[ad_1]

Chris Hill, chief executive of investment platform Hargreaves Lansdown, finds himself in the same position as many of his most crucial customers.

In the years before he retires, he would like the confidence boost of having a financial adviser review his affairs. He said the company’s data show that it is around age 48 that many of its customers have the same idea, as they start to reckon with the daunting prospect of turning savings into something they can live off in retirement.

“At that moment is when their confidence dips,” said Hill, 51. “Retiring is a really, really complicated time. And I think it’s one of those times when you do need to have some advice.”

As the tail-end of the baby boomer generation heads for retirement, and the next cohort of savers contemplate the prospect, their changing need for financial advice is a problem for Hargreaves.

Customers who want personal advice, many with a healthy pot of savings and investments, at this point often turn to more specialist wealth managers such as St James’s Place or Brewin Dolphin, which are more focused on providing personalised advice, generally for an annual percentage fee.

Of Hargreaves’ 1.7mn clients, just 10,000 receive personalised financial advice — whether in person, over the phone or online.

Hill wants to greatly increase that number and provide more advice options to help keep those customers thinking of going elsewhere.

With this goal in mind, the UK’s largest fund supermarket recently laid out plans to expand beyond its home turf of serving DIY investors and build up its financial advisory business, using tech and customer data to give it a competitive edge.

It wants a quarter of its new business, £5bn, to come from its new advice service in five years and is planning to hire 100 advisers — up from the current tally of about 70 — by 2026.

The intention is to try to stop some of Hargreaves’ wealthiest clients from quitting and to offer more services to existing customers by competing directly with wealth managers who provide advice, typically for an annual percentage fee.

“It’s a real challenger to that existing advice model where people say ‘what am I actually paying for and where do I get the value,’” said Hill. “We can help people on a once-off, because that is all they are looking for. You don’t have to pay your 1.5 or 2.5 per cent annually.”

Financial advisers oversee about £700bn, the largest share of the UK’s roughly £2tn wealth management industry, according to LEK Consulting. The research suggests there is scope for that number to grow.

About 70 per cent of UK household wealth is held by the over 55s. Among people close to retirement, 80 per cent say they probably need financial advice, LEK found, but only a fifth seek it out.

According to consultancy Boring Money, 13mn people in the UK are in the “advice gap”, unable or unwilling to pay financial advisers’ steep fees.

Platforms like Hargreaves, that have already supplanted paper and telephone-based stock brokers, think that “hybrid advice” — part automated, part personalised — offers a way to tap this market. Hargreaves said its plans were based on advisers being five times more efficient thanks to tech, making the service cheaper.

Rival investment providers Vanguard and Bestinvest, along with FTSE 100 asset managers Abrdn and M&G, are among those racing to expand in this market.

Hybrid advice promises a more sophisticated product than the much touted robo-adviser services, start-ups that use online questionnaires to guide customers to suitable investments and that have failed to deliver on their promises to grab substantial market share.

Using its trove of customer data, Hargreaves aims to provide features such as letting clients see whether they are saving as much as similar people or nudging them to seek support at times when they might be tempted to panic sell if the market moves sharply. People will also be able to pay to talk to an adviser.

“The cold war between full financial advice and DIY investing is over,” said Holly Mackay, chief executive of Boring Money.

Hargreaves’ plan has not revived its share price. Earlier this year, Hill announced the plan as part of a £175mn investment in tech, funded in part by suspending the company’s special dividend.

Shares fell nearly 16 per cent on the day and are now at their lowest level since 2013, having lost a third of their value this year. “They have rested on their laurels a bit,” said Julian Roberts, analyst at Jefferies. “They could have done something strategic to prepare for the calamity that has now befallen their share price.”

One former Hargreaves executive doubted tech-based advice was the magic bullet, saying: “People have been looking to automate advice for years. It’s almost impossible.”

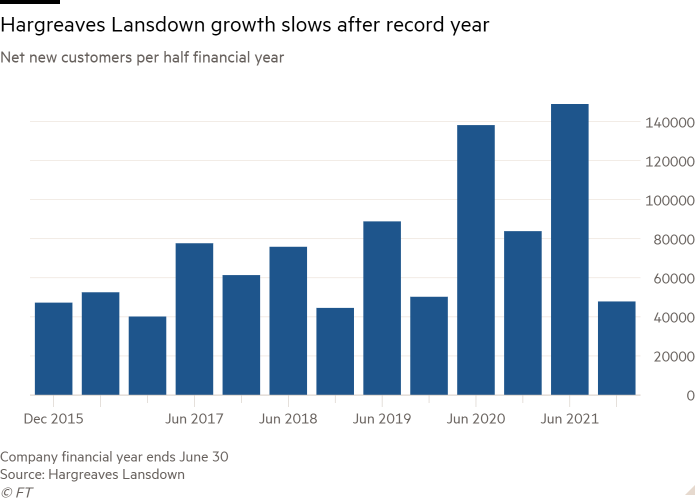

The business, which was founded in 1981 and expanded into fund administration and then online stock broking in the late 1990s, came out well at the start of the pandemic, benefiting from the retail stock trading boom and lots of new customers.

That boom has now ended but the new, often younger, customers, which are expensive to onboard but do not have as much money to invest, are one factor putting pressure on profitability.

Hargreaves has been well-loved by investors for its impressive margins, with an operating profit margin of 63 per cent before the pandemic. The company forecasts that margins will shrink into the mid 40s in the coming years, and only return to 55 per cent by 2026. Hill said being a more data-led business will require constant investment.

Nick Train, the company’s largest outside shareholder, lamented that the market had not “rewarded [this] entrepreneurial spirit”.

“We are forever badgering Hargreaves to stop paying so much in special dividends and invest more in functionality and opportunities,” he said at a recent event.

Even with the new advice service, Roberts argues it will be difficult for the company to overcome demographic trends. “I don’t think that people very often have money with Hargreaves that they survive on,” he said. “It’s not just that they were late to it. It’s a structural problem that may not have a complete solution.”

[ad_2]

Source link