[ad_1]

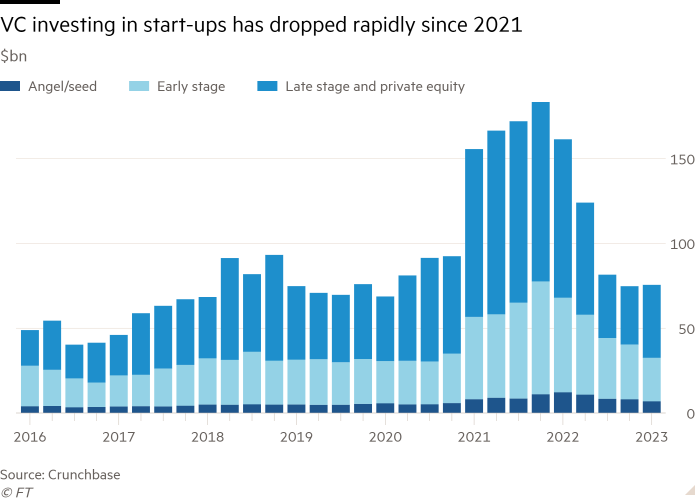

Venture capital funding of start-ups has plunged by more than 50 per cent in the past 12 months, as an economic downturn weighs on valuations at nascent tech groups.

Globally, venture funds invested $76bn into start-ups in the first three months of 2023, less than half the $162bn they deployed in the same period a year ago, according to data provider Crunchbase.

That sharp drop is despite two large fundraising rounds for tech companies taking place this year. In January, Microsoft invested $10bn into generative artificial intelligence company OpenAI, and last month payments company Stripe raised $6.5bn from investors.

Without the Microsoft transaction with OpenAI, the first quarter of 2023 would have been the worst quarter for venture investment in more than five years.

The collapse of start-up focused lender Silicon Valley Bank last month will further destabilise the funding ecosystem for young technology companies, squeezing those that relied on the bank for debt, said Gené Teare, senior data editor at Crunchbase.

As worsening economic conditions continue to damp sentiment for riskier investments, thousands of fledgling companies with an urgent need for capital are being forced to confront a collapse in their valuations, agree to punitive debt deals or face insolvency.

“Even before SVB [collapsed] this was the worst business environment anyone had seen,” said Sam Yagan, founder of dating website OKCupid and now an investor in early-stage companies.

“Most entrepreneurs and VCs have never been through a down market. We were telling people you can’t assume there will be more capital waiting for you. Now there are really good companies that can’t get capital.”

In the five years to the end of 2021, investment volumes roughly quadrupled as venture funds deployed more capital on behalf of institutional investors such as pension funds and university endowments, as well as new entrants including hedge fund Tiger Global which looked to ride the wave of rising tech valuations.

Since then, private market valuations at many start-ups that were once the darlings of Silicon Valley investors have been battered. Stripe, valued at $95bn in 2021, is now worth roughly half that having pushed through a fundraise last month at a valuation of $50bn.

The trend has forced some VCs to mark down the value of the companies held in their funds. Tiger wiped a third, or $23bn, off the value of its start-up holdings including Stripe and TikTok parent ByteDance earlier this year.

According to Crunchbase, VCs had a record $580bn of “dry powder” — cash they have raised but not yet invested — at the end of the first quarter. A largely frozen market for initial public offerings has also cut off a key source of funding for late-stage companies.

This has left many start-ups are facing a choice between raising money at a lower valuation, taking on debt, or cutting costs and trying to limp on until the funding environment improves.

Investors anticipate a wave of company failures later this year, as some start-ups run out of cash. The founder of one large Silicon Valley venture fund said: “Things are very, very tough.”

[ad_2]

Source link