[ad_1]

Receive free Cryptocurrencies updates

We’ll send you a myFT Daily Digest email rounding up the latest Cryptocurrencies news every morning.

Hello and welcome to the latest edition of the FT’s Cryptofinance newsletter. This week, we’re taking a look at venture capital stepping into crypto.

Venture capital can be fickle and chase trends as voraciously as any social media influencer but it is not done with crypto yet.

Its role in the bubble of 2020-22 is undeniable: ultra-low interest rates to stimulate the global economy after the pandemic generated free money that was directed into speculation, and few assets offered as much promise as crypto.

Rising coin prices were parlayed into more ventures to support valuations and the bubble inflated. The spectacular market crash coupled with rising interest rates meant the only thing that dried up faster than crypto’s unfulfilled promises were the waves of new money coming in for the industry to build and experiment with.

Last year investors poured roughly $30bn worth of capital into crypto projects both in 2021 and in 2022, according to numbers from capital markets data provider PitchBook.

In contrast, the value of crypto deals in 2023 add up to roughly $7bn and is currently on track to touch about $10bn for the year, a near 70 per cent decline from last year.

The money now is no longer going into projects such as non-fungible tokens (remember them?) or decentralised finance. Instead, PitchBook says, it is being channelled into projects in search of real-world uses for blockchain technology. And with that has come a more circumspect approach — both to what companies are doing and with whom they are doing it.

“Everyone has been humbled in crypto, and what was really required was to come in a little sceptical, rather than trying to do too much too quickly,” said Alex Felix, chief investment officer at CoinFund, a crypto-focused investment group based in New York. CoinFund, one of the industry’s oldest and most established crypto-focused investment firms, raised more than $150mn earlier this summer.

One of the big focuses now is the tokenisation of assets — reproducing securities as a token on a blockchain. Shifting legal assets on to digital ledger, in theory, means trading could be done round the clock, instead of only during working hours and days.

It could also encourage more liquidity in otherwise hard-to-shift assets and bypass intermediaries that charge fees for their services, such as brokers or securities depositories. No less than Larry Fink, chief executive of BlackRock and past bitcoin critic, calls tokenisation the “next generation in markets”.

PitchBook estimates that a total of 44 deals aimed at infrastructure and developer tools has risen to a cumulative $540mn year to date.

“If you’re an investor and you’re looking at a start-up building infrastructure, it’s easier to understand who they’re selling to, what their business model looks like, and what their revenues can be,” said Robert Le, crypto analyst at PitchBook.

Trident Digital Group this week announced it had secured $8mn in seed funding to try to reinvigorate the dead crypto lending market, with better and more sophisticated risk management.

It talked about lending yields tied to so-called risk-free rates and full backing of assets with US Treasuries. It bears some resemblance to a reverse repo transaction — and are concepts that investors readily understand. It’s certainly easier than “algorithmic stablecoin”.

The parties it will work with are “top tier” digital assets exchanges. A person familiar with the fundraising said potential lenders do not want exposure to Binance, which has been charged with multiple federal law violations by the US markets regulators.

“If you believe there is a use case for tokenisation and blockchain technology, then there will continue to be people who invest in this stuff,” said one crypto-focused investor. “If it doesn’t die, then there’s value in it. The ecosystem didn’t die, it just took a very big punch to the face.”

It’s a little odd to hear a venture capitalist sound like a value investor but there might be method to it. Every VC needs an exit plan.

Blue-chip market operators are devoting more energy to this space. Last week the London Stock Exchange Group said there was enough interest from the market that it was drawing up plans for an “end-to-end” blockchain-based service covering everything from issuance and trading to reconciliation and settlement. But it is likely the group will need to buy the right technology rather than build it in-house.

Even so, some VCs still see hope in the promises of two years ago. Brine Fi yesterday announced a $16.5mn funding round led by notable names such as Pantera Capital and Elevation Capital. It is focused on DeFi, a form of crypto trading without a centralised authority.

But Brine Fi and its investors are running firmly against the grain. According to PitchBook data, in the first half of this year only 25 deals worth $149mn were dedicated to the decentralised finance sector.

“I’ve spoken to a couple of VCs who do not think the regulatory environment in the US is going to be a risk for decentralised finance, and that [the sector] is untouchable for regulators . . . I don’t think that’s true,” said PitchBook’s Le.

What’s your take on the crypto investment scene? As always, email me your thoughts at scott.chipolina@ft.com.

Weekly highlights

-

The International Organization of Securities Commissions this week issued nine policy recommendations to address market integrity and investor protection concerns in the decentralised finance sector. The recommendations cover six areas, including understanding structures in DeFi as well as enforcement of applicable laws, and follow Iosco’s call earlier this year on global regulators to be faster and bolder on crypto markets.

-

Weeks before Sam Bankman-Fried’s much-anticipated trial, another former FTX executive has pleaded guilty to criminal charges. Ryan Salame, who co-led FTX’s Bahamian unit FTX Digital Markets, has become the fourth former FTX executive to make such a plea, likely bolstering the prosecution’s case against the former crypto kingpin.

Soundbite of the week: Grayscale is running out of patience

Grayscale is feeling bullish after a US court ruled last month that the Securities and Exchange Commission was wrong to reject the company’s application to convert its flagship product into a bitcoin-backed exchange traded fund.

It means the SEC has to go away and rethink the justifications for its denial. The judge favoured Grayscale because the regulator had allowed bitcoin ETFs that track futures on bitcoin. This week Grayscale’s lawyers Davis Polk sent a letter to the regulator that did its best to stuff its amusement into legalese.

“If any other reason could be offered in attempting to differentiate spot bitcoin ETPs from bitcoin futures ETFs . . . we are confident that it would have surfaced by now in one of the fifteen Commission orders that rejected spot bitcoin filings even after bitcoin futures ETPs began trading.”

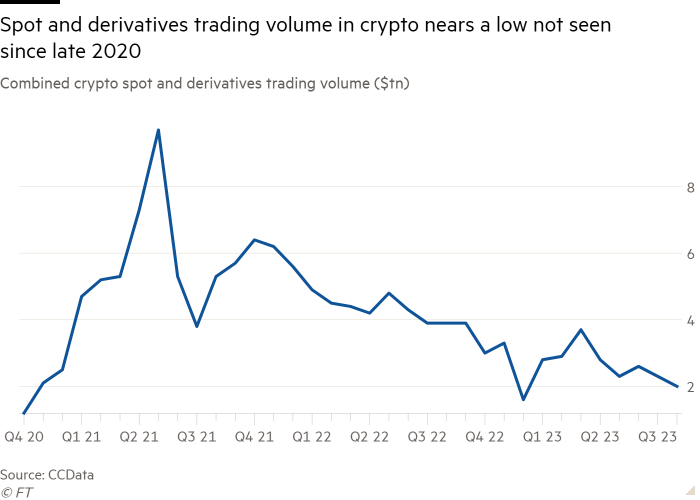

Data mining: Another milestone crypto lull

The combined spot and derivatives volumes in crypto reached the lowest level this year in August. The aggregated trading volume for both markets on centralised exchanges fell more than 11 per cent last month to just over $2tn, according to numbers provided by CCData.

Not only is this the lowest combined monthly trading volume in 2023, it is also the second-lowest combined volume on centralised exchanges since October 2020.

FT Cryptofinance is edited by Philip Stafford. Please send any thoughts and feedback to cryptofinance@ft.com.

[ad_2]

Source link