Good morning. This article is an on-site version of our FirstFT newsletter. Sign up to our Asia, Europe/Africa or Americas edition to get it sent straight to your inbox every weekday morning

The UK government’s first planned flight deporting asylum seekers to Rwanda was grounded last night by a series of last-minute interventions by the European Court of Human Rights and the Court of Appeal in London.

Government sources confirmed that no one would be on the flight, which had been due to carry seven asylum seekers to the Rwandan capital Kigali from a military base in Wiltshire.

Home secretary Priti Patel said many of those removed would be placed on the next flight. “Our legal team are reviewing every decision made on this flight and preparation for the next flight begins now,” she said.

The ECHR, which deliberates on possible violations of the European Convention on Human Rights, ruled yesterday that one of seven migrants due to be deported, an Iraqi, should not be removed until after the policy had undergone judicial review in the coming weeks.

This set off a string of other eleventh-hour rulings, including two further injunctions from the ECHR, three successful appeals at the UK Court of Appeal and one other ruling, leaving no one who could legally be deported.

What do you think of the government’s plans to deport asylum seekers to Rwanda? Share your thoughts with us at firstft@ft.com and we may feature your response in an upcoming edition of the newsletter.

Thanks for reading FirstFT Europe/Africa. Here’s the rest of today’s news — Jennifer

Five more stories in the news

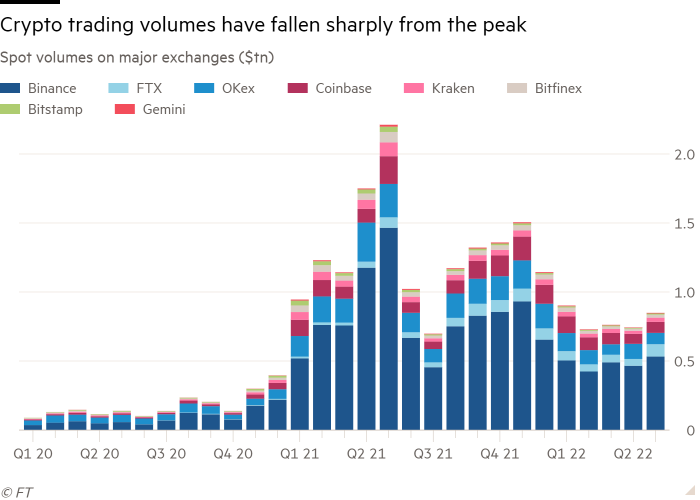

1. Crypto exchanges slash jobs Digital asset exchanges are shedding hundreds of workers in an abrupt reversal from the industry’s breakneck expansion as a two-year hot streak gives way to crypto chill. Nasdaq-listed Coinbase said on Monday that it would cut 1,100 employees, almost a fifth of the workforce, as it grappled with a slowdown in trading.

-

It’s risky business: Celsius Network, a crypto investment firm, blocked redemptions this week after locking-up client funds in complex products.

-

Background: Why are crypto lenders central to the digital asset market?

2. Double blow to Europe’s gas supplies sends prices higher A major US liquefied natural gas terminal — which accounts for about a fifth of the country’s LNG exports and about 10 per cent of Europe’s imports this year — said it would be offline for at least three months following an explosion, while Russia said it would cut flows through a critical route to Germany.

-

Difficult decisions: Western sanctions against Russia have forced Swiss businesses to make choices about cherished neutrality.

-

Good news for some: Iran’s expertise at accessing the world’s black markets is in demand as sanctions-hit Russian businessmen seek tips.

3. Credit Suisse banker removed for unauthorised messages Anthony Kontoleon, global head of equity capital markets syndicate in New York, left his position at the Swiss bank in April after he used unapproved messaging applications with clients, according to people with knowledge of the matter.

4. Germany to host extra Nato troops at home Berlin has proposed stationing most of the 3,500 extra troops it aims to contribute to the transatlantic alliance on its own soil rather than in Lithuania, significantly softening its initial backing for more foreign forces in the Baltics to deter potential Russian aggression.

5. JPMorgan defeats Nigeria in $1.7bn case The US bank has won a High Court lawsuit over facilitating payments to a former Nigerian minister with a money-laundering conviction, after a judge found no evidence that fraud had been perpetrated against the country.

The day ahead

Nato defence meeting Ministers gather in Brussels for the two-day event, including a working dinner with representatives from Finland, Georgia, Sweden, Ukraine and the EU.

Lawyers seek ‘unified front’ against Neil Woodford Two law firms representing investors in Woodford’s collapsed fund will ask the UK High Court to be appointed co-lead solicitors in a joined-up case for their 2,500 clients, which lawyers estimate could reach several hundred million pounds.

Fed interest rate decision Markets are betting on a 0.75 percentage-point rate rise — which would be the first since 1994 — at the conclusion of a two-day meeting by the Federal Open Market Committee. US central bankers will also convey a policy forecast in an updated “dot plot”.

Economic data The EU publishes March industrial production and April trade in goods data, while France has its final May consumer price index and harmonised index of consumer prices. Russia releases flash first-quarter flash gross domestic.

Join leaders from FTX, Monzo, JPMorgan and more on June 16-17 from the FT Future of Finance stage at the heart of Europe’s leading tech festival, The Next Web. Register for your free digital pass today.

What else we’re reading and listening to

The echo of 1970s policy errors Unexpectedly high inflation, wars in critical commodity-producing regions, declining real wages, slowing economic growth, fears of tightening monetary policy and turbulence in stock markets: today’s conditions were also dominant in the world economy 40 years ago, writes Martin Wolf.

Inside Tory wrangling over the Brexit bill Some of the most venomous criticism of government plans to rip up Boris Johnson’s 2020 deal and unilaterally rewrite trade rules for Northern Ireland came from within the ruling party, as some Tories accused foreign secretary Liz Truss of picking a fight with Brussels to further her leadership ambitions.

“A measure of whether Boris can actually deliver on anything lies in whether he can clear up the outstanding issues with Northern Ireland, fishing and the City” — Charles Russam, FirstFT reader in Milton Keynes, UK

Mr Goldman, Mr Sex When Financial Times reporter Patricia Nilsson started digging into the porn industry, she made a shocking discovery: nobody knew who controlled the biggest porn company in the world. Now, Nilsson and her editor, Alex Barker, reveal who is behind it. Listen to the latest episode of Hot Money, our investigative podcast series on the shadowy power structures of the porn industry.

Marine Le Pen’s RN gains ground The far-right anti-immigration party is set to gain influence in parliament as the second round of legislative elections looms, with polling groups forecasting France’s Rassemblement National to secure up to 40 National Assembly seats, up from eight.

Fed begins quantitative tightening on unprecedented scale The mammoth task of shrinking the US central bank’s $9tn balance sheet has finally begun. But investors are not clear about the impact of a process that has never before been attempted at such a scale.

Books

What are your favourite books of 2022? This year’s much-anticipated Summer Books series is close — and, as ever, we want to hear from you. Use the comments section here to tell us.

Thank you for reading and remember you can add FirstFT to myFT. You can also elect to receive a FirstFT push notification every morning on the app. Send your recommendations and feedback to firstft@ft.com. Sign up here.

Comments are closed, but trackbacks and pingbacks are open.