[ad_1]

One scoop to start: Goldman Sachs is offering its network of former partners, who range from tech executives to prime ministers, exclusive access to a new investment vehicle that will put money into the Wall Street firm’s private market funds.

Welcome to Due Diligence, your briefing on dealmaking, private equity and corporate finance. This article is an on-site version of the newsletter. Sign up here to get the newsletter sent to your inbox every Tuesday to Friday. Get in touch with us anytime: Due.Diligence@ft.com

Buffett becomes a toner head

Warren Buffett has often opined about the stack of corporate filings on his desk labelled “too hard”, a place to put investments too complex to grasp.

That has meant Berkshire Hathaway, the sprawling industrials-to-insurance conglomerate he leads, has often avoided investments in Big Tech companies such as Google.

This week the company disclosed it had dipped its toe into the tech complex, albeit with an investment in a relatively prosaic company as it hoovered up 121mn shares in computer and printer maker HP.

HP may have a Palo Alto address but it fits closer to many of Berkshire’s other staid investments such as grocer Kroger and rating agency Moody’s. As Lex writes:

“These large, established companies get investors excited not so much with newfangled products but an emphasis on cost efficiency, tight working capital management and careful capital allocation that weathers economic cycles.”

The HP investment — worth $4.8bn by the end of Thursday — is the latest in a string of dealmaking by Berkshire, which in roughly a month clinched an $11.6bn takeover of insurer Alleghany while also snapping up stock in oil producer Occidental Petroleum now worth $7.9bn.

It’s a striking shift by a man who had largely sat out dealmaking over the past six years, wary of sky-high valuations in the US stock market. Buffett had also missed out on bargains when the pandemic first struck, nervous that airlines, banks and other businesses would struggle as the economy tipped into recession.

Investors and analysts have told the FT that they see the recent moves as a sign that Buffett has conviction in the market even as war roils Ukraine and inflation hits consumers.

Though Buffett has stayed mum on what attracted Berkshire to HP, it has the same hallmarks as Berkshire’s wildly successful $600mn investment in Gillette, which grew to about $5bn in value after the razor blade company was acquired by Procter & Gamble in 2005.

HP sells its printers at low margins, just as Gillette sells razors at cost. But both companies make a fortune selling printer toner and razor blades at ever-increasing prices. The majority of HP’s profits come from its printing division, which carries double the profit margin of its PCs.

The investment in HP could also be an under-appreciated reopening trade.

After all, if the chieftains of Wall Street banks and other professional service firms have their way, rank-and-file workers will be back in the office and the printer ink will be flowing.

The private equity floodgates crack open at Toshiba

Japan’s largest-ever take-private deal could soon be on the horizon.

Toshiba’s board late on Thursday said the company, whose market value is about $17bn, will assemble a special committee to assess potential bids from private equity firms and other investors.

It came just a day after its second-largest investor 3D Investment Partners stepped up its campaign for the company to consider a buyout, describing the business as “a corporate governance embarrassment for Japan”.

The name-calling appears to have been effective. First expected out the gate is Bain Capital, which secured support from Toshiba’s biggest stakeholder, the Singapore-based fund Effissimo Capital, which, with various caveats, agreed to sell its 10 per cent stake into a future tender offer before a price had even been agreed.

It did so without knowing how much Bain would actually offer — which speaks volumes about how it views its shareholding, as Lex writes.

Bain’s proposal is in the advanced stages of preparation, people familiar with the matter told the FT’s Leo Lewis and Eri Sugiura, while acknowledging the political and technical challenges associated with ushering the sprawling 146-year-old corporate behemoth into new hands.

A growing number of senior figures at the company are leaning toward a take-private deal, said people familiar with the matter, after years of relentless internal strife and deepening divisions between management and activist shareholders.

But the Boston-based investor will also have to face off against what shareholders in favour of a buyout hope will be a number of rival investment consortiums.

Bain was among a number of private equity groups that talked to Toshiba’s strategic review committee last year. Others included KKR and Brookfield.

The process ended without any private equity offer that the committee felt it could recommend, and instead it endorsed an idea by its advisers at UBS to split the conglomerate in two.

Given the size of the deal and the experience in Japan required, KKR is widely viewed as the next most likely firm to come up with a proposal after Bain.

Bain’s agreement with Effissimo prevents the latter from selling its stake to other potential bidders, which raises significant hurdles for other buyout groups.

A buyout of Toshiba would mark a major milestone for the ascent of private equity in the world’s third-largest economy. The buyout industry held a record $650bn of “dry powder” waiting to be invested in the Asia-Pacific region at the end of 2021, according to management consultant Bain & Co — up from $477bn the previous year.

For Toshiba’s newly installed chief executive Taro Shimada, who is known internally to favour resuming talks with private equity groups, the pressure is on to restore the board’s relationship with shareholders and lead the company out of years of scandals.

The silver lining of the chaotic saga — which has resulted in the forced resignations of his predecessors — is that, at least in theory, the only way is up.

The private capital battle over Italy’s prized infrastructure

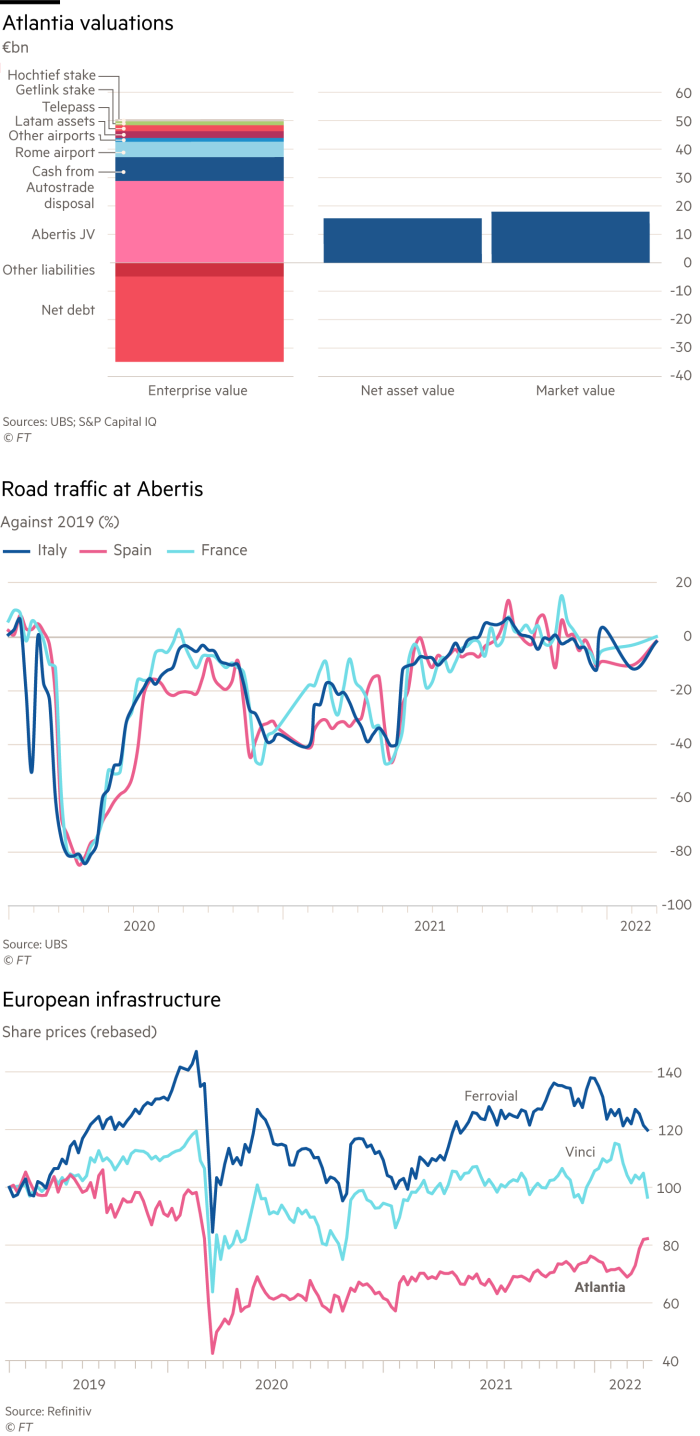

Last year we told you how Blackstone navigated a political minefield involving one of Italy’s wealthiest dynasties, a Spanish football tycoon and one of London’s most powerful hedge fund managers to buy a stake in Italy’s main toll road operator, Autostrade per l’Italia (Aspi).

Now the private equity giant is weighing a plan to ramp that up to the next level: bidding for Aspi’s owner, Atlantia — in what would be one of the country’s biggest and most politically significant buyouts.

DD readers may remember Atlantia as the group that managed Genoa’s Morandi bridge, which collapsed in 2018, resulting in the deaths of 43 people.

The tragedy prompted a years-long dispute between the Italian government and some of the company’s shareholders — including the Benetton retail dynasty and hedge fund billionaire Chris Hohn — over who should control the country’s roadways.

Blackstone and its fellow investors could now find themselves contending with Real Madrid president Florentino Pérez whose ACS construction company has said it’s interested in buying Atlantia’s motorway concessions business.

Pérez has indicated willingness to make a hostile approach if he fails to win the Benettons’ support. And Hohn has voiced support for a bid by Pérez in the past.

But Stephen Schwarzman’s private equity group has a key advantage: it’s working on the bid with Edizione, the holding company that manages the Benetton family fortune and owns a third of Atlantia, a person familiar with the matter told DD’s Antoine Gara and James Fontanella-Khan.

With the Benettons on its side, Blackstone’s bid could be pushed forward in the running.

The next step would be getting the green light from Rome to take on some of its most strategic assets. It won’t be easy, but it won’t be impossible, either. The government isn’t necessarily opposed to a Blackstone deal, people with knowledge of the matter say.

The Benettons have ruled out any deal resulting in the break-up of Atlantia, according to Reuters.

It’s still unclear whether Atlantia’s portfolio will be worth the potential bidding war, as Lex points out. Rising fuel costs and the increasing likelihood of an economic downturn could mean toll revenues could soon be on the decline.

Job moves

-

Richard Liu has stepped down as chief executive of JD.com, the Chinese ecommerce group he founded more than two decades ago. President Xu Lei has been appointed as the group’s new chief executive. More here from Lex.

-

Discovery has overhauled its management ahead of its $43bn merger with WarnerMedia, including naming Discovery’s streaming head JB Perrette as head of streaming for the newly formed entity.

-

Mediobanca director Angela Gamba has been appointed as lead independent director of the Italian lender’s board. She also serves as a director of Italian dairy group Parmalat.

-

UBS has hired Abhi Mitra as head of general partner capital advisory for the Americas. He has spent the last 11 years at Lazard, most recently as a managing director in its private capital advisory group.

-

Former Cosmopolitan editor-turned Spac chief Joanna Coles is joining the board of hardware rental start-up Grover.

-

Kirkland & Ellis has hired antitrust lawyer Alasdair Balfour as a partner in London. He joins from Allen & Overy.

-

Freshfields has appointed 27 new partners.

Smart reads

The ‘Ray-whisperer’ rallying the right How did David McCormick, the diversity-touting, Davos-attending Bridgewater CEO, turn into a MAGA-verse main character? His transformation shows there’s still money in the “America First” agenda, Bloomberg writes.

The billionaire behind the curtain In addition to being a cunning dealmaker, French media mogul Vincent Bolloré has emerged as a sponsor of the country’s new rightwing — though not quite a Gallic Rupert Murdoch, writes Harrison Stetler for the New York Times.

Dropping anchor As the west hits Russia with sanctions, yacht-owning oligarchs have found safe harbour on Turkish shores — and in the country’s banks, the Wall Street Journal reports.

News round-up

Frontline and Euronav in $4.2bn deal to create world’s biggest oil tanker fleet (FT)

Spac dealmakers sweeten terms to stem investor flight (FT)

Ex-Goldman banker banned by Fed over misuse of confidential information (FT)

Buyout group I Squared Capital eyes LNG sector after raising $15bn (FT)

Vietnamese carmaker VinFast files for US IPO to fund shift to electric vehicles (FT)

Nielsen investor WindAcre sought $1bn to support take-private deal (BBG)

Cambo North Sea field developer Siccar Point bought in $1.5bn deal (FT)

Shell/Russia: western knowhow is now a no-no in LNG project (Lex)

French elections: Hedging for Macron’s exit (Reuters)

Financial warfare: will there be a backlash against the dollar? (FT)

[ad_2]

Source link