[ad_1]

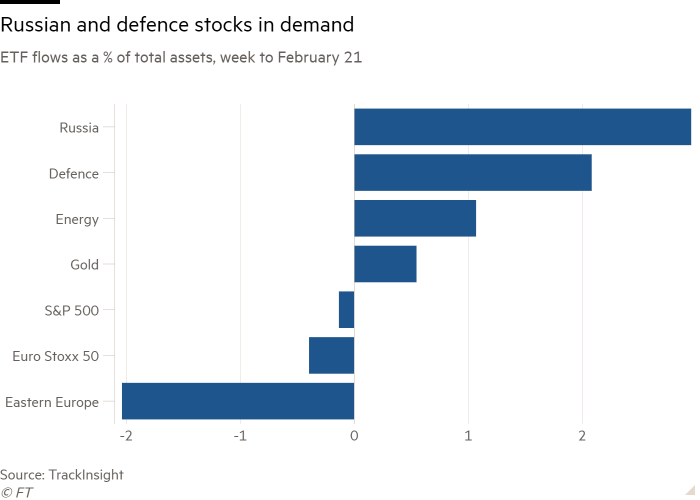

Western exchange traded fund investors have ignored rising tensions in Ukraine and bought into Russian equity funds in recent days, but have also loaded up on guns, bombs and bullets.

They have increased their exposure to gold — long considered a safe haven in times of crisis — and energy funds as oil prices hit $96.50 a barrel, but have cut their bets on the US and European stock markets and eastern Europe.

ETFs focused on Russian equities took in a net $89.5mn in the week to Monday’s US market close, according to data from TrackInsight. This equates to a third of the net flows so far this year and is equivalent to 3.1 per cent of the $2.9bn of assets held by the 15 ETFs, listed in the US, Europe and East Asia.

The VanEck Vectors Russia ETF (RSX) had net inflows of $61.3mn in the week to Monday, while BlackRock’s iShares MSCI Russia ETF (ERUS) attracted $20.6mn, according to TrackInsight.

Similar data from FactSet, covering 38 ETFs and mutual funds that have at least 50 per cent exposure to Russia, with combined assets of $8.7bn, showed net inflows of $69.7mn in the week to last Thursday.

The buying spree comes despite a sharp sell-off for Russian equities, with the Moex index down almost 20 per cent year to date. The median Russian ETF is smarting from a loss of 12 per cent so far this year in dollar terms, and 9.4 per cent in the week to Monday.

However, Todd Rosenbluth, head of ETF and mutual fund research at CFRA, said that while the inflows could be a sign of investors looking to buy Russian equities at beaten up valuations, they could also be suggestive of increased short selling of Russia-focused ETFs, a process that also increases the number of shares in issuance.

“The flow to Russian ETFs is either people trying to benefit from the discounted valuation from panic selling or using the ETF to create shares for shorting purposes,” Rosenbluth said. “Getting liquid access to Russian stocks is harder than it is using ETFs.”

Peter Sleep, senior portfolio manager at 7 Investment Management, pointed to “bottom fishing” by some investors, particularly with the Russian stock market already being cheap, as well as “people expressing hope that [the crisis] will all be over quickly”.

The Moscow bourse traded at 5.4 times forward earnings at the end of 2021, according to Siblis Research, compared to 12 times for emerging markets as a whole.

Elisabeth Kashner, director of global fund analytics at FactSet, believed the flows into some of the Russian ETFs, at least, were “opportunistic, probably based on energy price expectations”.

Kashner pointed out that the VanEck Vectors Russia ETF, at $1.2bn the largest such fund, has a 41 per cent exposure to the energy sector, via holdings such as Gazprom, Lukoil, Novatek, Tatneft and Rosneft, and is therefore potentially well-positioned to benefit from any crisis-driven rise in oil and gas prices.

Energy ETFs more broadly have also seen renewed interest, with net inflows of $619mn in the week to Monday, according to TrackInsight, with about half the money vacuumed up by State Street’s Energy Select Sector SPDR Fund (XLE).

Gold has been another in-demand sector, with inflows of $1.1bn over the week, taking buying so far this year to $4.8bn, a sharp reversal of fortunes from last year, when the sector was hit by net outflows of $9bn, the highest since 2013.

“During times of uncertainty, ETFs tied to gold are in vogue as an alternative to the stock market,” said Rosenbluth.

Sleep viewed oil and gold as the “natural hedge” during a time of geopolitical crisis, alongside high-grade debt such as US Treasuries and UK gilts.

However, the gold buying may not necessarily be driven by concern over the fallout from Russia’s aggression towards Ukraine.

“There are a couple of things playing into the gold story. I think it’s people hedging their risk and also the added bonus that it has historically provided some level of inflation protection,” said Kenneth Lamont, senior fund analyst for passive strategies at Morningstar. Inflation is rising sharply in much of the world, a trend that may be further exacerbated by even higher energy prices.

Defence sector ETFs have taken in $126mn, almost doubling their inflows so far this year.

“It’s the other side of the coin,” said Sleep. “You have got the optimists going into Russia and the pessimists buying into defence stocks.”

In contrast, broad S&P 500 ETFs saw $1.6bn walk out of the door in the week to Monday, reversing the buying witnessed earlier this year, while those tracking the Euro Stoxx 50 index saw outflows of $147mn. ETFs investing in eastern Europe shipped $4.7mn, a meaningful sum for a small sector.

Click here to visit the ETF Hub

[ad_2]

Source link