[ad_1]

Latest news on ETFs

Visit our ETF Hub to find out more and to explore our in-depth data and comparison tools

India and artificial intelligence fuelled demand for exchange traded funds in July, even as Europe fell out of favour.

The flows data suggest investors appear to be focusing on what are widely perceived to be two long-term engines of the global economy: AI is seen by many as a breakthrough technology destined to percolate across sectors, while India is hotly tipped to take the baton from China as the world’s fastest-growing large economy in the decades to come.

“India is becoming a more sizeable growth engine for emerging markets,” said Karim Chedid, head of investment strategy for BlackRock’s iShares arm in the Europe, Middle East and Africa region.

“There is also the demographic angle. It’s one of the few countries in the world where the demographics are very favourable. They have a large and growing workforce and consumer base,” Chedid added, with India’s population having this year overtaken China as the world’s largest.

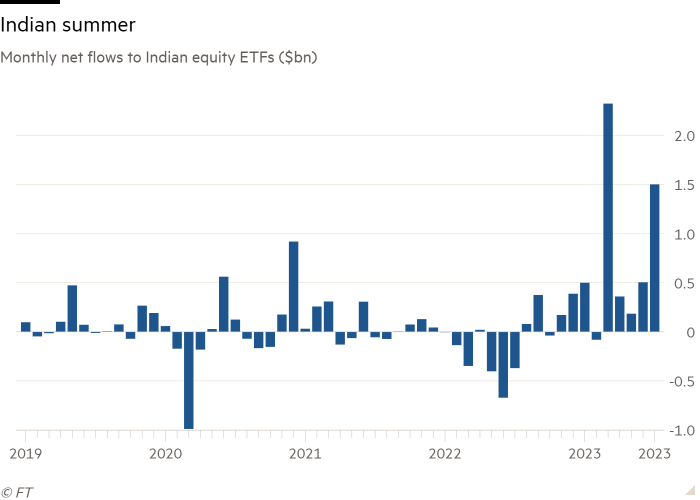

Indian equity ETFs took in a net $1.5bn in July, according to BlackRock’s data, the second-highest monthly figure for India on record, beaten only by the $2.3bn witnessed in March of this year.

In contrast with March, however, the bulk of the buying this time came from foreign investors, with US-listed Indian equity ETFs accounting for 80 per cent of the money. Emea-based investors were responsible for the bulk of the remainder, with flows into Emea-listed Indian equity ETFs now having been positive for nine straight months, BlackRock’s data shows.

Aside from the longer-term story, Chedid believed enthusiasm for India may also be being driven by the pullback in oil prices from last year’s highs, given that it is a large net energy importer.

AI is even more the rage, powering $5bn of monthly inflows into technology ETFs. This took the year-to-date tally to $20.8bn as demand for tech funds, which had started to plateau, has reaccelerated since the start of May.

“We have seen more focus on AI and the tech mega caps,” said Chedid, who believed the zeal for AI has been strong enough to help propel a broader switch in ETF investors’ appetite from the old world to the new.

“The US indices tend to be more weighted towards AI and tech than European indices so I think that has probably driven some of that change in focus,” he said.

Matthew Bartolini, head of SPDR Americas research at State Street Global Advisors, said the AI buying spree had been potent enough to reverse waning enthusiasm for “thematics” ETFs, in the US at least.

“Fuelled by funds focused on AI, thematic ETFs have witnessed a bit of a renaissance posting back-to-back months of inflows,” he said. “Thematics now have net inflows on the year. However, more than 100 per cent of those flows are driven by the robotics and AI sectors, and only five of the 13 sectors have inflows on the year.”

Chedid noted a degree of caution, though: Given that this year’s US stock market rally has been powered by a handful of tech giants, he said investors were increasingly favouring equal-weighted funds that limit exposure to these behemoths. BlackRock’s house view runs counter to this caution, however.

“We do like the AI theme, even the stocks where growth has been concentrated,” Chedid added. “Their value doesn’t look stretched because their earnings growth has been strong. Their fundamentals are OK.”

Overall, global net ETF inflows hit $88.1bn in July, down from $99.1bn in June. The dip was driven by weaker flows to equity ETFs, from $76.9bn to $59.7bn, although this was still the second-highest reading this year.

US equity funds took the lion’s share, $38.6bn, with non-European investors starting “to meaningfully sell European equity ETFs over the summer”, Chedid said.

“US equity flows have picked up compared to earlier in the year. It was international [ie non-US] equities that were holding up before. Now it’s more US equities holding that up,” he added.

Scott Chronert, global head of ETF research at Citigroup, said this demand for US stocks appeared to be largely homegrown, with US equity ETF flows “minimal outside of the US”.

Chedid expected this to change, however, with the economic backdrop in the US more propitious.

“The macro picture in Europe has been deteriorating. [Purchasing managers’ index] releases have shown a significant deceleration. Services have started to level off, manufacturing remains very weak and core [inflation] surprised on the upside in the eurozone. That may be why we are seeing some sluggish flows in Europe,” he said.

At the sector level, financials ($2.4bn) and energy ($1.2bn) both saw positive flows in July. Chedid said this made sense, with these sectors being buoyed by expanding net interest margins and a bottoming in oil prices, respectively. This was the first positive month for energy ETFs since November, with $12.2bn being excised in the interim.

What may be more noteworthy, however, was buying in other cyclical sectors such as industrials and materials, which each vacuumed up $1.6bn.

Bartolini noted that cyclical sector ETFs listed in the US took in almost $8bn in July, while defensives had outflows.

“Cyclicals have now outpaced defensives for two consecutive months. This is the first time that has occurred since the start of 2022, further illustrating how investors have been more willing to express risk recently,” he said.

Chedid was unconvinced of the merits of such buying, however.

“When we are still in a downturn it is unusual to get inflows to cyclicals. They tend to do well in the early cycle. These are soft landing flows. That’s not our view. We firmly believe we are heading for a recession [in the US] in the second half of the year.”

[ad_2]

Source link