[ad_1]

‘We’re in this for the long term,’ says exec

In response to customer demand, PayPal announced today that its users will now be able to transfer cryptocurrency from their accounts to other wallets and exchanges.

“This feature was the most demanded from our users since we began offering the purchase of crypto on our platform,” said Jose Fernandez da Ponte, SVP and general manager of blockchain, crypto and digital currencies at PayPal.

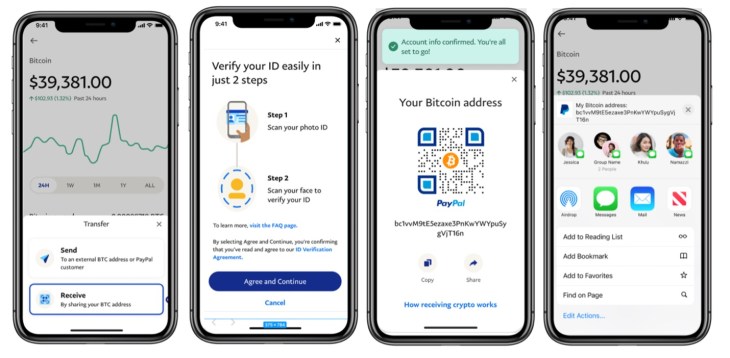

The new functionality will allow PayPal customers to transfer supported coins into PayPal, move crypto from its app to external crypto addresses including exchanges and hardware wallets and send crypto to other PayPal users “in seconds.”

Customers are responsible for network fees when they conduct external transfers, which depend on the blockchain and vary depending on the crypto asset. Internal transfers — PayPal to PayPal — have no fees.

“If users have crypto somewhere else and want to consolidate, they can bring it to PayPal from external addresses,” Fernandez da Ponte. “They can also send crypto to anyone who is in the PayPal system.”

PayPal gave its users the ability to buy, sell and hold crypto in October of 2020. Then, in late March of 2021, PayPal announced the launch of Checkout with Crypto, a feature that allowed consumers to check out at millions of online businesses using cryptocurrency. That feature expanded on PayPal’s current investments in the cryptocurrency market, which include its partnership with Paxos to power its service that allows customers to buy, sell and hold a range of cryptocurrencies and its acquisition of cryptocurrency security startup Curv. At Consensus last year, Fernandez da Ponte confirmed that offering its users the ability to transfer would be next.

“This is a natural conversion for our users who want to do more with their digital assets,” Fernandez da Ponte told TechCrunch this week. “We see ourselves as a conduit between the fiat, or traditional finance, environment and the web3 environment. We are enabling connectivity to other wallets, exchanges and applications.”

Giving its customers the ability to move their crypto assets — such as bitcoin, ethereum, bitcoin cash or litecoin — into, outside of and within PayPal is a move that the company could not avoid if it wanted to keep up with the continued crypto adoption and not be at risk for being viewed as behind the times in a fast-changing fintech landscape.

And despite the recent turbulence in the crypto space, Fernandez da Ponte said that PayPal is moving in this direction “as people are [still] adopting cryptocurrencies.”

“This move shows we’re in this for the long term,” Fernandez da Ponte added. “I think it’s important to stay the course and continue to invest in the space.”

The new functionality is only available to users in the U.S., and for security reasons, PayPal says it has implemented an additional identity verification process for users before they can transfer any crypto. The rollout will be a gradual one with select U.S. users being able to do so starting today, and with other “eligible” U.S. customers — those who complete the identity verification process — in the coming weeks.

My weekly fintech newsletter, The Interchange, launched on May 1! Sign up here to get it in your inbox.

[ad_2]

Source link