[ad_1]

The supposedly savviest investors on the planet — hedge fund managers — had a tough time justifying their fees in 2021.

Whatever their market acumen, many struggled to outperform benchmark stocks indices such as the US S&P 500, as the continued support of big central banks, chief among them the US Federal Reserve, kept bond yields low and stock prices buoyant.

So while the S&P climbed 27 per cent, hedge funds returned 10 per cent, according to data from Hedge Fund Research. Weighted by the size rather than the number of funds, it was 7.5 per cent.

Many, it seems, could have benefited from mimicking entrants to the light-hearted annual FT stockpicking competition. (Some of them, anyway.) The contest started life as an in-house league for journalists in our newsroom — similar to fantasy football, but for news and markets nerds. It has been open to readers for the past five years, and this time welcomed nearly 700 contestants.

The rules are similar to running a real portfolio, but only if you are a terrible fund manager who takes highly concentrated bets in just a handful of stocks and makes no adjustments to those bets for a whole year. No guts, no glory. Active management and portfolio hedging are for wimps.

The rules are straightforward: each contestant picks five stocks to go up (a long position) or down (short), or a mixture of the two. At the end of the year, the FT’s data whizzes crunch the numbers to find which of our amateur portfolio managers generated the highest average returns.

For simplicity, the exercise ignores currency movements and dividend payments. At stake is nothing more, and nothing less, than ego and bragging rights, and a tour of the FT’s London offices — Covid restrictions willing — for the winner.

At the time contestants were placing their bets — late January 2021 — market watchers were spellbound by the spectacle of retail traders in the US coordinating in vast numbers to pump up shares in downtrodden consoles store operator GameStop, as well as in a clutch of other so-called meme stocks. It appeared at the time that speculative participation in public markets — in meme stocks and beyond — was reaching a feverish peak.

So it is fitting that 2021’s winner, Petru David, summed up the logic behind his all-short portfolio in two words: “Bubble pop”. It is a strategy that earned him an average return of 64 per cent.

A round of applause please for the private equity executive from Romania, who spent his 2020 Christmas holidays in lockdown looking for the most overvalued stocks. A former accountant, he was aghast at the price-to-earnings multiples attached to some businesses, and shorted the Nigerian ecommerce vendor Jumia, clean energy group FuelCell Energy, software provider Appian, 3D printer maker 3D Systems and Palantir, the data analysis company co-founded by Peter Thiel.

“I was sure something was going to blow up, but I didn’t want to target only one sector,” he said.

David took the unusual step of putting hard cash behind several of his short positions.

“Don’t imagine that I made any money,” he said. His real-life investments, which had a shorter timeframe than our year-long contest, all yielded a loss. “But I’m very happy that I was proven right. Now it seems that the market has become more lucid.”

How did readers do this year?

David and the other titans of this year’s contest tower above the pack. The average portfolio return for all external contestants was minus 2 per cent.

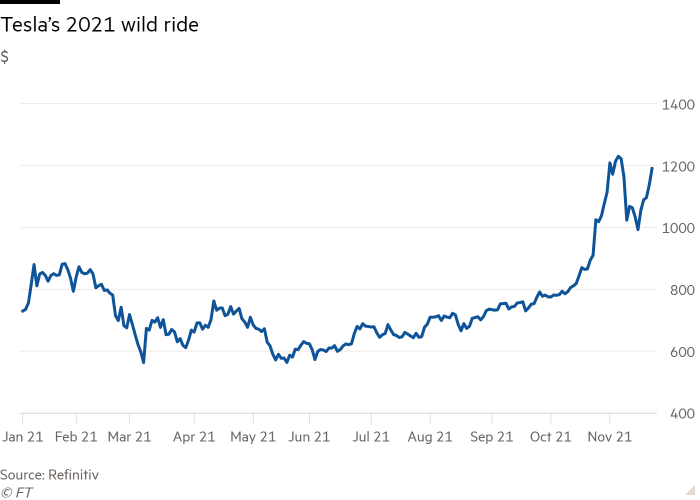

The key dividing line between success and failure here was, as in so many areas of financial markets, Tesla.

Betting against the electric carmaker was overwhelmingly the most popular single pick, with more than a quarter of contestants predicting Elon Musk’s auto business would come unstuck.

Like many professional investors in recent years, Tesla doubters were taken to the cleaners with a 25 per cent loss as it surged past $1tn in market value.

At the same time, long positions on Tesla were the second most popular positive bet in the competition (after “long” Amazon). Fifty-five contestants decided to back the company.

Contestants were more unified in their stance on meme stocks, which dominated the headlines last January just as contestants were making their picks. Many of our stock pickers bet heavily on these moonshot stocks crashing back to earth.

“Meme stocks were so volatile and so dramatic,” said top five reader Anthony Stamp, from east London, who works in advertising. “And the ones that looked like they were just bets on nostalgia companies or complete nonsense — whichever were the sketchiest — I shorted those.”

Stamp owes his 54 per cent average return to the fact that his portfolio of the “sketchiest” meme stocks did not include cinema chain AMC Entertainment. In a cruel twist, the king and queen of meme stocks — AMC and GameStop — charted sharply different trajectories over the timeframe of our contest.

GameStop shorts ended the year up an impressive 34 per cent. But AMC shares rose more than 100 per cent, totally wiping out the shorts. One reader, Ayodeji Awolaja, who picked long AMC as a winning position, described his wise or heroic bet in poetic terms. “Cinema will not die,” he said. He finished a very respectable 36th in the contest, but his 93 per cent average return at the halfway mark had shrunk to 30 per cent by the end.

Awolaja’s result goes to show that timing is every bit as important, and difficult, as picking the right positions, which is a shame for a fantasy contest where you have to stick with your bets all year.

All-short portfolios dominate the top ranks, but a few readers found success with positive bets.

“My grandmother had a stockbroker. She would base her instruction on her shopping trips. If she went into a shop and it was busy, she would be inclined to buy shares,” said Jennifer Rutte, a teaching assistant from Rugby in the English Midlands, one of the best-performing long-only investors in the contest, up 46 per cent.

Rutte’s portfolio was a straightforward bet on UK businesses she figured would do well in lockdown: AstraZeneca (jabs), Tesco (snacks), and Diageo (booze).

A similar strategy handed Adam Workman second place overall. He and Rutte both benefited from a near 40 per cent gain for Domino’s Pizza, as customers chowed down during lockdown.

Workman, a solicitor from Winchester, put his success down to “a huge slice of luck”. This is no time for false modesty, but in the interests of domestic harmony, he should probably use his bragging rights sparingly, as his wife finished 214th.

What were the popular picks?

Short positions do not figure among the best-performing picks, since the maximum possible return, for a company that goes to zero, is 100 per cent. The best short position was Chinese exam prep company Gaotu Techedu, which lost 98 per cent of its value in 2021 when the Chinese government cracked down on the education sector.

The best selections in the competition were three long calls, which led three players to more than triple their money on those positions at least, with bets on US shale group Silverbow Resources, aluminium giant Alcoa and Apollo Medical Holdings, while three others performed almost as well with their investment in US department store chain Dillards. The retailer’s stock surged following robust sales after shoppers flocked back to bricks and mortar stores as the pandemic ebbed in 2021.

Long Nvidia, the US gaming company, was the best pick chosen by more than a handful of players: 19 readers picked this, and more than doubled their money. They are lucky the contest ended on December 31; since then Nvidia has fallen by 20 per cent.

The reader who led the contest at the halfway mark, thanks to a portfolio that he described as “random”, fell to the middle of the pack as his star pick, a long bet on an obscure company, Moxian, dropped back closer to earth — ending the year up 61 per cent. This was not enough to offset a big loss in the reader’s short position in MV Oil Trust, which gained 135 per cent on the year.

How did the FT hacks do?

As a group, Team FT did a somewhat better than the readers, albeit with a much smaller number of contestants (30) and with more flexible rules (a hangover from when this was just an office game). Still, a win’s a win.

Gulf business correspondent Simeon Kerr takes home the trophy among FT journalists, after choosing a portfolio of local stocks on the theory that the UAE’s success in fighting Covid-19 would drive an economic rebound. His average return was a massive 94 per cent.

Runner-up Arash Massoudi gained 55 per cent with a strategy that he said aimed to “short the zeitgeist” at the start of last year. “The mania was all about special purpose acquisition companies and Chamath Palihapitiya was the frontman striking what seemed like some of the crazier Spac mergers,” said Massoudi, the FT’s corporate finance editor. “Four out of my five picks were shorts of Chamath’s Spacs.”

Global finance correspondent Robin Wigglesworth opted to bet against another big name. He took bronze with a pack of shorts on smaller stocks in Cathie Wood’s Ark portfolio, which he reasoned had been “mostly pumped higher by Ark itself”.

Defying journalistic cynicism with a fourth-place finish was New York M&A reporter Nikou Asgari, who went with an all-long portfolio including Hermes and LVMH on the terse logic of: “rich people getting richer and spending more on luxury”.

AMC shorts torpedoed the performance of investigative reporter Dan McCrum, who spearheaded the investigation of Wirecard. McCrum’s bets against GameStop and electric vehicle company Nikola served him well. But he ended the year close to the bottom of the pack thanks to the kryptonite Tesla and AMC shorts, plus an unsuccessful bet against Warren Buffett’s Berkshire Hathaway.

The FT’s star stockpicker of two years, Miles Johnson, came unstuck this year, finishing third to last among journalists. AMC shorts again take the blame, alongside some unlikely “long” bets on companies including WW, formerly known as Weight Watchers.

Bringing up the rear among reporters was City Bulletin writer Bryce Elder, with a portfolio of obscure biotech stocks, four of which ended the year in the red. His hopes that “just one success would be a ten-bagger that offset all the losers” failed to materialise as Covid variants again delayed clinical trials.

“My death or glory strategy delivered rather more death than glory,” he said.

OK, I’m in. How do I play in 2022?

Aspiring stock pickers — as well as FT journalists — are likely to find 2022 a challenging year for share price predictions.

Economies around the world are reigniting as they emerge from the tightest pandemic restrictions, but inflation is soaring in the US and Europe, interest rates rises are expected to raise company costs, and supply chain chaos continues to hamper business recovery. And that’s before we know what will happen on the big geopolitical question of the moment — growing US-Russia tensions over Ukraine.

But turbulent markets can create opportunities for the quick-thinking investor. Why not make some bold calls about which companies will benefit and which will lose out in 2022, by pitting your wits against FT journalists in the next round of our annual stockpicking contest?

Contestants must choose five stocks from around the world and take either a long or short position — betting that the shares will either rise or fall. The winner is the person who generates the highest overall return on their portfolio. No money is wagered — so the only potential loss is your pride.

Entries will close at midnight GMT on Sunday, February 6, and the contest will be judged on the gains or losses made between February 7 and December 31.

A tip: it is unwise to take your lead from FT journalists, whose performance tends to be erratic. Note that they will be picking from the same stocks indices as everyone else for 2022.

The competition entry form is at FT.com/stockpick2022, where you can enter your five picks. The three readers whose portfolios perform best in the 2022 contest will be invited to the FT’s offices in London early in 2023 — subject to lockdowns and travel restrictions.

In case he repeats his extraordinary performance, our 2021 winner Petru David from Romania is worth listening to. “No, the bubble hasn’t popped,” he said. “The same stuff that was expensive last year is expensive now. I don’t think the market has corrected enough.” Good luck!

[ad_2]

Source link