[ad_1]

This article is an on-site version of our Disrupted Times newsletter. Sign up here to get the newsletter sent straight to your inbox three times a week

Today’s top stories

For up-to-the-minute news updates, visit our live blog

Good evening.

The UK economy performed slightly better than expected in the first half of the year and grew a little in the latest quarter, but the news looks unlikely to change the current miserly outlook for growth.

Gross domestic product was 0.2 per cent higher in the second quarter compared with the previous three months and 0.4 per cent higher than a year earlier, according to today’s data, but remains below pre-pandemic levels.

The latest figures were more positive than economists had expected. The Bank of England said last week that it no longer expected a recession but that the economy would remain near stagnation for the next two years.

Huw Pill, its chief economist, speaking the day after the BoE had raised interest rates to a fresh 15-year high of 5.25 per cent, said its programme of policy tightening was succeeding in getting inflation down, a point echoed this morning by Jeremy Hunt, the chancellor. Food prices look to be an exception: Pill warned on Monday they would still be rising much faster at the end of the year than overall inflation.

Consumer spending appeared to be more resilient than expected in the face of rate rises; the car industry helped lift manufacturing and warm weather gave a boost to the services sector. Industrial action had a smaller impact than in previous months although strikes by junior doctors are ongoing.

The pound rose in response to the data as investors increased their bets that the BoE had not yet finished its cycle of rate rises. Next week’s inflation and wage growth data will help determine its next move.

Some analysts think that the pick-up in growth could prove shortlived as much of the effect of higher interest rates has yet to feed through to households. James Smith, of the Resolution Foundation think-tank, said: “The big picture is that the UK economy has expanded by just 0.4 per cent since the start of 2022 — the weakest growth in 65 years outside of a full-blown recession.”

Zooming out from today’s data, the UK economy’s long-term problem is that it is too London-centric, argues chief data reporter John Burn-Murdoch. London is the only one of the 10 regions in England and Wales to have grown in every quarter since the depths of the pandemic in 2020, while three others — including the South East — have dipped into regional recessions in the past 12 months.

Removing the capital’s output and headcount would shave 14 per cent off British living standards, he writes. To put this into an international context, the UK would be poorer than any single state in the US.

Need to know: UK and Europe economy

This week’s huge surge in European gas prices highlights how the region’s success in weaning itself off Russian energy has left it more vulnerable to volatile global markets. Australian producers of liquefied natural gas are in talks to avert a strike that threatens to disrupt LNG supplies and caused gas prices to jump almost 40 per cent on Wednesday.

Russia’s targeting of Ukrainian grain supplies and Ukraine’s drone strikes on Russian vessels have increased concerns about world food security. The UN said: “A single mis-step by either party will have disastrous consequences simply because there is no immediate substitute for all the grain exported by Russia and Ukraine from the Black Sea.”

Ukraine’s government bonds, however, have surged in price over the past two months as investors grow more optimistic about how much of their money they will get back when the country is eventually rebuilt.

French statistical authorities put paid to the theory that a 331-metre-long cruise ship was responsible for better than expected third-quarter GDP data.

Need to know: global economy

US inflation, as measured by the consumer price index, edged up from 3 per cent to 3.2 per cent in July, the slowest pace of growth since March 2021, bolstering the case for the Federal Reserve to keep interest rates steady at its next meeting in September. The core measure, stripping out volatile items such as food and energy, hit an annual 4.7 per cent, the lowest level since October 2021. However, US producer prices rose more than expected.

Fernando Villavicencio, a presidential candidate in Ecuador, was shot dead at a campaign event. The politician and former journalist had spoken out against organised crime and corruption. Six Colombians are being held in connection with the assassination.

India passed a controversial and long-delayed data protection bill to regulate the internet and sharing of online data. Civil liberties groups say it gives the government too many carve-outs, allowing it to access users’ information.

Need to know: business

The White House unveiled a ban on US investment in Chinese tech linked to military use — focusing on quantum computing, advanced chips and artificial intelligence. The EU said it would issue its own proposals by the end of the year, while the UK is considering whether to follow suit.

Ahead of the US announcement, Chinese internet giants Baidu, ByteDance, Tencent and Alibaba were rushing to buy high-performance Nvidia chips vital for building generative AI systems. Alibaba announced a return to strong sales growth, boosting its shares in New York, but its cloud unit could yet take a hit from the US controls.

China is attempting to dominate the trading of lithium carbonate, a mineral used in the manufacturing of electric vehicle batteries, by wresting benchmark contracts for minerals away from the west.

Beijing yesterday lifted pandemic-era restrictions on overseas travel, boosting tourism-related stocks in Japan and South Korea, the erstwhile favourite destinations of Chinese tourists.

The US Supreme Court put on hold Purdue Pharma’s $6bn bankruptcy settlement that would shield members of the Sackler family, the company’s owners, from future lawsuits linked to the opioid crisis.

Tapestry, owner of fashion brands Coach, Kate Spade and Stuart Weitzman, agreed to buy Capri Holdings, home to luxury labels Versace, Jimmy Choo and Michael Kors, for $8.5bn. The combined revenue of the six brands is more than $12bn.

Driverless taxis have been approved in San Francisco, the first US city where they are free to roam the roads and carry paying passengers without restrictions.

Science round-up

July was officially the hottest month ever recorded. The European Earth observation agency said the average global temperature was about 1.5C warmer than that of the pre-industrial period of 1850 to 1900 before human-induced climate change began to take effect. A third of England’s healthcare facilities will be at risk from heatwaves by 2050.

An FT Big Read looks at the sudden warming of the oceans where missing ice and bleached coral are just some of the visible signs of climate change concerning researchers.

A UK-commissioned report showed Antarctica is facing a catastrophic cascade of extreme environmental events as global warming increases, which will affect climate across the world.

New research suggests early humans were wiped out in Europe by “glacial cooling” more than a million years ago, challenging the idea that people have continuously lived in the region since first arriving.

Hopes that Cambridge might become the “science capital of Europe” have taken a knock as locals object to building plans and the lack of water and transport infrastructure. Staying out of the EU’s Horizon research programme would also do great damage, says the FT editorial board.

On a more positive note, top scientists said the UK would be better prepared for the next pandemic with a new vaccines centre that aims to develop a jab for any new potential killer pathogen within 100 days.

AstraZeneca signed a deal with Chinese pharma company CanSino Biologics to develop messenger RNA vaccines for infectious diseases, building on the success of the technology in finding a jab for Covid-19.

The US is investing $1.2bn in projects aiming to strip carbon dioxide out of the atmosphere with hopes that the technology could play a big role in achieving its net zero goals.

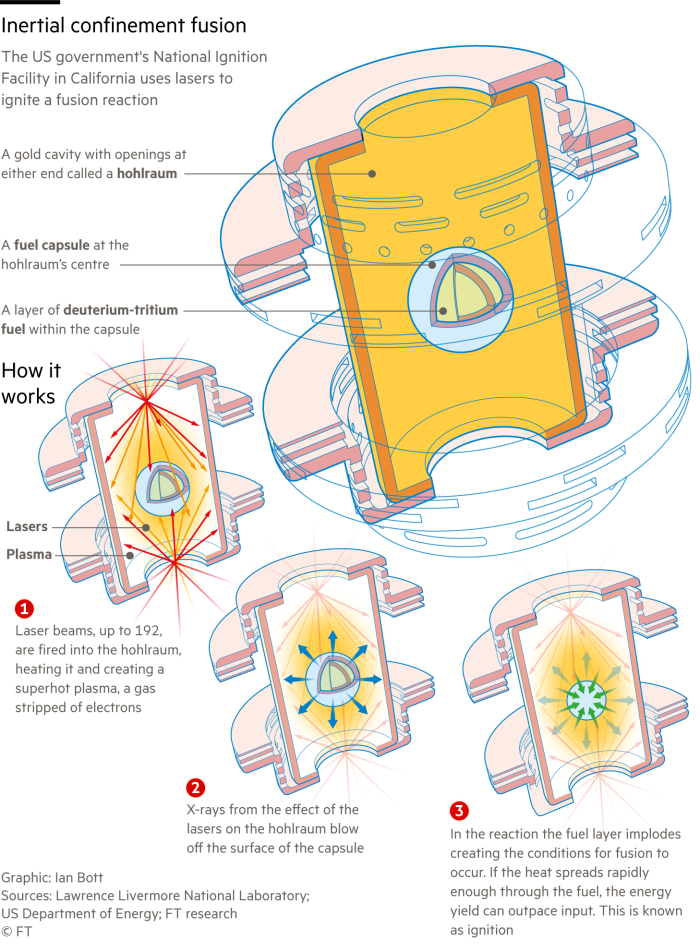

The biggest news of the week also came from the US, where scientists achieved net energy gain in a fusion reaction for the second time, an accomplishment described by US energy secretary Jennifer Granholm as “one of the most impressive science feats of the 21st century”. Here’s a reminder of how it works.

Something for the weekend

Try your hand at the range of FT Weekend and daily cryptic crosswords.

Interactive crosswords on the FT app

Subscribers can now solve the FT’s Daily Cryptic, Polymath and FT Weekend crosswords on the iOS and Android apps

Some good news

Plastic waste recycling is gaining momentum. The latest development comes from US researchers who have found a way of turning containers into soap.

Thanks for reading Disrupted Times. If this newsletter has been forwarded to you, please sign up here to receive future issues. And please share your feedback with us at disruptedtimes@ft.com. Thank you

[ad_2]

Source link