[ad_1]

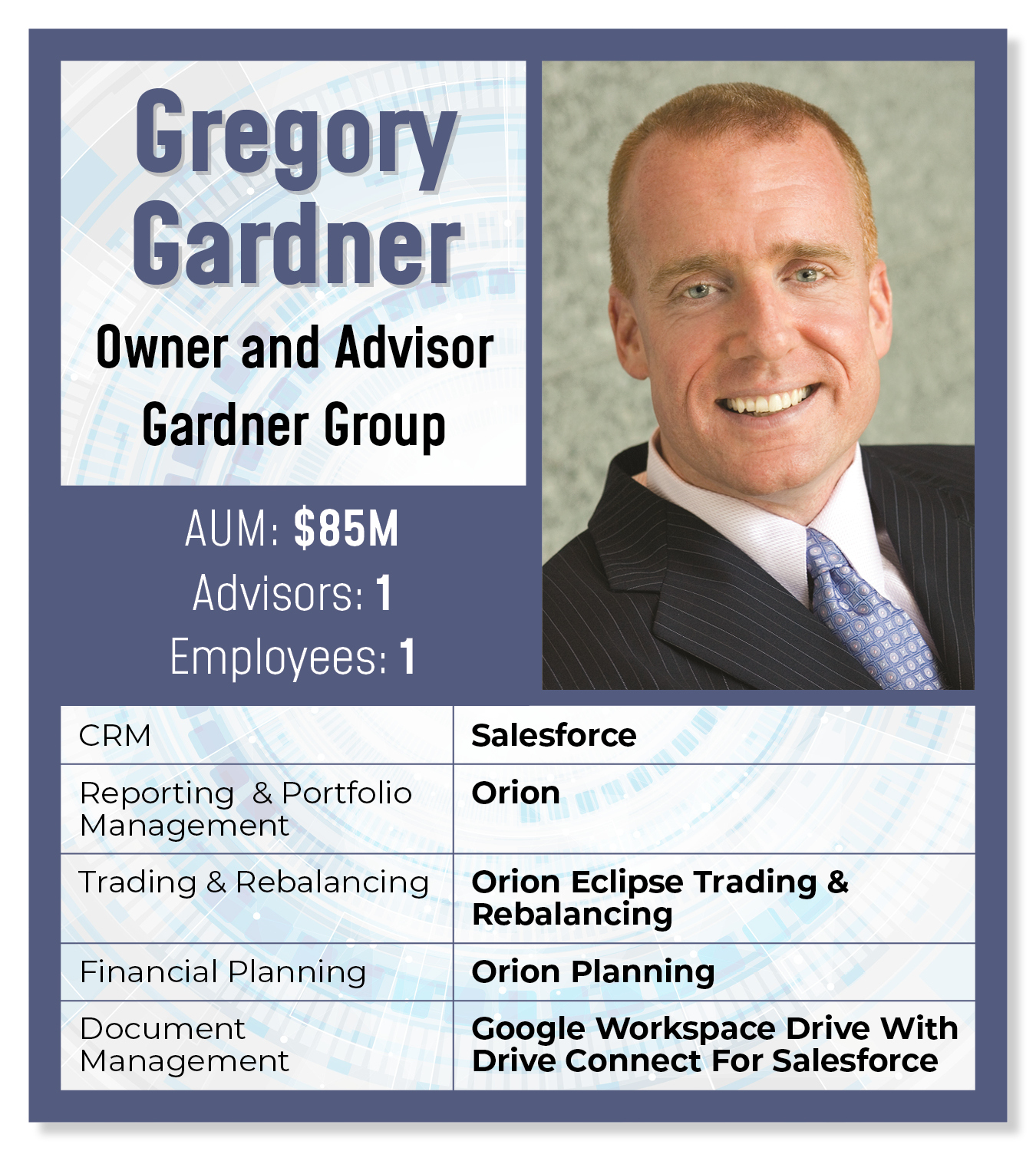

CRM: Salesforce

It’s been a 10- and 15-year journey [in terms of CRM use]. We had Junxure, which was a wonderful product. But they were struggling on how to get to the cloud [about 11 years ago, prior to the acquisition of Junxure by AdvisorEngine].

So, I made the transition to Salesforce, which was great. As a business owner, every decision going forward was going to be whether to integrate it with Salesforce or not. That meant making a conscious decision to fire a couple of vendors whose products we liked, but who weren’t integrated [with Salesforce and that had no plans to do so]. That’s been our mantra as we look at the competition, as we look at how to better run a business: If it doesn’t work with Salesforce, we don’t look at integrating it.

It’s not my goal to run my office from my phone. But I want to be able to answer a question from my phone. And I can pretty much do that now with the way we’ve got everything integrated, automated and cloud-based. The thought of me being in the server business again is about as unattractive as it gets [Junxure, which originally launched in 1995 went through several iterations where it often was run on an advisory firm’s own local servers]. I cannot fathom any financial, automation or efficiency benefit I would ever see by going into that business again.

We now have Salesforce running the show. It is our source of truth. Everything starts with Salesforce. For every possible integration we can, we want it to be able to talk to Salesforce in one form or another. And that allows us to use Salesforce’s platform to automate things.

We now have Salesforce running the show. It is our source of truth. Everything starts with Salesforce. For every possible integration we can, we want it to be able to talk to Salesforce in one form or another. And that allows us to use Salesforce’s platform to automate things.

My technology bill is probably bigger than some firms. If you look at my subscriptions and some programming fees, I think last year it was about $75,000 in total technology expenses. You can’t find a good employee for $75,000.

We try to automate step by step. I think our most complex [work]flow is probably 10 to 12 steps in maybe six months. That’s for a new client. We want to onboard them as efficiently, but at the highest level of service possible. And technology is allowing us to do that.

From a pure technology standpoint, there are some things I would change. But I don’t know how to explain to Salesforce or in the context of financial planning. From an automation standpoint, it’s, “Why can’t I do this? You’ve got to do an extra step.” Technology is kind of like a foreign language to me. I can read it and understand what’s going on. But I can’t write it. If you took me down to Cancun and told me to order off a menu, I know what I’m getting. But I can’t speak Spanish, I can’t write it.

Portfolio Management/Reporting/Trading & Rebalancing/Financial Planning/Trading: Orion

We’re able to pick up even more automation with Orion Planning. It puts it in the CRM. It loads the data quickly, with good aggregation.

With Orion Eclipse [Trading & Rebalancing] their trading platform that has saved us hundreds of hours a year of labor. We’ve been pleased with that. They also feed into Salesforce.

We have viewed Orion’s Redtail CRM as a very good product, but we want our CRM to run a business, not our CRM to run a financial planning practice. The advantage we’re seeing is we’re getting more integration, more automation with our phone system, with our accounting systems, with running a business than if we were using Redtail. I’ve never heard anything bad about Redtail. It’s very, very good for financial planning. I wanted to view it as we’re running a business. Maybe it could be argued we’re running a technology company and the byproduct is financial planning.

Document Management: Google Workspace Drive and Drive Connect

After trying three to four different bulky, and costly, systems, we now use Google Workspace Drive and integrate into Salesforce with Drive Connect [a Salesforce AppExchange application developed by Appiphony for integrating and building out workflows between the two]. It does a good job of automation, etc. within Salesforce. It creates our folder template hierarchy and creates and merges some documents like our client agreements, for example.

After trying three to four different bulky, and costly, systems, we now use Google Workspace Drive and integrate into Salesforce with Drive Connect [a Salesforce AppExchange application developed by Appiphony for integrating and building out workflows between the two]. It does a good job of automation, etc. within Salesforce. It creates our folder template hierarchy and creates and merges some documents like our client agreements, for example.

[Editor’s note: It should be noted that this is not an off-the-shelf product created for financial advisors. While the most tech-savvy advisors could set up an SEC-compliant, comparably low-cost document management and archival system combining the two, most advisors will require the services of a consultant for setup and ongoing maintenance of this solution.]

Communications: Twilio

I have third-party consultants who do all our upgrades for me, and the last project was redoing our Twilio phone system. The goal is to have a person talk to the client. If I’m not available, we’re adding in some more automation, so the client knows I’m in a meeting. Then voicemail gets sent straight to me in an email but also creates the task in Salesforce. All our phone calls are now getting captured by Salesforce. There’s a little bit of compliance. There’s a little bit of CYA. But mostly it’s automation and delivering a better, higher experience for the client.

[Editor’s note: For advisors unfamiliar with Twilio, it is an API-based digital communications service, often associated with the management, integration and automation of phone and texting services. While it has hundreds of thousands of users from startups to large enterprise companies, and with the vast majority using it for legitimate purposes, the company has also taken some flak for conveying large volumes of spam on behalf of its customers/clients (the FCC sent the company a robocall cease and desist letter in January). Twilio also suffered a significant breach in 2022, whereby attackers instigated a series of phishing campaigns through the service].

As told to reporter Rob Burgess and edited for length and clarity. The views and opinions are not representative of the views of WealthManagement.com.

Want to tell us what’s in your wealthstack? Contact Rob Burgess at [email protected].

[ad_2]

Source link