[ad_1]

Welcome to FT Asset Management, our weekly newsletter on the movers and shakers behind a multitrillion-dollar global industry. This article is an on-site version of the newsletter. Sign up here to get it sent straight to your inbox every Monday.

Does the format, content and tone work for you? Let me know: harriet.agnew@ft.com

At a briefing on Wednesday afternoon in London to discuss the outlook in emerging markets, executives at Ashmore, an investment house specialising in developing countries, kicked off by addressing “the elephant in the room” — Russia.

The country had just recognised the independence of two regions in eastern Ukraine and the US was warning of an imminent broader land grab.

The situation, Ashmore pointed out, was fluid. It demanded a “very, very careful” approach from fund managers. But the core view was that the Russian president would not send troops towards Kyiv. There would be no full invasion and instead, “a good chance that soon we won’t be talking about it”. A few hours later, Russia invaded its neighbour on multiple fronts.

Even investors generally downbeat on Russia and sceptical of its motives have been blindsided as President Vladimir Putin has exceeded expectations for the ferocity of his campaign, writes markets editor Katie Martin in this column.

“Investors are on the back foot,” agrees Dominic Armstrong, chief executive of Horatius Advisory. “No one expected to see cruise missiles fired into Europe in 2022 in a hostile attack.”

In this analysis by the asset management team we explore how many investors called it wrong. And the broader financial shockwaves will be difficult for investors everywhere to navigate, given the complex interplay between the impact on stocks, the financial sanctions that are being slapped on Russia, rocketing commodity prices, the drag on global economic growth from heightened geopolitical uncertainty, and any response that central banks may take. Armstrong adds:

“From a short-term perspective, it’s too soon to be buying equities and credit on the sound of cannons — there’s too much uncertainty. Commodities will remain of great interest although the whipsawing, even in gold, is quite telling. People are worried.”

Meanwhile investors’ ability to buy and sell Russians assets such as stocks and bonds has deteriorated sharply in a sign that western sanctions are eroding the country’s links to foreign capital markets.

Here’s Merryn Somerset Webb on why the crisis in Ukraine is adding a further dose of uncertainty to markets.

And Mohamed El-Erian, an adviser to Allianz and Gramercy, looks at six factors to guide investors during the Ukraine turmoil. He writes:

What will be common, however, is the importance of financial resilience that allows investors to retain as much optionality as possible for the time being. Rather than reflecting indecisiveness, it is an important recognition of an extremely uncertain situation that is some distance from resolution.

Terry Smith’s tough start to 2022

It’s starting to look as though being compared to Warren Buffett might be some kind of curse for UK stockpickers. First Nick Train, founder of Lindsell Train and one of the fund managers hailed as the UK’s answer to the Sage of Omaha, admitted to “arguably the worst period of relative investment performance” in two decades. Now, an even more popular name has found himself on the wrong side of the market.

Terry Smith, who grabbed headlines this year with his jabs against Unilever’s undue focus on the “purpose of mayonnaise,” is one of the UK’s best-known investors. The Fundsmith founder has an army of retail followers who buy his funds in droves. Their loyalty has been rewarded with a 500 per cent rise in Smith’s flagship Fundsmith Equity Fund since inception, translating to double digit annualised returns, net of fees.

But the £26bn fund performed worse than its wider market benchmark by a narrow margin in 2021, and has tumbled around 15 per cent this year so far, as Joshua Oliver and Robin Wigglesworth explore in this piece.

Many of the fund’s biggest bets, such as PayPal and Facebook owner Meta Platforms, have inflicted serious damage as tech stocks have sold off amid expected interest rate rises. This chart from Pensioncraft, showing the drop in Smith’s stock picks from their recent highs, does not paint a pretty picture.

Ian Aylward, head of fund selection at Barclays, said Smith’s focus on so-called “quality growth” companies has been “unwavering”.

“This has been the most profitable space in the stock-market to invest over the last decade or so, but there are periods when being exposed to such names is relatively painful and the year so far has been one of those times.”

These losses highlight long standing concerns from some analysts that British fund buyers are too attached to star managers, like Train or Smith, whose performance can swiftly deteriorate. But from his base on the island of Mauritius, Smith brushed off the brutal start to the year as a mere bump in the road:

“We are focused on delivering strong returns to our investors over the long-term . . . [Fundsmith] is for long term investors who want their investment to compound in value over the long term. I said ‘long term’ twice in that sentence deliberately.”

Chart of the week

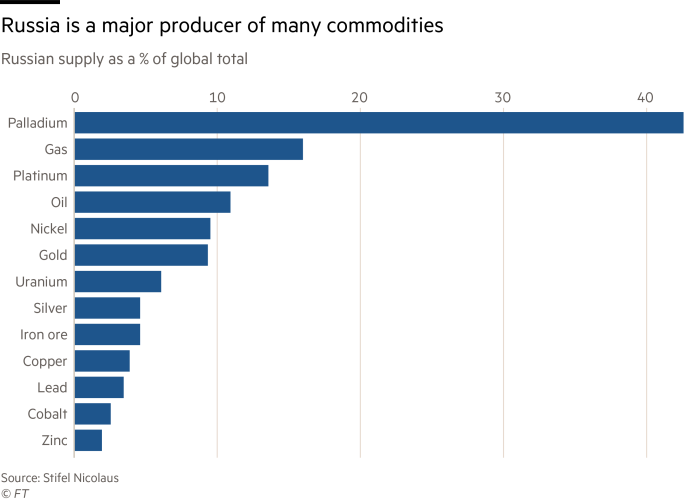

Russia’s status as one of the world’s leading producers of many raw materials presents a dilemma for western policymakers as they hit Moscow with severe economic sanctions over its invasion of Ukraine, writes Akila Quinio. More than 15 per cent of total natural gas supply stems from Russia, making it the world’s second-largest producer. The nation accounts for more than a tenth of global market share for oil, and is a major exporter of base and precious metals ranging from gold to nickel to iron ore.

Russia also produces more than two-fifths of the world’s palladium, according to data from US bank Stifel. The white metal, which resists corrosion, is often used as a catalytic converter for cars and a component of laptops and mobile phones.

Escalating tensions in eastern Europe come at a moment when inventory levels for many commodities were already squeezed. Demand has outstripped supply as economies emerge from coronavirus-induced lockdowns, leading traders to stockpile raw materials — further stoking persistently high rates of inflation.

The world’s considerable dependence on Russian commodities underscores the challenges faced by governments in Europe and the US as they retaliate against the assault on Ukraine while striving to mitigate damage to their own economies.

10 unmissable stories this week

Profits at the Berkshire Hathaway conglomerate soared in the fourth quarter but Warren Buffett said that he and longtime right-hand man Charlie Munger had found “little that excites us” as they sought out new investments.

Allianz Global Investors, one of Europe’s largest asset managers, and activist Cevian Capital are urging investors to vote against companies that fail to link executive pay to climate targets.

Hedge funds and other investors could be forced to share more information with regulators and the public about their bets that individual share prices will fall under a new rule proposed by the US Securities and Exchange Commission on Friday.

McDonald’s is learning the hard way. Don’t mess with Carl Icahn — even when the subject in question is the ethical treatment of pigs rather than payouts to shareholders. Brooke Masters argues companies had better start getting used to activism on a wider range of issues.

Meanwhile don’t miss this profile of Icahn, on how the consummate corporate raider is trying on a softer side for size. “It sounds hokey, but I have always been upset by unnecessary cruelty,” the 86-year-old activist said in an interview. “It just bothers me, especially with animals.”

Boris Johnson’s moves to “stop Russian companies raising money on London markets” face a problem. Only three Russian firms have conducted an initial public offering in the UK since 2014. Russia’s waning reliance on UK finance has reduced the bite of British sanctions.

California’s Calpers has appointed a Canadian fund manager as its new chief investment officer to oversee its $478bn portfolio as the largest US public pension plan embarks on plans to boost exposure to private markets.

Trading in unlisted US penny stocks has dropped almost three-quarters from its peak last year, when this niche corner of the market experienced an influx of amateur traders lured by rebounding asset prices, government stimulus cheques and the prospect of an escape from lockdown boredom.

Jupiter has failed to halt three years of outflows. These have reached a cumulative £12.3bn as clients continue to pull money from unpopular areas like UK and European equities, despite the counterbalance of interest in ESG strategies.

The pandemic recovery boost to wealth managers looks to be over, as turbulence hits financial markets. St James’s Place, said it is expecting slower growth in 2022, while Hargreaves Lansdown shed almost a sixth of its value after its annual results revealed that the lockdown trading boom had hit profits as the company spent more on tech and customer service.

And finally

Pablo Picasso’s Buste de femme accoudée, gris et blanc is on display at Sotheby’s on New Bond Street this week, ahead of the Modern and Contemporary auctions on Wednesday and Thursday. This sublime portrait from 1938 encapsulates his two lovers of the period: the blonde, youthful, guileless Marie-Thérèse Walter and the dark-haired, vulpine Dora Maar. It’s a close contender for my favourite Picasso, up there with Boy Leading a Horse at the Museum of Modern Art in New York.

Which is your favourite work by Picasso? Email me: harriet.agnew@ft.com

Thanks for reading. If you have friends or colleagues who might enjoy this newsletter, please forward it to them. Sign up here

We would love to hear your feedback and comments about this newsletter. Email me at harriet.agnew@ft.com

[ad_2]

Source link