[ad_1]

The ability to offer businesses more ways to accept digital payments is crucial globally, but merchants’ specific needs typically differ based on geography.

In recognition of those nuances, Liquido has for two years been working on building payments infrastructure aimed at modernizing payments access for businesses in Latin America. And today, the company is emerging from stealth to offer what it describes as core payment services that “serve a wide range of needs and customer preferences….through one unified and integrated API.”

Interestingly, while many companies in the U.S. may start out serving clients in their home country and later expand to LatAm, Mountain View, California-based Liquido started out specifically to serve the LatAm market. So far, it’s processed more than $300 million in payments through a closed beta with several consumer brands in the region ($20 million of that was processed in the first two quarters of 2022), and now says it’s ready to open access to cross border and local merchants across Latin America.

Digital payment via credit cards is very common in the U.S., but in LatAm, where an estimated 28% even have credit cards, it is far less so. And even among those who do use credit cards, fraud is quite prevalent. Yet, the transaction value of digital commerce in Latin America was estimated at more than $100 billion in 2019 and is now expected to increase by about 73% by 2025, according to Statista. In a nutshell, Liquido wants to make it easier for people to buy things online. With Liquido, the startup touts that businesses can accept and process “all forms of payment” — from credit and debit cards to bank transfers to digital wallets, and even cash — in order to increase payment acceptance rates.

“Between my work at Uber and DiDi, I spent several years devoted to the LatAm market, and I was struck by the prevalence of cash payments for rides,” said Shanxiang Qi, Liquido co-founder and CTO. “This observation led me to conclude that even the middle and upper echelons of society in the region lacked convenient access to digital payments, which ultimately limited options for business.”

Qi teamed up with MK Li, a former VC who began his career as a product manager at Google and Microsoft.

The pair say with Liquido, they are building in LatAm something “similar to what Stripe has built in the U.S.” but also expanding beyond traditional payments into extended payment services.

“A company like Stripe or dLocal could work right now for the market but doesn’t quite provide the same level of seamless experience as they could do in Europe and the U.S.,” he told TechCrunch in an interview. “Their infrastructure is quite different. And also there are a lot of silos of different channels of payment. And, the users also have different preferences about payments as well as risk profiles. The fraud profile in the local market is drastically different.”

To help remedy fraud, Liquido says it has built something called a “Payment Success Booster,” which does things like perform customizable fraud flagging and transaction blocking, WhatsApp payment recovery, flexible payment method switching and smart routing and retrying.

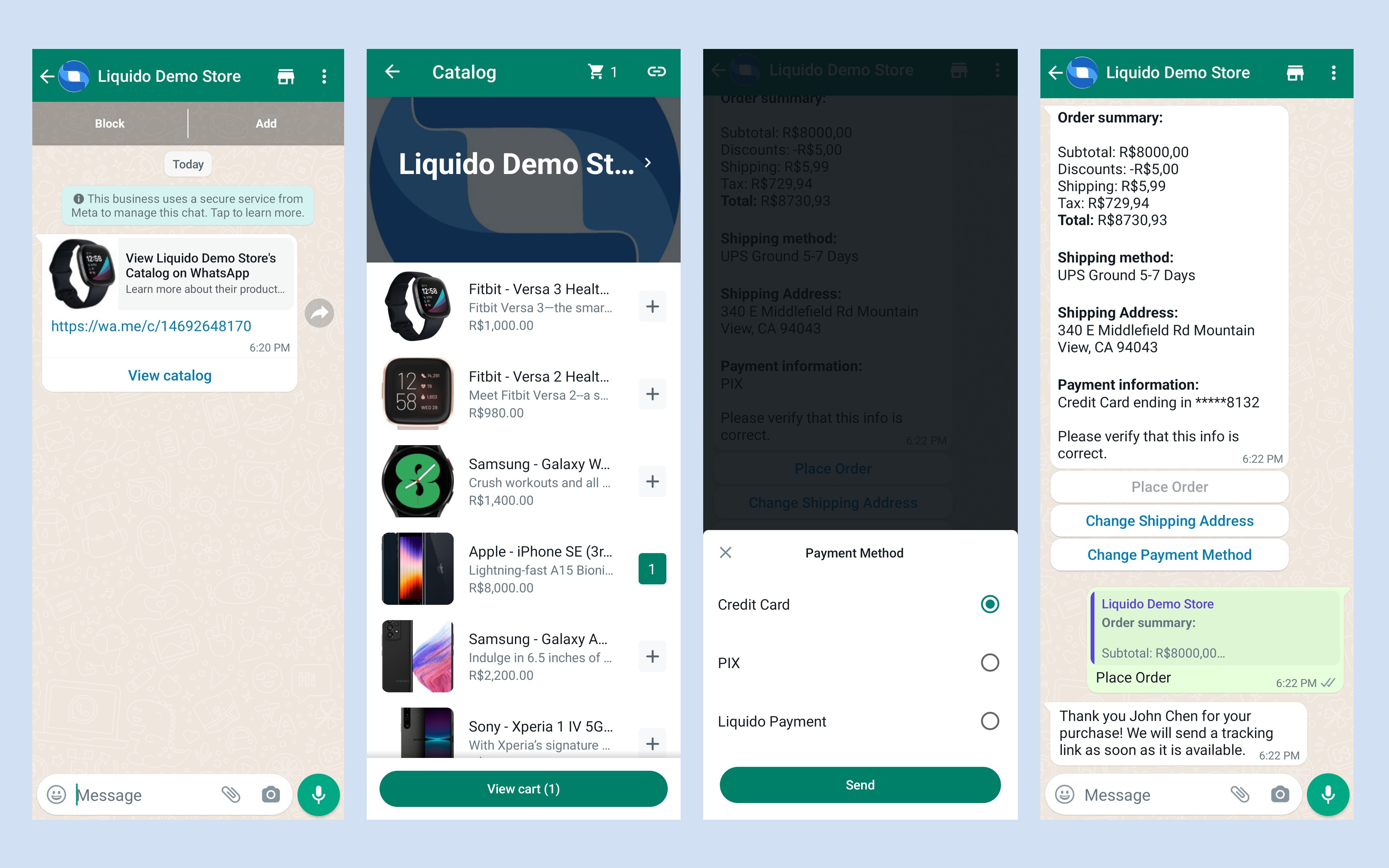

The company says it has also built a Payment Plus Platform (PPP), which runs on top of its core payment services and is designed to “create customer experiences tailored to local markets and grow within verticals.” The company has now introduced the first offering for its PPP, something it calls the “WhatsApp Liquido-Store.” It allows merchants to create “a mini Shopify-like storefront within WhatsApp” without any coding knowledge required, they say, giving customers a way to browse, find and buy from merchants through WhatsApp, which is by far the most used social network in Latin America.

Image credit: Liquido

Liquido says it also provides alternative solutions to help companies to make payroll payments as well as pay suppliers and associated businesses through bank transfers. Now, the company takes payments further.

The startup in 2021 raised $26 million in funding across two rounds, both led by Index Ventures. Other backers include Base Partners, Restive Ventures, Mantis VC and UpHonest Capital.

“Shan and MK tapped into payments in a part of the world that was ripe for disruption,” said Mark Fiorentino, a partner at Index Ventures. “Based on their previous work, they each brought a depth of understanding to the issues and developed one of the most advanced, yet practical, payments systems found anywhere in the world.”

Fiorentino is impressed with the evolution of the company’s offering over time, in particular, the addition of the WhatsApp Liquido store.

“There’s an interesting opportunity to help increase conversion rates and LTV per user,” he said. “So suddenly this is not just a payments company, but more like payment-enabled software in a way that owns more of the revenue generation and cost reduction value chain.”

Want more fintech news in your inbox? Sign up here.

Got a news tip or inside information about a topic we covered? We’d love to hear from you. You can reach me at maryann@techcrunch.com. Or you can drop us a note at tips@techcrunch.com. Happy to respect anonymity requests.

[ad_2]

Source link