offices change hands, as funds come to the end of their lives or owners struggle to refinance, he expects the discounts to be severe. If values drop far enough, he foresees enough mortgage defaults to pose a systemic risk.

“If your loan to value ratio is above 70 per cent and your value falls 30 per cent, your mortgage is underwater,” he said. “A lot of offices have more than 30 per cent mortgages.”

According to Curlow, as much as 15 per cent is already being knocked off the value of US offices in final bids. “In the US office market you have a higher level of vacancy,” he said, adding that America “is ground zero for rates — it all started with the Fed”.

UK office owners are also having to navigate changing working patterns and rising rates.

Landlords with modern, energy-efficient blocks have so far fared relatively well. But rents on older buildings have been hit. Property consultancy Lambert Smith Hampton suggested this week that more than 25mn sq ft of UK office space could be surplus to requirements after a survey found 72 per cent of respondents were looking to cut back on office space at the earliest opportunity.

Hopes have also been dashed that retail, the sector most out of favour with investors coming into the pandemic, might enjoy a recovery.

Big UK investors including Landsec have bet on shopping centres in the past six months, hoping to catch rebounding trade as people return to physical stores. But inflation has knocked the recovery off course.

“There was this hope that a lot of shopping centre owners had that there was a level in rents,” said Mike Prew, analyst at Jefferies. “But the rug has been pulled out from under them by the cost of living crisis.”

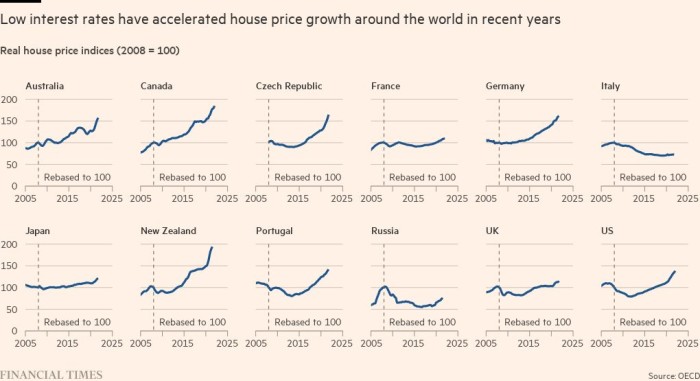

As rates rise from ultra-low levels, so does the risk of a reversal in residential markets where they have been rising, from Canada and the US to Germany and New Zealand. Oxford Economics now expects prices to fall next year in those markets where they rose quickest in 2021.

Numerous investors, analysts, agents and property owners told the Financial Times the risk of a downturn in property valuations had sharply increased in recent weeks.

But few expect a crash as severe as that of 2008, in part because lending practices and risk appetite have moderated since then.

“In general it feels like commercial real estate is set for a downturn. But we had some strong growth in Covid so there is some room for it to go sideways before impacting anything [in the wider economy],” said Overby. “Pre-2008, leverage was at 80 per cent and a lot of appraisals were fake. We are not there by a long shot.”

According to the head of one big real estate fund, “there’s definitely stress in smaller pockets of the market but that’s not systemic. I don’t see a lot of people saying . . . ‘I’ve committed to a €2bn-€3bn acquisition using a bridge format’, as there were in 2007.”

He added that while more than 20 companies looked precarious in the run-up to the financial crisis, this time there were perhaps now five.

Dickerman, the private equity investor, believes the economy is poised for a long period of pain reminiscent of the 1970s that will tip real estate into a secular decline. But there will still be winning and losing bets because “there has never been a time investing in real estate when asset classes are so differentiated”.

[ad_2]

Source link