[ad_1]

I recently allowed myself to descend into a crass “comment fight” on LinkedIn with an individual who is, to say the least, an opponent of annuities. He also has little regard for the people who sell them. The word-fight began when I was unexpectedly accused of “living in an echo chamber.” I was compelled to defend the benefits of annuities against what I viewed as an unfair disparagement by this individual, a screed that bordered on hysteria. Moreover, because he could not refute my factual replies to his false claims, his responses sank to the level of ad hominem attacks on me that were notable for their inaccuracies, innuendo, mischaracterizations and falsehoods. As the back-and-forth continued, I was careful to stick to the facts while he countered with name-calling. Sound like another area of contemporary society?

Well, how about this for coincidence? As this regrettable exchange was playing out in real time, late at night and into the early morning, in the very middle of it I received an alert on my iPhone that episode 152 of That Annuity Show podcast had been released. If you are not familiar with That Annuity Show, it is a podcast that offers value to anyone who desires to better understand the benefits of annuities and their practical applications. The podcast attracts a wide variety of guests who address diverse topics including academic research, marketing, technology, innovation, product development and more. Paul Tyler, CMO OF Nassau RE, hosts the podcast along with Ramsey Smith, Founder & CEO of ALEX.fyi. They are frequently joined by guest host Bruno Caron, Associate Director at A.M, Best.

Picture this. I’m listening to the podcast while simultaneously participating in this “war of words,” over annuities, when I get to the point in the interview where Caron calls attention to a statement found on page 61 of my book, Constrained Investor, where I state that:

“Annuities remind me of politics. They ignite polarized beliefs that sometimes make it difficult to have fruitful discussions.”

“Wow! I am living this reality. It is just like politics!”

It is Not About a “Side”

The LinkedIn exchange inspired numerous comments from other LinkedIn members. In response to one made by Dr. Donald Moine, I explained that “I am pro intelligent retirement income planning. That makes me, by definition, pro-annuities, AND pro-investments. It is hard for some people to comprehend that neither ‘camp’ is the answer, but both are vital parts of the answer.”

After 18 years spent working in the field of income distribution planning, I can tell you that nothing is truer than this: No single “silo” is the answer to retirement income. In 2005, I became a founding member and director of the non-profit Retirement Income Industry Association, an organization whose mission it was to produce research benefiting from, “A view across the silos.” The association did pioneering work in communicating the need for diverse business silos to join together in order to craft the next generation of retirement income solutions.

Because asset management and insurance are equally vital components of proper income planning, prejudices against annuities like those espoused by my word-fight opponent only serve to work against the best interests of the American retiree.

A New Way to Assess and Serve Retirees’ Needs

If you hold views that are preventing your embrace of annuities, let me offer you an alternative way to think about serving the needs of your retiree clients. At retirement, any client can be placed into one of three categories of investors:

- Underfunded Investors

- Overfunded Investors

- Constrained Investors.

Because “underfunded” investors rely primarily upon Social Security for retirement income, clients you are working with will almost always fall into the “overfunded” and “constrained investor” categories.

Overfunded clients are a lucky minority who have more wealth assets than are required to create their desired level of retirement income.

Constrained investors represent a lucrative market of desirable clients because all of them arrive at retirement with assets. However, the amount they’ve saved is not high in relation to the level of income they require to support a, “minimally acceptable lifestyle.” This does not mean that constrained investors have low investment account balances. On the contrary, they may have multiple millions of dollars. When working with constrained investors, it is less about the “amount” and more about the “relationship” between the amount of accumulated savings, and the level of income the savings must produce.

For example, imagine a client, Paula, who is retiring with $925,000 in investible assets. After subtracting Social Security, Paula requires her savings to produce an annual income of $41,076. Let me explain how that number was determined.

Funding Paula’s Minimally Acceptable Lifestyle

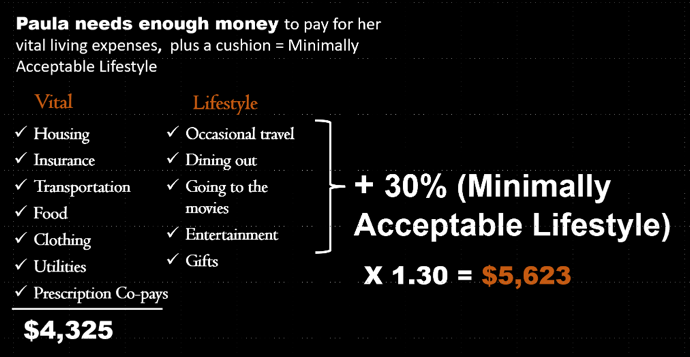

An integral component of the Constrained Investor framework is the calculation of the investor’s monthly income needed to support a Minimally Acceptable Lifestyle. This is done by adding up all of the retiree’s vital expenses, and then, to account for the funding of lifestyle expenses, grossing that number up by a factor of 30%.

Paula’s monthly vital expenses total $4,325. By adding 30% to the vital expenses total, we arrive at Paula’s Minimally Acceptable Lifestyle need of $5,623 per month.

The next step is to calculate Paula’s income gap. This is done by subtracting her monthly Social Security retirement benefit from her total required monthly income.

$5,623 minus $2,200 = a monthly income gap of $3,423, or, on an annual basis, $41,076.

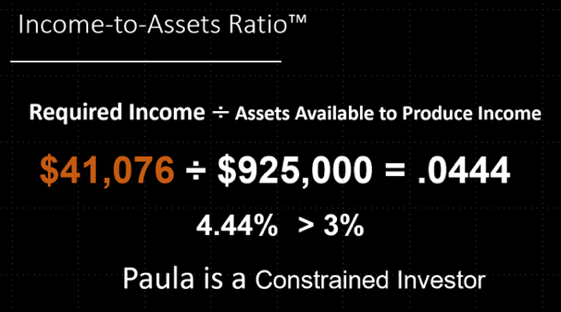

Now that we know that Paula needs her saving to fund her annual income need of $41,076, we turn to Income-to-Assets Ratio. This gives us an uncomplicated way to determine if Paula is a constrained investor.

We simply divide the annual income needed by the amount of assets available to produce income. If the resulting percentage is 3% or higher, the client is a constrained investor.

In Paula’s case, we can see that she is indeed constrained. Dividing her annual income need of $41,076 by $925,000, give us a result of 4.44%. That is greater than 3%, so, Paula is a constrained investor.

What does that really mean? I can answer that in one word: caution.

Paula’s savings will be under pressure to produce monthly income that she must have. I cannot make this point strongly enough. Constrained investors share the common characteristic of having an absolute reliance upon their savings to produce income that is essential. This means that they cannot afford investing mistakes. Constrained investors lack the cash cushion to absorb the losses. Yet, because we seek to generate inflation-adjusted income, constrained investors need to be consistent investors with an appropriate degree of long-term exposure to risk assets.

This conundrum creates the need for an investing framework that delivers positive behavioral characteristics by placing its central emphasis on mitigating risks that can reduce or even entirely consume the retiree’s income. Specifically, I am referring to the management of timing risk and longevity risk.

The Constrained Investor framework features safe monthly paychecks throughout retirement, combined with risk mitigation, making it much easier for the retiree to remain durably invested in risk assets through all market conditions.

Why Longevity Annuities Must Be Recommended

Constrained investors face a challenge in making their retirement incomes last for life. Systematic withdrawal plans with high “confidence rates” are no substitute for true longevity protection. This is where the recommendation of an annuity is absolutely essential.

If you, like my word-fight-opponent, hold negative views of annuities, it really is past time to let them go. Regardless of your business model, annuities have been transformed in order to easily accommodate your needs.

In my view, RIAs have no excuse to avoid annuities. Plenty are available with no commissions or surrender charges. There are also innovative “Contingent Deferred Annuities” that add lifetime income protection to client portfolios. And there are multiple fiduciary annuity marketplaces that facilitate both product selection and transaction handling. Fiduciary annuities appear in your portfolio management application like any other “wrapped” asset. No longer is there a rational argument to levied against annuities.

Out of Synch with Women’s Needs

If after all of this you still eschew annuities, I have a prediction for you: your rigid thinking is likely to cost you plenty in the years ahead. As women assume control over most of the available wealth assets, the male-dominated advisor community will reckon with a radically altered set of proprieties and investing preferences for which they are generally unprepared. As Blackrock recently stated, “Simply put, when it comes to money, men and women see the world quite differently.” BCG Consulting finds that, “Too many firms rely on broad assumptions about what women are looking for, resulting in products, services and messaging that can feel superficial at best and condescending at worst.”

Prior to launching the industry’s first retirement income solution developed expressly for “boomer” women, my firm did extensive research on gender-based differences in investing preferences. In comparison to men, Blackrock may actually be understating how radically different women in the “boomer” cohort view investing.

Men are all about ROI, historical performance and stock-picking. Considering that 86% of advisors are male, many advisors are currently unprepared to shift their investing orientation toward women’s top priorities: risk reduction, goals and confidence. Adding to this challenge is the phenomenon of male advisors alienating female spouses. When “boomer” husbands pass, seven out of 10 incumbent male advisors are fired by the widow. So, the problems goes well beyond advisors’ long-held investing recommendations. There are cultural, gender bias and stereotyping issues that advisors will also need to address.

What does this have to do with annuities? Everything. Annuities uniquely provide lifetime income security, they reduce risk and they make it easier for clients to reach defined goals. Continued rejection of annuities places advisors’ future success in jeopardy. I’m not overstating what is at stake. If you cannot, or will not, provide what the person who controls the assets is looking for, you will have little chance of gaining or maintaining a relationship.

A New Climate Demands New Answers

With interest rates rising, stock prices dropping, inflation surging and the Fed tightening, the 14-year engineered bull market in equities has ended. Whereas a “reverse dollar-cost-averaging” approach could have worked in the yesterday’s economic climate, it cannot work for millions of constrained investors in today’s.

We have entered a new era notable for a sharp focus on risk mitigation. Unlike my word-fight opponent, it is imperative advisors move past historical prejudices in favor of open-mindedness and a willingness to listen. Clients are not much concerned about annuity sales practices of 10, 20 or 50 years ago. They are, however, concerned about their financial security today, and tomorrow. I believe you will find it both professionally and personally rewarding if you offer them an opportunity to secure tomorrow, today.

Wealth2k founder David Macchia is an entrepreneur, author, IP inventor and keynote speaker whose work involves improving the processes used in retirement income planning. David is the developer of the widely used The Income for Life Model, and the recently introduced Women And Income. He is the author of two books, Constrained Investor and Lucky Retiree: How to Create and Keep Your Retirement Income with The Income for Life Model

[ad_2]

Source link