[ad_1]

Good morning. This article is an on-site version of our FirstFT newsletter. Sign up to our Asia, Europe/Africa or Americas edition to get it sent straight to your inbox every weekday morning

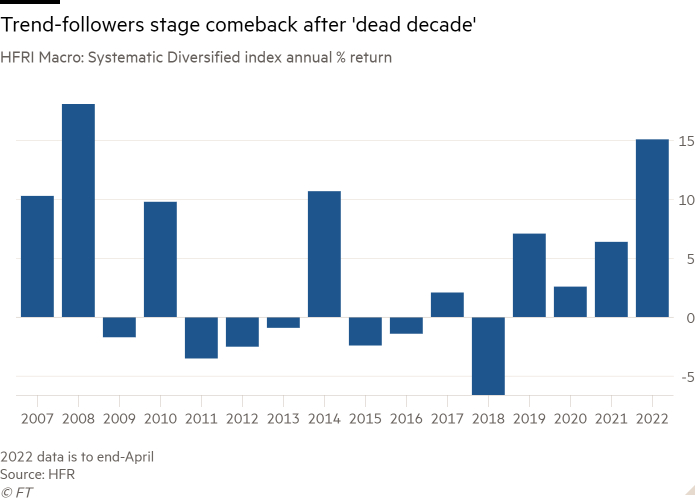

Hedge funds that use powerful computers to run their portfolios are making huge profits in this year’s market turmoil, marking a resurgence for a sector trying to recover from a long stretch of weak performance.

Trend-following hedge funds, which use mathematical models to try to predict market movements, had struggled for years as central bank bond-buying suppressed much of the volatility on which they thrive.

But the $337bn industry is now making its biggest gains since the 2008 financial crisis, according to data provider HFR.

These quantitative funds have profited in particular from bets against government bonds, which have been shaken by expectations that the Federal Reserve will keep raising interest rates aggressively to fight high inflation. They have also capitalised on a surge in energy and commodity prices, fuelled by supply chain bottlenecks and Russia’s invasion of Ukraine.

“Now is one of those 2008 moments where everyone [in trend-following] is doing well again. The trends are clearer”, said Leda Braga, founder of Systematica Investments and former head of systematic trading at BlueCrest.

Thanks for reading FirstFT Europe/Africa. Here’s the rest of the day’s news.

The latest on the war in Ukraine

-

Sanctions: Ukraine’s allies and partners must go further and apply measures that will undermine Russia’s ability to finance its war, writes Andriy Yermak, chief of staff to President Volodymyr Zelensky.

-

Military briefing: The battle for Sievierodonetsk in Donbas illustrates how fighting is likely to unfold this summer: in a grinding war of attrition.

-

Winners and losers: As the war enters its fourth month, the possibility of a Ukrainian victory is raising questions, including what would “winning” mean?

Five more stories in the news

1. Plant scientists welcome UK bill to deregulate crop engineering The UK will introduce legislation today to accelerate the genetic engineering of crops in England. The bill has dismayed environmental campaigners but delighted researchers, including those opposed to leaving the EU who said the relaxation of genetic technology rules was a rare benefit of Brexit.

2. Qatar pledges to invest £10bn in UK over next five years Qatar has pledged to invest £10bn in the UK, including in the tech, healthcare, infrastructure and clean energy sectors, as the British government steps up efforts to woo sovereign wealth fund investment from oil-rich Gulf states.

3. Sombre mood descends on Davos Russia’s invasion of Ukraine, surging inflation, Chinese lockdowns and growing uncertainty about globalisation have conspired to chill the business mood at the World Economic Forum meeting in Davos. “There are three R words right now: It’s Russia, it’s recession and it’s [interest] rates,” said Citigroup chief Jane Fraser.

4. Asset managers divided by HSBC executive’s climate criticism A provocative speech on climate change by HSBC executive Stuart Kirk has split the asset management industry, with many disagreeing with his tone but others welcoming his willingness to prompt debate and highlight inconsistencies in environmental, social and governance investing.

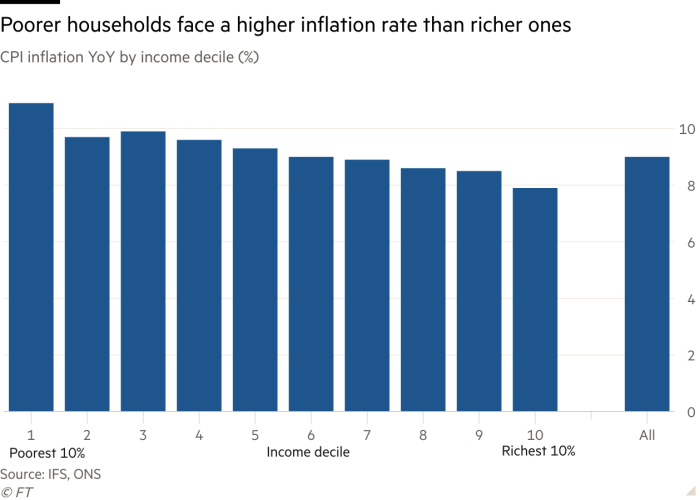

5. UK inequality worsens as wages rise fastest for high earners Inequality is on the rise again in the UK, with figures showing average earnings in finance were 25 per cent higher in cash terms in March than the pre-pandemic level, outstripping the 15 per cent growth over the same period in mean earnings across the economy.

The day ahead

Economic data The European Central Bank publishes its twice-yearly stability review and the OECD publishes its eurozone economic outlook. France releases May consumer confidence figures and Germany has final first-quarter gross domestic product data and a GfK consumer confidence survey. In the US, minutes from the Federal Reserve’s Federal Open Market Committee’s May meeting are out.

Corporate reporting Amazon shareholders will vote on executive pay, unionisation and a 20-for-1 stock split, Twitter holds its annual meeting, and Marks and Spencer chief executive Steve Rowe checks out after 39 years. Peter Thiel will retire from Meta’s board at its annual shareholder meeting. Other companies reporting include Hollywood Bowl, Nvidia, Pets At Home, Severn Trent and SSE.

World Economic Forum ECB president Christine Lagarde, the Irish, Dutch and Slovakian prime ministers and the president of the European parliament join a Davos forum on EU unity in response to Russia’s invasion of Ukraine.

What else we’re reading

UK energy suppliers braced for backlash as bills set to soar Pressure is building on the UK government to impose a windfall tax on energy groups, which could target not only oil and gas producers but also electricity generators. But suppliers complain that they too have been hit by surging gas prices and that the retail sector is particularly fragile.

German companies struggle to be heard above the noise Germany’s largest industrial groups are finding it harder to capture investors’ attention. While the country’s renowned “hidden champions” have little desire or need for media exposure, German businesses can no longer count on their products to do all the talking.

The Fed must act now to ward off the threat of stagflation Whether there is going to be a recession in leading economies has arisen at Davos. This is the wrong question, Martin Wolf argues, at least for the US. The right one is whether an era of higher inflation and weak growth, similar to the stagflation of the 1970s, looms.

Is the ‘subscription economy’ going to feel the Netflix effect? The rash of businesses offering subscriptions took off in about 2011, led by TV and music streaming services and quickly followed by beauty products, clothes, organic coffee, craft beer, pet food and more. The “subscription economy” is heading into its first serious downturn, Helen Thomas writes.

The rise of the Gulf and hopes for sustainability Luxury companies are reporting a flurry of spending in the Middle East thanks to rising oil prices, strong economic growth and a return to shopping locally, just as the two most important markets — the US and China — look less than rosy, executives said at the FT Business of Luxury Summit last week.

How To Spend It

Kylie Minogue has topped the charts for decades. Now her wines are winning awards. What’s the secret to her business? The pop megastar-turned-mogul explains all.

Thank you for reading and remember you can add FirstFT to myFT. You can also elect to receive a FirstFT push notification every morning on the app. Send your recommendations and feedback to firstft@ft.com. Sign up here.

[ad_2]

Source link