[ad_1]

HSBC is raising mortgage rates for the second time in a week, a move expected to be copied by other lenders that will ramp up the financial pressure on UK households and the political danger for prime minister Rishi Sunak.

Brokers warned that other UK lenders would follow HSBC’s decision on Wednesday, exacerbating the cost of living crisis ahead of an election next year.

Moves to withdraw or reprice mortgage deals have increased in recent weeks as the financial markets react to stubbornly high inflation data, which has changed expectations of how far the Bank of England will have to raise interest rates.

The issue dominated exchanges at prime minister’s questions on Wednesday, with Sunak insisting the government’s “number one priority” was cutting inflation and bearing down on interest rates.

But Sir Keir Starmer, Labour leader, claimed Sunak was distracted by political infighting in the ruling Conservative party at a time when people were worried about “their bills, the cost of the weekly shop and spiralling mortgage rates”.

HSBC, one of the UK’s largest mortgage lenders, said it would withdraw its rates for new residential mortgages by 5pm on Wednesday, before announcing new prices on Thursday. Last week the bank wrongfooted mortgage brokers by pulling its deals at short notice before repricing earlier this week.

“Over recent days, cost of funds has increased and, like other banks, we have had to reflect that in our mortgage rates,” it said.

Lenders fear that volatility in swap rate markets — which they use to price their fixed-rate mortgages — will leave them exposed. Adrian Anderson, director at broker Anderson Harris, said he was “confident other [lenders] will follow shortly”.

Andrew Montlake, managing director at broker Coreco, said HSBC was unlikely to be the last lender to raise rates this week. Having withdrawn and repriced its rates to allow it to process a flood of applications, he said “swap rates have moved again and they’re still getting lots of business, so they’ve had to move them up again”.

Simon Gammon, founder and managing partner at broker Knight Frank Finance, said: “They’re nervous about lending at a loss.”

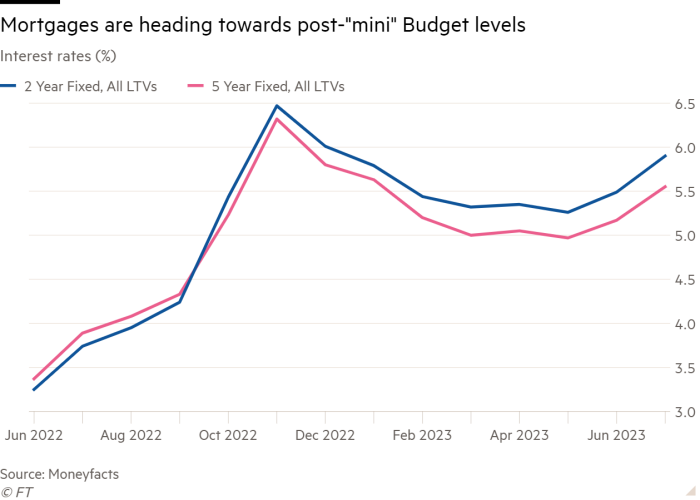

The issue of rising mortgage costs is becoming increasingly political. Fears among Tory MPs about a “mortgage time bomb” contributed to the ousting of Liz Truss as prime minister last year, after her “mini” Budget spooked markets and pushed up interest rates.

Labour is attempting to conflate the Truss economic disaster with the current rise in mortgage rates, suggesting a pattern of Tory economic mismanagement. Sunak insisted the situation now was completely different and the economy was “resilient” and inflation was falling.

Earlier on Wednesday, chancellor Jeremy Hunt said tackling inflation was the “number one challenge” and said the BoE had “no alternative” but to raise interest rates to tackle it. “We have to do everything we can as a government, as a country, to support the Bank of England in their mission to squeeze inflation out of the system. And that is our primary focus.”

On Monday, Santander said it was temporarily withdrawing all of its fixed and tracker mortgages for new borrowers “in light of changing market conditions”. Clydesdale Bank, NatWest and Coventry Building Society were among lenders that raised rates across their home loans portfolio this week.

BM Solutions, a specialist buy-to-let lender that is part of Lloyds Banking Group, said on Wednesday it would withdraw rates across its range on Thursday evening, and return with higher prices from Friday.

The average interest rate on a two-year residential fixed product hit 5.9 per cent on Tuesday, up from 5.26 per cent at the beginning of May, according to finance site Moneyfacts. A year ago, rates on two-year fixed mortgages were averaging 3.25 per cent.

The rise in the cost of borrowing is already being felt by estate agents. “It is not starting to hurt yet,” said Matthew Leonard, director at estate agent Winkworth in Bath, but added that the sales market was “definitely quieter” in recent weeks.

[ad_2]

Source link