[ad_1]

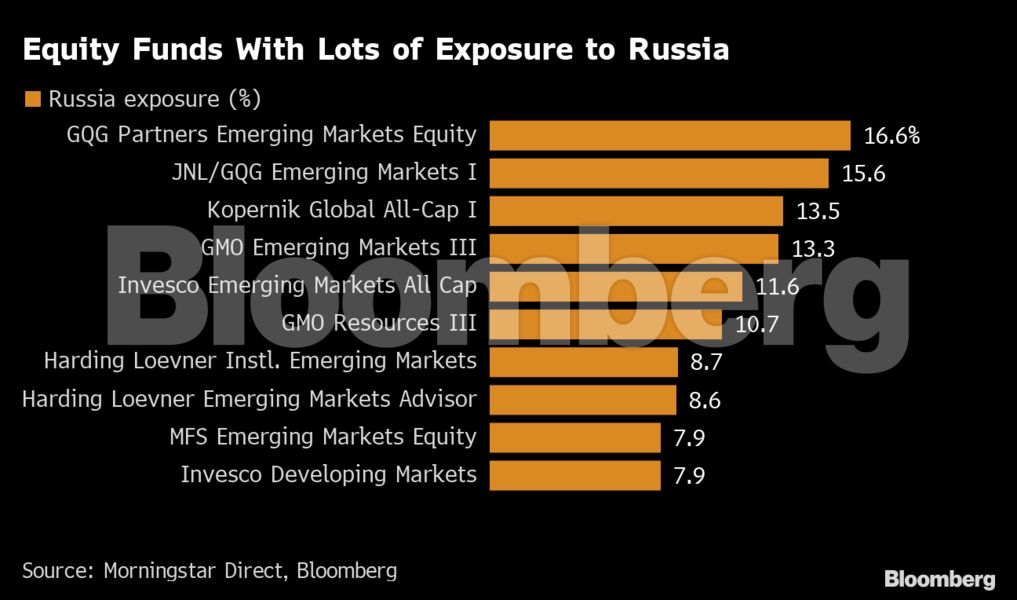

(Bloomberg) — They may not have Russia in their name, but a number of popular mutual funds have significant exposure to the country, with one nearing 17% of assets.

The U.S.-based equity mutual fund with the highest exposure to Russia in percentage terms is the $8.8 billion GQG Partners Emerging Markets Equity Fund, which had 16.6% of assets, or about $1.5 billion in U.S. dollar terms, exposed to Russian securities at the end of September, according to data provided by Morningstar Direct. Sberbank of Russia PJSC is among the fund’s top 10 holdings.

The GQG fund has fallen 2.5% over the past month, and is down 4.4% for the year. One of the funds on the list is in the green, however — the $1.9 billion GMO Resources II fund. That fund, which is heavy in the oil and gas and mining sectors, is up 3.4% for the past month and has a 4% gain for the year. Gazprom PJSC was the fund’s eighth-largest holding as of Nov. 30, 2021, at 2.4%.

One of the funds with significant exposure to Russian securities is among the top 100 largest funds in 401(k)s, according to a list provided by data firm BrightScope Inc. That’s the $45 billion Invesco Developing Markets, which had 7.9% of assets exposed to Russia as of Dec. 31, 2021, or about $3.4 billion in U.S. dollar terms.

To contact the author of this story:

Suzanne Woolley in New York at [email protected]

[ad_2]

Source link