[ad_1]

Stephen Schwarzman, the founder of Blackstone Group, received a record $1.1bn in income in 2021, and was one of three insiders at the world’s largest private equity group to receive over $160mn as its profits soared.

Schwarzman’s haul mostly came from about $940mn in dividend payments due to his ownership of nearly 20 per cent of the private equity group’s shares. The figure scratches the surface of the wealth that Schwarzman generated last year as Blackstone’s stock doubled.

His shares rose by $15bn in value and Schwarzman earned a further $150mn in “carried interest” compensation, underscoring how buoyant financial markets and investors’ rush into private funds is creating unprecedented wealth in a less regulated corner of Wall Street.

To put the income Schwarzman received in 2021 into context, it was 55 per cent more than the $615mn he received in 2020 and about 20 times that of JPMorgan chief executive Jamie Dimon, who has led the largest bank in the US since 2005. Other insiders at Blackstone also received multiples of what Dimon, the banking industry’s foremost senior executive, earned.

Blackstone president Jonathan Gray received nearly $325mn in pay and dividends in 2021, according to filings released by the firm Friday evening, while Hamilton James, its recently departed vice-chair, received more than $160mn. At current prices, Gray and James’s Blackstone shares are worth $5.3bn and $2bn, respectively.

Joseph Baratta, the firm’s head of private equity, and Michael Chae, its chief financial officer, received more than $55mn in 2021, a figure comparable to the pay and dividend income earned by Dimon, and more than that of Goldman Sachs chief executive David Solomon.

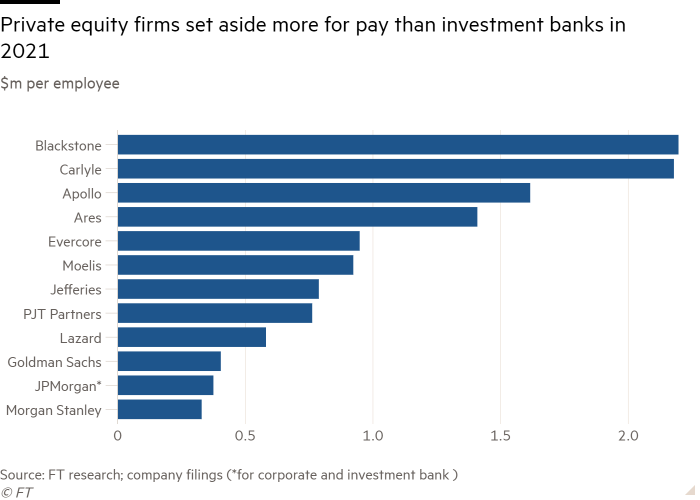

These sums underscore how the balance of power on Wall Street has shifted to fast-growing alternative asset management firms, which can offer employees payouts that dwarf the sums earned by traders and investment bankers.

Top executives at private equity firms typically receive salaries that are modest compared to their entitlement to receive “carried interests”, giving them a share of the profits on successful investments. Founders and top executives like Schwarzman are also large shareholders, meaning that they receive sizeable dividend income.

Distributable profits at Blackstone, which pays out the majority of its profits in the form of dividends, rose 85 per cent to $6.2bn in 2021, allowing it to increase its dividend by 80 per cent.

Blackstone’s about 3,800 employees collectively received total pay and benefits of $8.3bn, or about $2.2mn per employee, although this is skewed somewhat by the top earners. The figure includes about $4bn in cash-based pay, stock awards, and $3.7bn in unrealised performance-based profits that are contingent on future asset sales and can fluctuate wildly, but not the dividends received by shareholders like Schwarzman.

Blackstone’s assets under management ended the year at a record $881bn and it currently holds nearly $9bn in unrealised performance-based profits on its books, underscoring that pay could rise in 2022 if financial markets remain buoyant.

Had Blackstone sold all of its investments at their year-end values, Schwarzman would have received $538mn in carried interest-based pay, while Gray would have received $434mn. Blackstone partners also collectively received $47.5mn in tax windfalls based on a “tax receivable agreement” that is set to pay them $1.6bn over the next 15 years.

Blackstone said its pay is based on “long-term alignment with our investors”.

With additional reporting from Sujeet Indap and Mark Vandevelde in New York

[ad_2]

Source link