[ad_1]

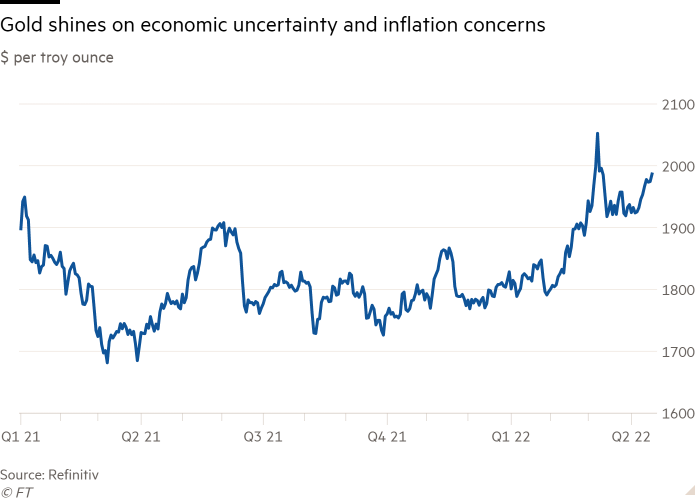

Gold prices climbed and US stocks slipped on Monday as worries over a weakening global economy were heightened by signs that coronavirus lockdowns had clouded the outlook for growth in China.

The yellow metal, which typically advances during periods of uncertainty, rose about 0.8 per cent to $1,989 a troy ounce, reaching its highest level in more than a month.

US stocks dipped on Monday, with the blue-chip S&P 500 index down 0.3 per cent in afternoon action, while the Nasdaq Composite shed 0.6 per cent in thin trading as markets reopened from the long weekend. Trading volumes in stocks in the S&P 500 were about 20 per cent below recent averages, according to Bloomberg data.

A broad MSCI index of equities markets in the Asia-Pacific region dropped 1.1 per cent, its second consecutive day of declines. Big European markets were closed for the Easter Monday holiday.

In government bond markets, the yield on the 10-year Treasury gained 0.06 percentage points to 2.87 per cent. Yields move inversely to price.

The cautious start to the trading week followed China’s release of a flurry of economic data. Gross domestic product rose 4.8 per cent in the first three months of 2022 compared with the same period in 2021, exceeding market expectations.

But economic activity data for March revealed how Beijing’s zero-Covid policy, including the lockdown of Shanghai, has eroded the growth outlook of the world’s second-biggest economy. Retail sales declined 3.5 per cent in March from the same month in 2021, the first year-on-year fall since July 2020; the annual rate of increase in industrial production slowed; and indicators tracking China’s struggling property market further deteriorated.

“While the March data shows notable slowing in growth momentum, with the escalation in zero-Covid policy and broadening disruption on economic activity, the drag on economic activity will likely be larger in April compared to March,” JPMorgan analysts said.

JPMorgan reduced its forecast for China’s GDP growth in 2022 from 4.9 per cent to 4.6 per cent. Barclays also trimmed its estimate for 2022 growth from 4.5 per cent to 4.3 per cent.

The latest bout of concerns over China added to investor uneasiness over global central banks’ plans to tighten monetary policy in an attempt to rein in raging inflation. Indeed, US natural gas prices rallied 10 per cent to $8.03 per metric million British thermal unit on Monday — the highest level since 2008.

Investors will closely watch speeches from Federal Reserve officials, including chair Jay Powell, this week that may give further guidance on how aggressively policymakers will raise interest rates this year.

Jan Hatzius, chief economist at Goldman Sachs, said at the weekend that the central bank faced a “hard path to a soft landing” as it attempted to push the inflation rate down to its 2 per cent target, from 8.5 per cent, by sharply boosting borrowing costs and reducing the size of its $9tn balance sheet.

Hatzius sees a 15 per cent chance that the US will fall into recession in the next year and 35 per cent that it will do so in the next 24 months.

Investors also digested the latest batch of corporate results. Bank of America on Monday reported better than expected earnings fuelled by a lending rebound and higher interest rates.

First-quarter earnings season in the US started on a decent footing, with companies in the S&P 500 so far reporting earnings 7.5 per cent higher than estimates, according to FactSet.

However, less than a tenth of companies on the blue-chip index have updated the market so far, and investors will have a better picture of the overall outlook by the end of this week, when a further 67 constituents including Netflix, IBM and American Express will have reported results.

[ad_2]

Source link