[ad_1]

(Bloomberg) — FedEx Corp. is ripping up founder Fred Smith’s well-worn playbook as it rethinks virtually the entire business. That could mean the end of FedEx drivers as we know them.

The courier’s vast and complex system of overlapping delivery networks will be simplified with the integration of its two largest business lines in the most sweeping restructuring in its 50-year history. Chief Executive Officer Raj Subramaniam, who took over for Smith less than a year ago, calls it “a more holistic approach to how we move packages” that will help the company save $6 billion by 2027.

The overhaul centers on a merger between its Ground unit, which uses non-employee contractors to move parcels, and its Express division, which hires only staff drivers. FedEx didn’t offer many specifics on the integration plans or implications, aside from telling investors last week that it would use a “hybrid” of the employee and contractor models.

With volume expected to migrate to the lower-cost Ground unit, experts predict the company will lean more toward contractors — and potentially do away with staff drivers entirely.

“Will they go all the way to independent contractor service-providers? Yes, I see that happening,” said Satish Jindel, founder of ShipMatrix, which provides logistical consulting and market data.

The move would draw a sharp contrast with rival United Parcel Service Inc., which has long earned higher margins even with a fleet of highly paid, unionized staff drivers. At a time of waning e-commerce and economic uncertainty, FedEx aims to put shareholder returns ahead of its previous growth mindset.

Read more: FedEx Aims to Cut Costs by Merging Delivery Networks

The plan is winning rave reviews on Wall Street, but it’s not without challenges, in the form of potentially heavy job losses. It’s akin to a corporate merger in its scope and complexity, and FedEx’s track record with such integrations is mixed.

“There is past execution risk with this company,” said Trip Miller, managing partner at Gullane Capital Partners, a Memphis-based fund that has been a longtime FedEx shareholder. “Things have not always gone to plan and in the planned time period.”

In its earliest days, FedEx was built around its Express business, in which packages are loaded onto planes, flown near their final destinations and transfered to company-owned trucks for delivery. Smith started the company in 1973 with a handful of Falcon 20 private jets that were converted to freighters. That first day of operations, FedEx delivered 186 packages.

When FedEx bought a trucking business in 1998, Smith insisted it remain a distinct operation, giving rise to the Ground unit. Unlike Express, the new business line stuck to road-based routes plied by contract drivers. To customers, there was little distinction — both staff and contract drivers wear FedEx-branded uniforms and operate trucks with the logo on the side. In practice, it gave people a cheaper-but-slower alternative while giving FedEx more flexibility, Smith argued.

It also meant that the Ground and Express units didn’t coordinate with each other, sending staff and non-staff drivers on overlapping routes and duplicating costs for such things as the finance department and back-office work.

UPS, by contrast, always has operated a single network, even after beginning air express service in 1988 to counter FedEx. Despite having a unionized fleet of drivers, UPS has consistently outpaced the company by profitability as it capitalizes on the efficiencies of its network. Since Carol Tome took over as CEO in 2020, UPS has widened its adjusted operating margins to 13.8% for 2022, compared to just 6.1% for FedEx.

See also: FedEx Contractor Revolt Intensifies With Calls for Pay Raise

The contractor model offers a considerable labor-cost advantage, giving FedEx a big opportunity if it’s able to generate network efficiencies similar to UPS, said John Haber, the chief strategy officer for Transportation Insight. For years, FedEx Ground took market share from UPS, which at one time was the only large, private ground courier, Haber said.

“It makes sense to me that the contractor model is the direction to go for them,” Haber said. “It’s definitely a less costly model for sure.”

The move toward contractors also makes sense because the delivery of ground packages doesn’t fall under the Railway Labor Act, which governs union workers in the railroad and airline industries. FedEx’s Express unit operates airplanes, and those workers currently fall under the restrictive labor law. Consolidating ground deliveries into Express, where drivers are on the payroll, could open up FedEx to a unionization effort, Haber said.

“It’s definitely much more difficult with the contractor model to unionize,” he said.

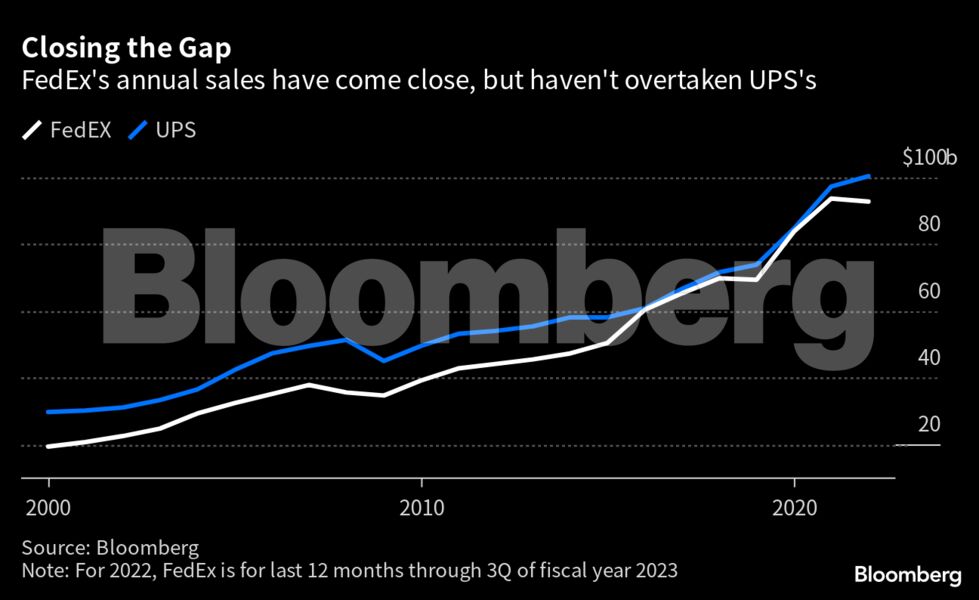

UPS has long been a foil for Smith. In a 2019 interview with Bloomberg, the then-CEO described FedEx’s growth-at-all-costs strategy through the lens of its battle with UPS, saying he was “firmly of the belief we will pass UPS” within three years. Last year, FedEx generated $93.5 billion in revenue, trailing its rival by about $7 billion.

Smith, who remains FedEx’s chairman, declined to comment for this article, as did Subramaniam.

The shakeup has already led to workforce reductions, including 10% of top management. In February, the company said 12,000 jobs had been eliminated since June. By the end of next month, FedEx expects to have cut 25,000 US workers over the past fiscal year.

FedEx had 345,000 full-time employees and about 202,000 part-time workers as of May 31. FedEx’s Ground unit has more than 6,000 delivery contractors.

The company has hinted at a shift toward the Ground unit and away from Express, which is FedEx’s largest by sales and least profitable. The courier plans to reduce flights to Asia by consolidating volume on fewer planes and moving packages by truck when feasible. Already, the improved ability to track and reroute packages and optimize that data has made it possible for Express packages to be handled by Ground.

“It’s not that they’re trying something that is so out of this reality and practicality,” said Jindel, of ShipMatrix. “They didn’t have the relationship between Express and Ground volume that could have allowed them to do it earlier.”

The decision to break from Smith’s approach was cheered by analysts. At least 12 raised their stock-price targets or recommendations immediately after the announcement, even as they warned of challenges.

JPMorgan’s Brian Ossenbeck called the move “a significant and complicated change that will take time to execute.” The transition could make FedEx more vulnerable to service disruptions, said Helane Becker, an analyst with TD Cowen.

“While we believe these network changes should reduce costs, operational reliability could suffer in cases of severe weather or unscheduled employee absences,” Becker said in a note.

Integrating the businesses could be a tall order for FedEx, which has struggled with such matters in the past. The company in 2016 bought TNT Express for $4.8 billion to expand in Europe. That deal became an albatross after leading to heavy costs at a time of weak international demand. It was also hit by a severe cyberattack that crippled the courier’s computer systems and caused some customers to leave. FedEx has only recently completed the integration of those operations.

FedEx has a long history of reducing guidance. While announcing a cost-cut plan in September, Subramaniam withdrew profit targets he had just set in June. The revised guidance in December was well below the earlier forecast.

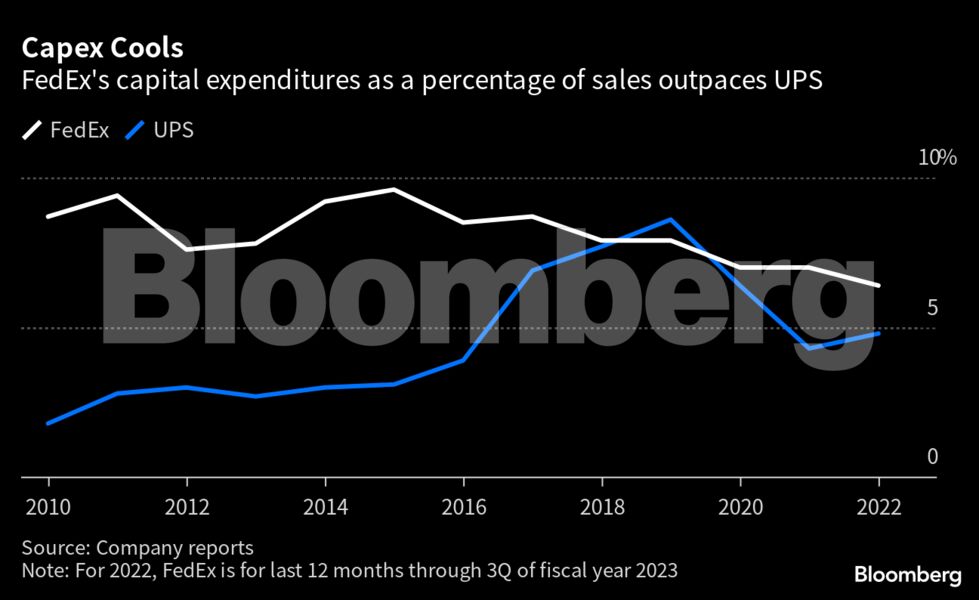

To boost margins, Subramaniam is scaling back on capital expenditures after decades of hefty investment to spur growth and narrow FedEx’s sales gap with UPS. The restructuring also calls for $4 billion in cost savings through fiscal 2025, with metrics to help track their progress.

“What’s critical now is that over next two years as this is being implemented they can show on a quarterly earnings call that they are achieving those interim milestones,” Jindel said. “It’s not something that happens in one specific day. Every day they need to be executing on them.”

© 2023 Bloomberg L.P.

[ad_2]

Source link