[ad_1]

Mortgage rate forecast for next week (Nov. 15-19)

Mortgage rates fell early last week. But rate shoppers shouldn’t get complacent.

Average rates had already risen by Wednesday, Nov. 10 — the same day Freddie Mac reported a drop below 3%.

Now, 30-year rates are averaging closer to 3.25% according to our own data. And they could rise higher still depending on key economic reports that will be released next week.

Find your lowest mortgage rate. Start here (Nov 14th, 2021)

In this article (Skip to…)

>Related: 7 Tips to get the lowest refinance rate

Will mortgage rates go down in November?

Mortgage rates have been on a roller coaster in November. But, despite rises and falls, they haven’t moved much outside their current range of 3% to 3.15%, according to Freddie Mac.

That’s good news for borrowers. It means mortgage financing is still cheap — which is especially helpful for home buyers facing ever-rising prices.

However, we might see rates break out of their current low range before the end of the year. And there are a few reasons for that:

- Inflation — Higher inflation typically leads to higher rates. And the annual U.S. inflation rate was at a 30-year high in October

- Economic activity — Consumer spending increased in September (the latest reading). And unemployment claims fell to their lowest level since March 2020. Both are strong indicators of an improving economy, which should lead to increased rates

- Covid cases declining — Fear and economic uncertainty around the Coronavirus pandemic have been keeping mortgage rates low over the last two years. As Covid cases trend downward, rates will continue to move upward

Of course, all these factors are tied together.

As Covid cases recede, the economy should continue to improve. That means the Fed can start withdrawing its pandemic-related support — and mortgage rates should go up to more ‘normal’ ranges as a result.

This could mean the end of Covid-era, record-low rates.

Keep in mind, though, that even the highest mortgage rate predictions for Q4 2021 are around 3.20-3.30%. That’s still far below pre-pandemic levels. (30-year rates were at 3.72% in January 2020).

So today’s mortgage rates are still very low by any historical standard.

Get started shopping for mortgage rates (Nov 14th, 2021)

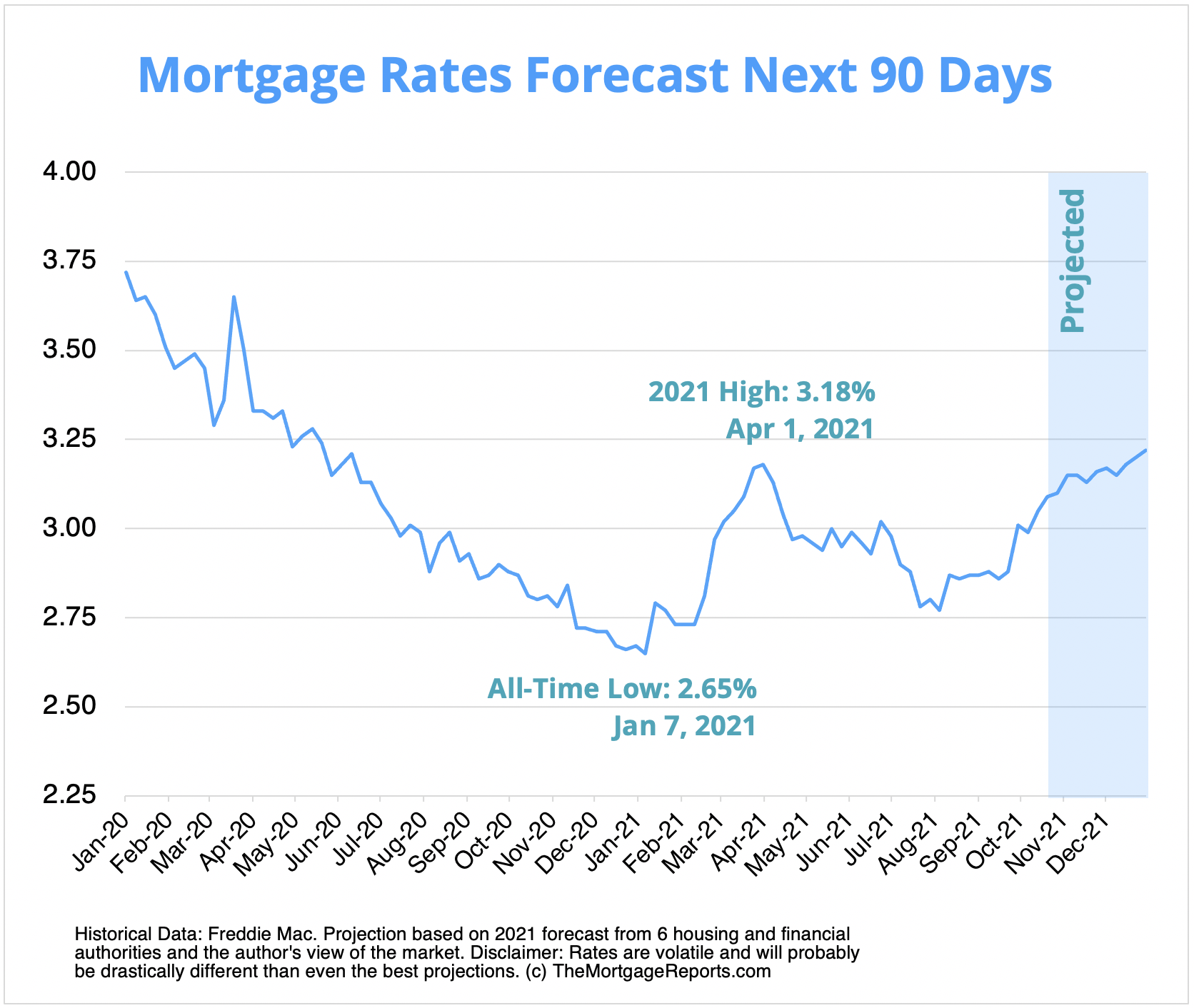

Mortgage interest rates forecast next 90 days

Mortgage rates are still in the low-3% range for qualified borrowers. However, interest rates are likely to keep rising through 2021 and 2022 as the economy climbs out of its Covid slump.

Mortgage rate predictions for late 2021

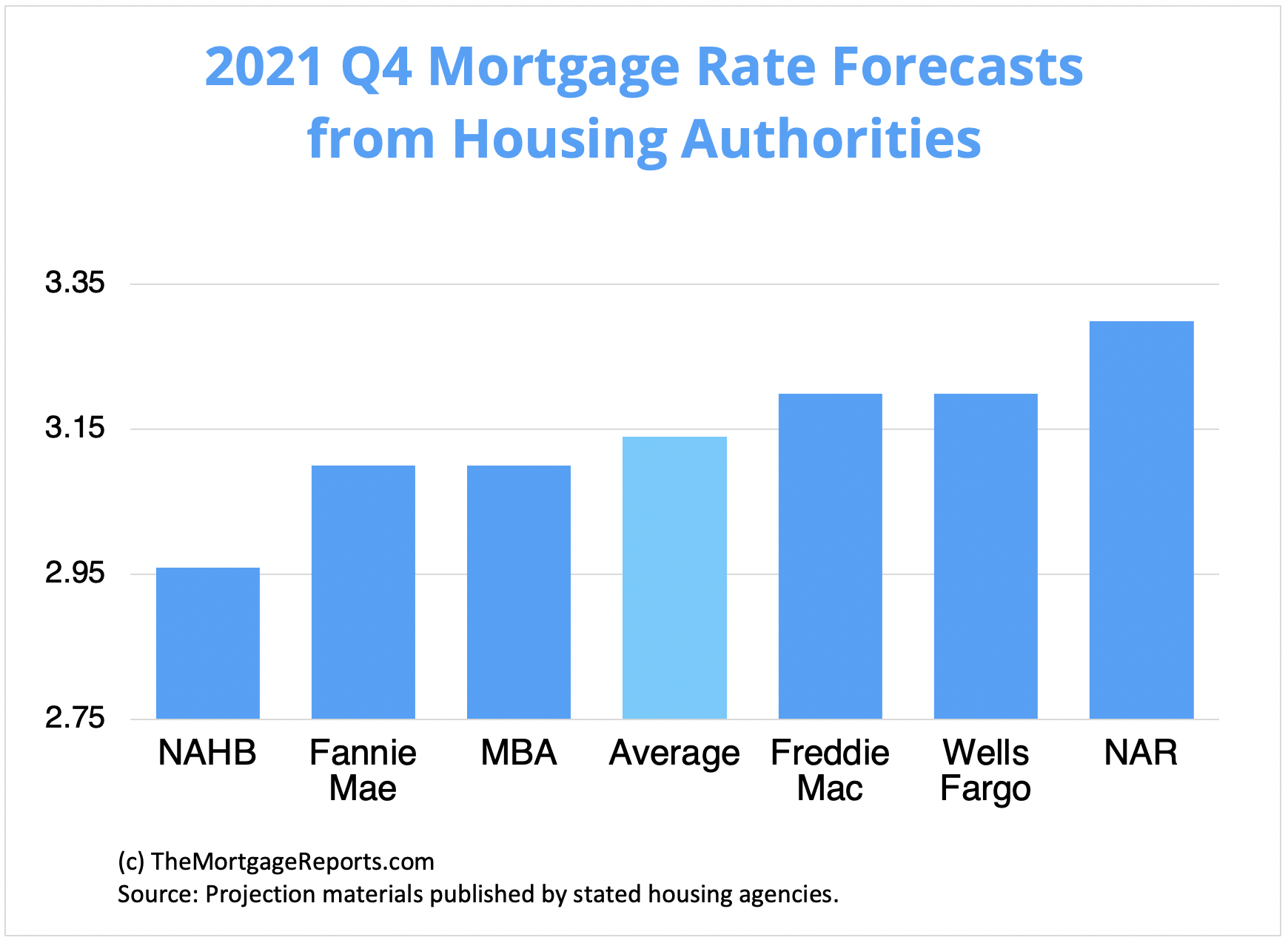

Most industry experts expect mortgage rates to rise at least modestly through the end of 2021.

Some, like the National Association of Home Builders and Fannie Mae, think mortgage rates will hover right around 3% in November and December. Others, like Freddie Mac and the National Association of Realtors, see average 30-year rates going as high as 3.20% or even 3.30% before the end of the year.

| Housing Authority | 30-Year Mortgage Rate Forecast (Q4 2021) |

| National Assoc. of Home Builders | 2.96% |

| Fannie Mae | 3.10% |

| Mortgage Bankers Association | 3.10% |

| Freddie Mac | 3.20% |

| Wells Fargo | 3.20% |

| National Association of Realtors | 3.30% |

| Average Prediction | 3.14% |

Current mortgage interest rate trends

Mortgage rates fell last week. The average 30-year fixed rate dropped from 3.09% to 2.98% according to Freddie Mac’s weekly rate survey.

Per the survey, 15-year fixed rates also dropped slightly, from 2.35% to 2.27%. And the average rate for a 5/1 ARM stayed about flat at 2.53%.

| Month | Average 30-Year Fixed Rate |

| January 2021 | 2.74% |

| February 2021 | 2.81% |

| March 2021 | 3.08% |

| April 2021 | 3.06% |

| May 2021 | 2.96% |

| June 2021 | 2.98% |

| July 2021 | 2.87% |

| August 2021 | 2.84% |

| September 2021 | 2.90% |

| October 2021 | 3.07% |

Source: Freddie Mac

Unfortunately, mortgage rates are moving away from the record-low territory seen in 2020 and 2021.

But keep in mind that rates are still ultra-low from a historical perspective.

Just three years ago, in November 2018, 30-year rates were at nearly 5 percent (4.94%, according to Freddie Mac’s survey). And in November of 2019 they were averaging between 3.5 and 4.0%.

So if you haven’t locked a rate yet, don’t lose too much sleep over it. There are still great deals to be had — especially for borrowers with strong credit.

Just make sure you shop around to find the best lender and lowest rate for your unique situation.

Mortgage rate trends by loan type

Many mortgage shoppers don’t realize there are different types of rates in today’s mortgage market.

But this knowledge can help home buyers and refinancing households find the best value for their situation.

Following are 3-month mortgage rate trends for the most popular types of home loans: conventional, FHA, VA, and jumbo.

| September 2021 | August 2021 | July 2021 | |

| Conforming Loan Rates | 3.20% | 3.05% | 2.99% |

| FHA Loan Rates | 3.25% | 3.13% | 3.10% |

| VA Loan Rates | 2.81% | 2.73% | 2.64% |

| Jumbo Loan Rates | 3.17% | 3.02% | 2.97% |

Source: Black Knight Originations Market Monitor Report

Which mortgage loan is best?

The best mortgage for you depends on your financial situation and your goals.

For instance, if you want to buy a high-priced home and you have great credit, a jumbo loan is your best bet. Jumbo mortgages allow loan amounts above conforming loan limits — which max out at $548,250 in most parts of the U.S.

On the other hand, if you’re a veteran or service member, a VA loan is almost always the right choice.

VA loans are backed by the U.S. Department of Veterans Affairs. They provide ultra-low rates and never charge private mortgage insurance (PMI). But you need an eligible service history to qualify.

Conforming loans and FHA loans (those backed by the Federal Housing Administration) are great low-down-payment options.

Conforming loans allow as little as 3% down with FICO scores starting at 620.

FHA loans are even more lenient about credit; home buyers can often qualify with a score of 580 or higher, and a less-than-perfect credit history might not disqualify you.

Finally, consider a USDA loan if you want to buy or refinance real estate in a rural area. USDA loans have below-market rates — similar to VA — and reduced mortgage insurance costs. The catch? You need to live in a ‘rural’ area and have moderate or low income to be USDA-eligible.

Find your lowest mortgage rate (Nov 14th, 2021)

Mortgage rate strategies for November 2021

Rates seem likely to rise in November and December. But there are still great opportunities to be had for home buyers and refinancing homeowners in 2021.

Here are just a few strategies to keep in mind if you’re mortgage shopping in the next few months.

Take advantage of the fall and winter home buying market

It’s no secret that 2021 has been a tough time to buy a home. Low inventory and skyrocketing prices have pushed many would-be buyers (especially first-time home buyers) out of the market.

But things could look a little better in fall and winter.

As Realtor.com said, “The 2021 homebuying season has aligned with pre-pandemic seasonal patterns, with a familiar sweet spot for buyers expected in the fall.”

That’s when competition typically wanes, and price gains cool off a little. And 2021 should be no exception in that regard.

Plus, mortgage rates are on the upswing. So buyers who manage to find a home before the end of 2021 may be able to secure some of the last pandemic-era rates.

In short: If you’re still house hunting, don’t give up. You might have better luck during the colder months. And cheap financing is still available, too.

Consider an adjustable-rate mortgage

Most home buyers and refinancers opt for a 30-year, fixed-rate mortgage. And for good reason. These loans offer stability, predictability, and financial security for the long run.

But what if you don’t plan to keep your home for the long run?

Homeowners who only plan to keep the property a short time — less than 10 years — might be able to save a lot more with an adjustable-rate mortgage (ARM).

ARM loans usually have far lower rates than fixed-rate mortgages. The catch? Your low rate is only fixed for the first few years (typically 5, 7, or 10). After that your mortgage rate and payment can increase.

But if you won’t stay in the home past year 10, the risk of increasing rates doesn’t matter. And you could save a bundle on interest in the short term.

Interested in ARM financing? Talk to a loan officer about your options. They can help you compare adjustable- versus fixed-rate mortgages and find the best loan for your situation.

Save more by shopping around

Mortgage lenders are still offering historically low rates to good borrowers. But there’s a catch.

You can’t just look for the lowest rate advertised online. Because the rates lenders advertise aren’t available to everyone.

Those offers typically represent borrowers with perfect credit, 20% down or more, and a sterling credit history.

Those criteria won’t apply to everyone. The rate you’re actually offered depends on:

- Your credit score and credit history

- Your personal finances

- Your down payment (if buying a home)

- Your home equity (if refinancing)

- Your loan-to-value ratio (LTV)

- Your debt-to-income ratio (DTI)

To figure out what rate a lender can offer you based on those factors, you have to fill out a loan application. Lenders will check your credit and verify your income and debts, then give you a ‘real’ rate quote based on your financial situation.

You should get 3-5 of these quotes at minimum. Then compare them to find the best offer.

Look for the lowest rate, but also pay attention to your annual percentage rate (APR), estimated closing costs, and ‘discount points’ — extra fees charged upfront to lower your rate.

This might sound like a lot of work. But you can shop for mortgage rates in under a day if you put your mind to it. And shaving just a few basis points off your rate can save you thousands.

Compare mortgage and refinance rates. Start here (Nov 14th, 2021)

Mortgage interest rate FAQ

Current mortgage rates are averaging 2.98 percent for a 30-year fixed-rate loan, 2.27 percent for a 15-year fixed-rate loan, and 2.53 percent for a 5/1 adjustable-rate mortgage, according to Freddie Mac’s latest weekly rate survey. Your own rate could be higher or lower than average depending on your credit score, down payment, and the lender you choose to work with, among other factors.

Mortgage rates could increase next week (November 15-19, 2021). Rate watchers should keep an eye on the Retail Sales report, which comes out Tuesday, as this data is a key indicator of economic growth. The more the U.S. economy improves, the higher interest rates should go.

It’s unlikely mortgage rates will go down in 2022. The ultra-low rates enjoyed by homeowners and buyers in 2020-2021 were largely driven by the Covid pandemic. And as the pandemic (hopefully) continues to recede in 2022, rates should keep on climbing.

Yes, it’s very likely mortgage rates will increase in 2022. Along with a decline in new Covid cases, we’re seeing positive growth in the U.S. economy. Increased consumer spending, low unemployment, and a strong real estate market could all help push rates up. Not to mention, the Fed expects to have completely withdrawn its pandemic-era mortgage support by mid-2022. And that means it will no longer be keeping mortgage rates artificially low.

Freddie Mac is still citing average 30-year rates in the low-3 percent range. But remember that rates vary a lot by borrower. Those with perfect credit and large down payments may get below-average interest rates, while poor-credit borrowers and those with non-QM loans might see interest rates closer to 4 percent. You’ll need to get pre-approved for a mortgage to know your exact rate.

For the most part, industry experts do not expect the housing market to crash in 2022. Yes, home prices are over-inflated. But many of the risk factors that led to the 2008 crash are not present in today’s market. Low inventory and massive buyer demand should keep the market propped up next year. Plus, mortgage lending practices are much safer than they used to be. That means there’s not a sub-prime mortgage crisis waiting in the wings.

At the time of this writing, the lowest 30-year mortgage rate ever was 2.65 percent. That’s according to Freddie Mac’s Primary Mortgage Market Survey, the most widely-used benchmark for current mortgage interest rates.

Locking your rate is a personal decision. You should do what’s right for your situation rather than trying to time the market. If you’re buying a home, the right time to lock a rate is after you’ve secured a purchase agreement and shopped for your best mortgage deal. If you’re refinancing, you should make sure you compare offers from at least 3 to 5 lenders before locking a rate. That said, rates are rising. So the sooner you can lock in today’s market, the better.

That depends on your situation. It’s a good time to refinance if your current mortgage rate is above market rates and you could lower your monthly mortgage payment. It might also be good to refinance if you can switch from an adjustable-rate mortgage to a low fixed-rate mortgage; refinance to get rid of FHA mortgage insurance; or switch to a short-term 10- or 15-year mortgage to pay off your loan early.

It’s often worth refinancing for 1 percentage point, as this can yield significant savings on your mortgage payments and total interest payments. Just make sure your refinance savings justify your closing costs. You can use a mortgage calculator or speak with a loan officer to crunch the numbers.

Start by choosing a list of 3-5 mortgage lenders that you’re interested in. Look for lenders with low advertised rates, great customer service scores, and recommendations from friends, family, or a real estate agent. Then get pre-approved by those lenders to see what rates and fees they can offer you. Compare your offers (Loan Estimates) to find the best overall deal for the loan type you want.

What are today’s mortgage rates?

Low mortgage rates are still available. Connect with a mortgage lender to find out exactly what rate you qualify for.

Verify your new rate (Nov 14th, 2021)

1Today’s mortgage rates are based on a daily survey of select lending partners of The Mortgage Reports. Interest rates shown here assume a credit score of 740. See our full loan assumptions here.

Selected sources:

- https://www.blackknightinc.com/category/press-releases

- https://www.federalreserve.gov/monetarypolicy/fomccalendars.htm

- http://www.freddiemac.com/research/datasets/refinance-stats/index.page

[ad_2]

Source link