[ad_1]

This article is an on-site version of our Unhedged newsletter. Sign up here to get the newsletter sent straight to your inbox every weekday

Good morning. Stocks were boring yesterday. Less boring were Spacs, several of which got slapped down hard. BuzzFeed lost over 40 per cent after its lock-up period ended. The riskiest end of the risk spectrum remains a tough place to be.

Our first section today asks readers to do some scenario analysis and portfolio building. We very much hope you will send us your views: robert.armstrong@ft.com and ethan.wu@ft.com.

Place your bets on the US economy

When markets are especially uncertain, as they are now, it helps to have a good framework. Here’s a neat one, suggested by Unhedged’s rates guru, Ed Al-Hussainy of Columbia Threadneedle. He proposed a simple but sharp two-by-two matrix, condensed below. Each cell shows an economic outcome that could develop over the next 12 months:

This is, of course, too clean-cut. Outcomes that lie between or outside of the cells are possible. But the four scenarios together capture a wide range of likely outcomes, and can help us plan ahead.

What do you think the probability distribution is of A through to D? (The only wrong answer is 25/25/25/25.) And which of the following asset classes should outperform in each scenario? You can go long or short:

-

Growth stocks, value stocks, or defensive stocks

-

Short end, long end, and belly of the Treasury curve

-

Corporate credit, investment grade, or junk

-

EM debt, local currency, or dollar-based

-

Real estate

-

Gold

-

US dollar

-

Haven currencies (yen, Swiss franc)

-

Commodities — energy, food, industrial metals

We’d love to hear your thoughts by email. We’ll report back on what readers say — and provide our own thoughts — later in the week. (Ethan Wu)

BDCs: a public window into private debt

As the economic cycle turns, private debt markets are causing some worry. There has been a deluge of capital into the space, competition for assets among managers has been hot, and the whole thing feels a little toppy. Here is Ruchir Sharma of Rockefeller Capital writing in the Financial Times a few weeks ago:

After 2008, as regulators tightened the screws on public debt markets, many investors turned to these private channels, which have since quadrupled in size to nearly $1.2tn. A substantial chunk of it is direct lending from private investors to often risky private corporate borrowers, many of whom are in this market precisely because it is unregulated.

Sharma implies that high-growth, low-regulation areas such as private capital are ripe for a market “accident”. But it is tricky to assess a claim like this, because private markets are private. You might get some disclosures, for example, in the reports of the publicly traded private equity houses, or from debt filings of individual borrowers. On the whole, though, information about the private debt industry is not easy to find, not terribly granular, and not terribly uniform.

But we do have one clear — if small — window into this world, in the form of publicly traded business development companies.

BDCs are a species of closed-end investment fund that own primarily the debt of small- and medium-sized private companies, often those owned by private equity firms (a private equity company might do a buyout deal, give some of the debt to limited partners, keep some for itself, and park some in a BDC). Sometimes BDCs also own leveraged bank loans, little slices of equity, or other bits of the capital structure, too.

BDCs pay out most of the income from their investments as dividends. The debts they own tend to be floating rate, making them an attractive way to get exposure to high-yielding debt in a rising-rate environment. They boost their returns by carrying some debt themselves, usually equivalent to about half of their total assets. Importantly for investors, BDCs also pay fees to the management companies (often private equity houses) that control them, equivalent to a few percentage points of assets annually (a few BDCs are self-managing).

Looking at the shares of BDCs, we can get some sense of how the market assesses the riskiness of private debt. Here are some of the financial parameters of five of the larger BDCs. All sums are in millions, except the share prices:

The fact that many BDCs are trading at meaty discounts to net asset value suggests some anxiety about credit quality in the portfolios. So do dividend yields north of 8 per cent.

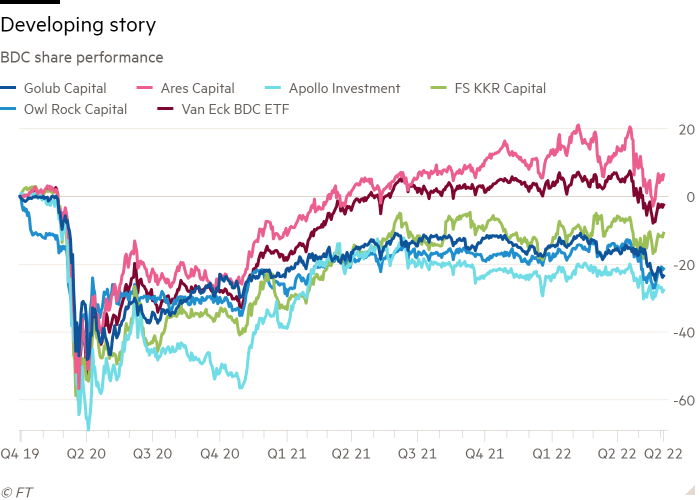

Here is how the stocks have performed, not including dividends, since just before the coronavirus pandemic (the dark maroon line is a broad exchange-traded fund covering much of the industry):

The sector’s high dividends, or course, change the picture. Ares, the best performing of the bunch — with a good reputation as a risk manager and a reasonable fee structure — has trailed the S&P’s 33 per cent total return in the period by only a few percentage points. Owl Rock, by contrast, has returned -3 per cent over the period.

The worry with the BDCs is that the credit quality is somewhat hard to monitor, because the managers have little incentive to mark down the valuations of the debt until the portfolio companies actually fall behind on their payments. At that point, things are already pretty bad, and will be getting worse fast. How much should we worry about this as the cycle turns?

I asked Jefferies analyst John Hecht, and he argued that you have to look at the record of each company:

We’ve always called it an industry of haves and have nots. [Our ratings of the stocks] are almost exclusively about our opinion of the managers’ ability to manage credit risk, and that comes from history. The reason the group trades where it does is that half the market participants don’t do that well.

But there are some — for example Ares — that have been really good at managing credit risk, particularly in disrupted environments. And there are others like Apollo that doesn’t have that historical performance.

(Note, above, that Ares trades at a premium to NAV and Apollo at a 22 per cent discount.) Chelsea Richardson, who covers the BDCs for Fitch Ratings, pointed out to me that one reason for comfort is that in the bad early days of the pandemic, many PE sponsors provided financing to portfolio companies that had cash flow problems, protecting lenders. But she also had two worries.

First, rising rates will increase portfolio companies’ debt burdens. Second and importantly, as the BDC industry has grown, competition for assets has turned fierce, especially from huge, non-publicly traded BDCs such as Blackstone’s Bcred fund, which now has $38bn in assets. The competition has made middle market debt deals very expensive, leaving lenders with little cushion should things go wrong.

It makes sense that if there is going to be trouble in the world of private credit, the weaker players in the BDC industry — leveraged buyers of debt from risky companies — might be where the trouble starts. Unhedged will be watching closely.

One good read

Tiger Global — or, as FT Alphaville’s Robin Wigglesworth calls it, the Yolo hedge fund — made a huge bet on tech. Boy, has it not panned out.

[ad_2]

Source link