[ad_1]

Rough weather ahead. That was the message from Rishi Sunak’s Spring Statement this week.

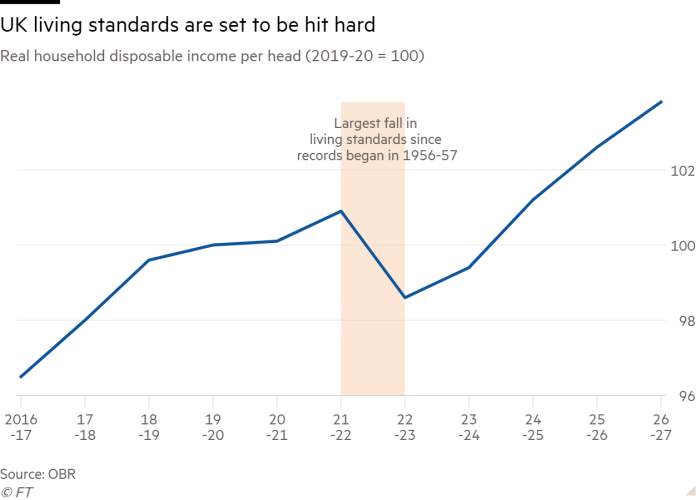

While the chancellor highlighted the support he was giving to many hard-pressed households, the reality is that most people will suffer a financial battering in the coming years as the UK suffers the toughest squeeze since the aftermath of the second world war. As the Office for Budget Responsibility, the official watchdog, says, after-tax household disposable incomes in the 2022-23 financial year will see “the largest fall in a single year since records began in 1956-57”.

FT Money looks at how householders and savers will be affected by the chancellor’s fiscal measures, including the headline increase in national insurance thresholds, and the bleak outlook the UK faces. As Sunak said himself the day after he presented his statement to parliament, “I acknowledge there are uncertain times ahead.”

The economy is still expected to grow modestly despite the impact of the Ukraine war, the after-effects of the pandemic, Brexit and surging inflation, especially in energy and food. The OBR forecasts a 3.8 per cent rise in the 2022 calendar year — down from an earlier 6 per cent prediction — and growth of just 1.8 per cent next year as the post-Covid recovery peters out.

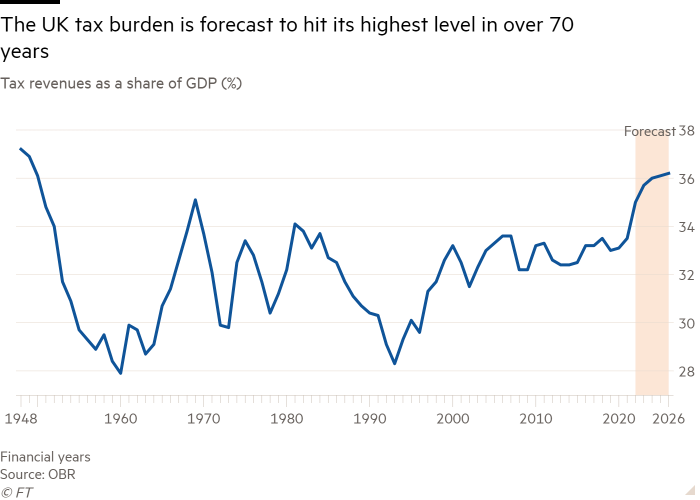

But the hit to our pockets will be as big as in the worst recessions, as HM Revenue & Customs grabs a bigger share of our collective economic output than at any time in more than 70 years.

The pain is unevenly spread. The main beneficiaries of Sunak’s tax changes are lower-paid earners, with somebody on the minimum wage — around £16,500 a year — gaining £140. But those on the median wage of £27,500 a year will lose by £360 and those on £40,000 by £800, according to the Institute for Fiscal Studies (IFS), a think-tank.

Much worse, in the view of the chancellor’s critics, those not in work, including the poorest, will gain very little. They will receive nothing from the £3,000 increase in the threshold for national insurance, Sunak’s top giveaway, as this is paid only by those in work. So pensioners and people on benefits, who struggle to pay escalating energy and food bills, miss out. Those who don’t have cars won’t gain from the 5p cut in fuel duty either.

Spare a thought too for young people who have recently graduated or plan to do so in the next few years. Spring Statement documents show this year’s increases in student loan repayments could raise £11bn in 2022-23. That is nearly double the £6bn he is handing out by lifting national insurance thresholds.

The chancellor is giving back only about a quarter of the tax increases he announced last year, aimed at dealing with Covid and financing the NHS. Paul Johnson, IFS director, says: “He continues, despite his rhetoric, to be a chancellor presiding over a very big increase in the tax burden. What he did was not enough even to stop the expected tax burden rising yet further.”

If there is a glimmer of light at the end of the tunnel, it is Sunak’s promise that some of the money could be returned to taxpayers via a penny cut in the basic income tax rate, in 2024-25, just before the likely date of the next general election.

But that’s a long way off. In the meantime, inflation-fuelled increases in tax revenues mean he has an extra £50bn unspent in 2021-22. Perhaps enough to provide extra relief to households later this year, if home budgets are punished even harder than expected.

Inflation makes tax thresholds bite

Soaring inflation, which economists say could reach 10 per cent this year, coupled with previously announced tax rises, damps the effect of this week’s giveaways.

Sunak last year froze the thresholds at which basic and higher rate taxpayers pay income tax between April 2022 to April 2026, rather than planning to increase them in line with inflation as usually happened in the past.

With annual inflation hitting a 30-year high of 6.2 per cent in February and rising, the extra tax collected from the freezing of the thresholds will far outweigh the cut in income tax, according to the OBR’s analysis. As a result, many more people than first anticipated in March 2021, when the chancellor announced the move, will be drawn into paying income tax in the first place — or paying a higher rate.

The OBR predicted there would be 36.1mn basic rate income taxpayers in 2025-26, up from the 33.4mn it previously estimated in March 2021, a rise of 8.3 per cent. It forecast the number of higher-rate taxpayers would also increase to 6.8mn, compared with its previous estimate of 4.8mn — 42 per cent higher than would otherwise have been the case.

Meanwhile, the chancellor announced that from July, he would boost the national insurance threshold at which people start paying national insurance contributions (NICs) from £9,880 to £12,570 — the same level at which income tax starts being levied. This will mean people will pay no tax or NICs on annual earnings below £12,570. Sunak said the move would help around 30mn working people, with a typical employee saving over £330 in the year from July.

However, the measure needs to be weighed against Sunak’s decision to press ahead with plans to raise the NICs rate in April by 1.25 percentage points to finance health and social care.

Amanda Tickel, head of tax at Deloitte, says the rise in the NICs threshold was the most expensive measure the chancellor announced on Wednesday. The measure is forecast to cost £25.9bn between 2022 and 2027. But this pales in comparison with the £86.6bn expected to be raised by the higher NICs rate over the same period.

Still, the lowest earners will receive some respite from the decision to increase the threshold. The IFS found that in 2022-23 anyone earning between around £10,000 (the current NICs threshold) and £25,000 would pay less tax on their earnings.

But those earning more than £25,000 would pay more, due to the combined effect of freezing income tax thresholds and increasing the NICs rate. The IFS adds that by 2025-26, “virtually all workers” will be paying more tax on their earnings than they would have paid without Sunak’s changes to rates and thresholds.

“Essentially for every £4 the chancellor took off taxpayers last year, he’s saying we can have £1 back,” says Laith Khalaf, head of investment analysis at AJ Bell, citing OBR data. “Looking at the combined effect of personal tax changes announced since last year, taxpayers are still considerably out of pocket.”

The chancellor is likely to have more tax measures planned for the autumn. A “tax plan” document released by the Treasury alongside the Spring Statement revealed a commitment to reviewing more than 1,000 existing tax reliefs and allowances.

Tax advisers said reliefs on capital gains tax, inheritance tax and pensions tax were areas the government might probe. Andrew Barr, wealth planner at Succession Wealth, says: “Sunak is boxed in and is signalling his intentions now with the Budget and 2024 election on the horizon. Tax reform feels like it’s being lined up for the next Budget.”

If nothing else, squeezing a bit more money out of these taxes would help pay for that promised basic income tax reduction.

Pensioners under pressure

The cost-of-living crisis is expected to generate a £1.7bn tax haul for the Treasury as more over-55s dip into their pensions to keep their finances afloat.

As rising fuel and energy prices continue to squeeze household incomes, the OBR forecast tax receipts from over-55s accessing defined contribution pensions, which are subject to income tax, to be £400mn higher in 2021-22 than the previous year.

The OBR says the significant revision of the tax take from people making the most of so-called “pension freedoms” is a result of greater numbers of older workers turning to their pensions to ease financial strains of the pandemic and cost-of-living crisis.

The pension reforms of 2014 gave people with defined contribution pensions the flexibility to withdraw their funds from the age of 55, subject to tax paid at their marginal rate.

More over-50s have brought forward their retirement plans in the pandemic and gained early access to their pension pots, the OBR says. “The first three quarters of 2021-22 show that withdrawals are once again on course to outstrip expectations and are up almost a fifth on the same period in 2020-21”, it says.

It also revises up its expected tax take from pension dippers by £800mn a year from 2022-2023, “as we assume that people will make use of earlier withdrawals to manage the rise in the cost of living this year, and that the steady state level of withdrawals will be higher than we had previously assumed”.

Andrew Tully, technical director at Canada Life, a pension provider, says the OBR was setting the expectation that the cost of living crisis would be with us for “years to come” as people look to their pensions as a bank account.

“This is understandable behaviour as people look to make ends meet but we need to remember that pensions are already likely to be stretched over a longer lifespan than previous generations and any withdrawals will need to be sustainable over this period,” he says.

Pensioners received little in the way of good news from the chancellor, with no improvement on the 3.1 per cent increase in the state pension from next month — half the current rate of inflation. “Inevitably, there will be a rise in pensioner poverty,” says Baroness Altmann, a former pensions minister.

Investment outlook subdued

Sunak had few surprises for investors. Money managers took Wednesday’s updated economic forecasts with a grain of salt, given that the full power of the economic shockwaves from Russia’s invasion of Ukraine have yet to be measured.

“The reduction in growth forecasts and inflation predictions are probably not that reliable for this year given the uncertainty abounding, but the direction of both is clear; growth is going lower and inflation is going higher,” says Neil Birrell, chief investment officer at Premier Miton Investors.

For many strategists, the statement also underscored the dilemma for the government and the Bank of England between the need to support growth and household finances and the imperative not to drive inflation any higher. “A big fiscal giveaway would throw fuel on inflationary fire,” says Guy Foster, chief strategist at wealth manager Brewin Dolphin.

The City’s focus remains on Threadneedle Street rather than Westminster. William Hobbs, chief investment officer for Barclays Investment Solutions, says: “The big story of the day is still the tightrope that central banks have to walk, that is getting a lot more wobbly because of the stagflationary shock that the war in Ukraine is going to deal to the UK and European economy.”

But despite the clouded outlook, Hobbs urged savers to “stay as calm as possible” and not fixate on short term market movements. “The worst thing that happens for individual investors at a time like this is that their time horizons shift,” he says.

Spring Statement coverage

Gold and commodities offer the most obvious haven for investors seeking relief from the turbulence, but the prices of these assets have already shot up. The environment should also favour inflation-linked bonds, according to Hobbs.

For stock pickers, Brewin Dolphin singled out companies that hold real assets such as property or infrastructure, as well as companies with strong brands, such as luxury group LVMH, whose customers are better able to absorb higher prices.

“For companies, it depends on how good they are at passing on . . . price increases,” says Anna MacDonald, fund manager at Amati Global Investors.

MacDonald says the chancellor’s decision to steer clear of a windfall tax on energy companies will have come as a relief to many investors. Energy majors, including BP and Shell, are key dividend payers that feature prominently in many income-focused strategies. She says: “It would not have been helpful for people’s portfolios.”

The chancellor’s signals about his priorities for the autumn Budget also received a positive review from some investors, as Sunak plots a revamp of corporate taxation and R&D programmes, with an eye to boosting productivity. Claire Madden, managing partner of Connection Capital, welcomed Sunak’s “sentiment of recognising just how powerful the private sector is in terms of fuelling growth and filling up the coffers of the Treasury”.

Mortgage rates rising

The chancellor left the housing market largely untouched but the worries over rising inflation, which he echoed, are causing banks and building societies to raise the costs of mortgages for homeowners and buyers.

Anyone who secured an attractive long-term fixed-rate deal in 2020 or last year, when the Bank of England base rate fell to a historic low of 0.1 per cent, has little to fear in the short term.

But those remortgaging, taking out a new mortgage or raising more money will face higher costs as lenders push up their rates.

Swap rates, which banks use to guide their pricing of home loans, have been rising in recent days, pointing to hardening expectations that more Bank of England rate rises are on the way.

This week, lenders including Halifax, Lloyds, Barclays, HSBC and Santander put up their tracker or variable rates by 0.25 percentage points, according to data from finance website Moneyfacts. Virgin Money raised rates on some of its fixed-rate mortgages by 0.3 percentage points, while Coventry Building Society and NatWest lifted rates by 0.3 points.

Aaron Strutt, product director at broker Trinity Financial, says banks’ funding costs are on the rise. “Some lenders have told us their two-year fixed rates are lower than the cost of funding them,” he says. “There is an expectation that mortgages will get much more expensive sooner rather than later and we are already getting used to seeing more significant rises.”

Rates on shorter-term mortgages have risen faster than long-term deals, leading to an unusual situation where the rates on two and five-year fixes are almost the same. Strutt points to Santander charging 2.04 per cent for its two and five-year fixes.

Greener homes

One concrete measure affecting households in the chancellor’s statement was on greening our homes. Householders looking to improve the energy efficiency of their homes by installing solar panels, heat pumps or insulation will see their costs fall by 5 per cent after Sunak scrapped VAT on these works from April. Wind and water turbines will also be added to the list of “energy saving materials” benefiting from the relief.

The government said it would translate into savings of £1,000 on the installation of rooftop solar panels for the “typical family”, with another £300 in annual savings expected on energy bills. Its costs to the Exchequer are modest, however, at around £60mn a year.

Scott Clay, a director at specialist lender Together, says the VAT cut is a step in the right direction. However, he adds, the overall costs of installation of eco-materials remain very high. “Families and property investors alike will need to find this finance from elsewhere.”

Reporting by Emma Agyemang, Josephine Cumbo, Joshua Oliver, James Pickford and Stefan Wagstyl

[ad_2]

Source link