[ad_1]

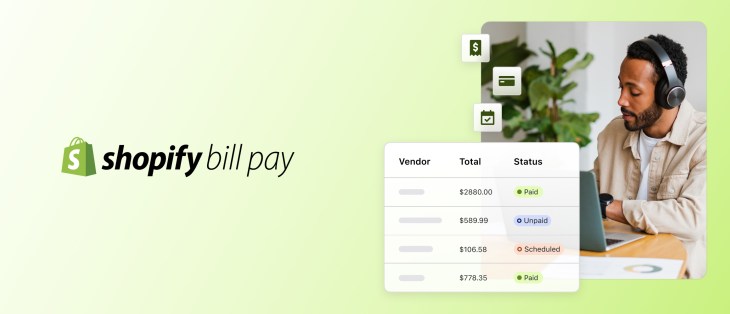

Shopify has teamed up with Israeli B2B payments startup Melio to launch a new bill pay tool designed to allow U.S.-based merchant customers to manage their expenses and vendors via its platform.

It’s another step in Shopify’s plan to straddle the intersection of fintech and commerce, noted Shruti Patel, global head of merchant services partnerships and monetization at Shopify.

The rationale behind the new feature plays to the notion that if merchants can spend less time on tedious tasks such as consolidating their invoices and paying bills, they can spend more time focusing on growing their businesses. It also was in part driven by merchants asking for money movement capabilities, Patel told TechCrunch in an interview.

“We have been on the fintech journey since we introduced payments back in the day, powered by Stripe,” she said. “That gave us tons of insight on our payments data. And then we came out and offered Shopify Capital in 2016, which was designed to meet our merchants’ micro and macro lending needs. And then last year we introduced what we call Shopify Balance, which was almost like a money management tool.”

Shopify intentionally worked to embed the bill pay feature into its existing product — and the same place its merchant customers run their businesses — because it wanted it to be a fully integrated accounts payable solution within the store administration.

“If you look at how banks offer and financial institutions offer bill pay today, it’s a pretty redirect experience,” Patel said. “…But a lot of those experiences are pretty broken because they just link to a bank account and enable them to use them through that one method of payment.”

By contrast, she said, Shopify merchants will have a choice of funding sources such as a bank account, Shopify Balance, credit or debit card or an ACH bank transfer. They can even pay with credit cards even if a vendor doesn’t accept them.

“It’s not only the cost optionality on which payment method and how to choose that, but also the speed we are allowing them to schedule payments,” Patel added. Shopify, for example, can allow for payments to be made up to four days earlier than a traditional bank, she said. Merchants also have the option to pre-schedule payments.

The bill pay feature is free for its merchants but there are “minimal fees” associated with certain payment methods such as a credit card, according to Patel.

“One of the reasons we wanted to do this for our merchants is going back to some of the feedback we heard which was how much bill pay is a pain point, especially for smaller merchants who cannot afford very expensive subscription plans,” she said.

Internally, having the ability to offer bill pay will offer Shopify insights on how they’re spending and which vendors they’re spending with.

“And today, banks have that insight, but they don’t really do anything with it, because they’re not running storefronts for the small businesses,” Patel said. “What we want to do is really have that data help us drive more revenue for our merchants.”

Shopify declined to say how many merchants it has in the U.S., noting only that it works with “millions of merchants” overall.

Want more fintech news in your inbox? Sign up here.

[ad_2]

Source link