[ad_1]

Wars are also big economic shocks. The Vietnam war destabilised US public finances. The Korean war of 1950-53 and the Yom Kippur war of 1973 triggered huge increases in prices of vital commodities. This time, too, a war directly involving a huge energy exporter, Russia, and, with Ukraine, an important exporter of many other commodities, notably cereals, is raising inflation and causing sharp reductions in the real incomes of consumers. More important, the war has added to already pervasive stresses on economies, international relations and global governance. The walkout by western ministers and central bankers from last week’s G20 meeting, as the Russian delegation spoke, was a sobering reminder of our divided world.

Even before Russia’s invasion of Ukraine, the world had not recovered from the economic costs of Covid, let alone its wider social and political effects. Supply disruptions were pervasive and inflation had soared to unexpectedly high levels. Monetary policy was set to tighten sharply. The risk of recession, worsened by defaults and financial disruption, was high. To this had to be added growing tensions between China and the west and their divergent policies on Covid.

This war follows pestilence and threatens famine. Together these are three of Ezekiel’s four “disastrous” judgments of the Lord. Alas, the fourth, death, follows from the other three.

The war is in sum a multiplier of disruption in an already disrupted world. Economically, it works via five main channels: higher commodity prices; disruption of trade; financial instability; the humanitarian impact, above all millions of refugees; and the policy response, notably sanctions. All these things also raise uncertainty.

In its latest assessment of the world economy, the IMF has duly lowered prospects for economic growth and raised its expectations of inflation for a second time in succession. After the excitement of the unexpectedly rapid recovery from the Covid-induced recessions of 2020, disappointment has set in. Forecasts for global economic growth this year have been reduced by 1.3 percentage points since October 2021. For high-income countries, the forecast has been lowered by 1.2 percentage points and for emerging and developing countries by 1.3 percentage points. Estimates of potential output are also generally below pre-pandemic expectations.

Inflation forecasts have also been raised sharply. It is now forecast to reach 5.7 per cent in high-income economies and 8.7 per cent in emerging and developing countries. Nor is this just the result of higher commodity prices or other supply shortages. As Jason Furman of Harvard’s Kennedy School insists, this inflation is “demand-driven and persistent”. As in the 1970s, strong demand could sustain a wage-price spiral, as workers seek to maintain real incomes. The Fund argues, against this, that oil is far less important than it used to be, labour markets have changed, and central banks are independent. All this is true. But the interplay between policy mistakes and supply shocks may still create stagflationary havoc.

It is not hard to imagine far worse outcomes than those suggested by the Fund in its baseline forecast, since this assumes that the war remains restricted to Ukraine, sanctions on Russia do not tighten further, a more lethal form of Covid does not arrive, the tightening of monetary policy is modest and there are no big financial crises. Any (indeed many) of these hopes could go awry.

A huge issue for human welfare, if not the world economy, is the probability of financial distress in emerging and developing countries, especially those also hit by higher commodity prices. As the Global Financial Stability Report points out, a quarter of issuers of hard currency debt already have liabilities trading at distressed levels. The west must now help crisis-hit emerging and developing countries far better than they have done in the fight against Covid.

The one upside of recent disasters is that absolute dictatorship is being discredited. The concentration of power in the hands of one fallible human being is high risk, at best, and catastrophic, at worst. The Putin regime is a ghastly reminder of what can happen within such a dispensation. But Xi Jinping’s attempt to eliminate a highly infectious and not particularly dangerous pathogen from his country is another sign of what unchecked power may bring. Democracy has not covered itself in glory, but its leaders can at least be removed.

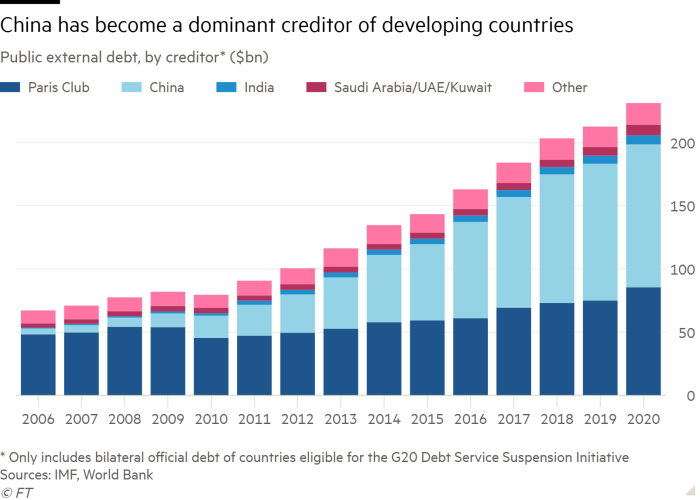

Yet, alas, we share the planet with these regimes and especially with that of China. Unlike Russia, China is a superpower, not just a declining power with bottomless resentment and thousands of nuclear warheads. At the very least, the west will need to co-operate with China over the management of developing country debt.

More fundamentally, we do need peace, prosperity and protection of the planet. These cannot be achieved without some degree of co-operation. The Bretton Woods institutions are themselves a monument to the attempt to achieve this. Twenty-five years ago, many hoped we were on the road toward what humanity needed. Now alas, we are again on a downhill path to a world of division, disruption and danger.

If no further shocks arrive, the present disruptions should be overcome. But we have been reminded that huge shocks are possible and are also almost always negative. Russia must be resisted. But if we cannot sustain minimal levels of co-operation, the world we will end up sharing is unlikely to be a world we want to live in.

[ad_2]

Source link