[ad_1]

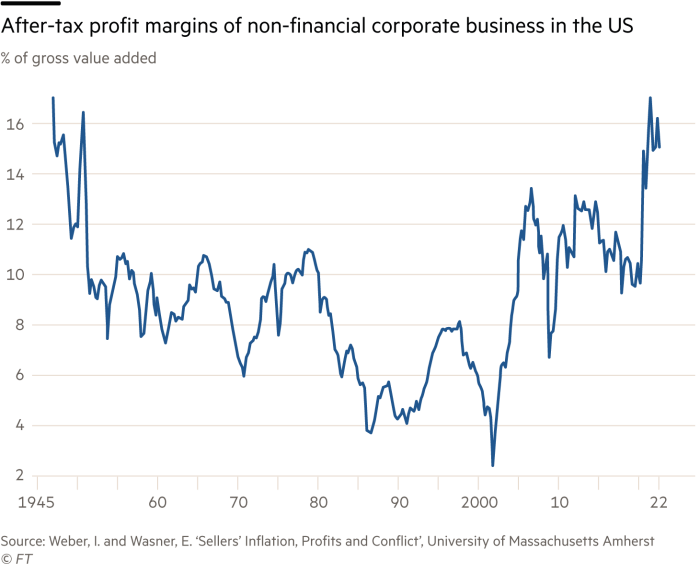

Profit margins of US companies have reached levels not seen since the aftermath of the second world war.

There is a strong correlation between the rising share of corporate profits in gross domestic product and the sharp price rises in the US after the Covid pandemic, according to a paper published by the University of Massachusetts.

Having made windfall profits on the back of commodity price fluctuations and supply bottlenecks, large companies have been emboldened to raise prices further to increase profit margins.

They found that there was little evidence that the models used to explain the inflation of the 1970s — such as excess aggregate demand, money supply expansion or increased wage costs that prompted a spiral — applied to this recent rise. Covid-19 price rises are predominantly a sellers’ inflation, they say. Where cost increases are being experienced by all their competitors, companies have felt safe to pass them on in the expectation of an “implicit agreement” that rivals will do the same.

Federica Cocco and Keith Fray

Our other charts of the week . . .

The introduction of remote work as a result of the pandemic has helped boost birth rates, specifically among wealthier and more educated women.

“While the long-running decline of fertility rates across the developed world makes it difficult to be optimistic overall about the future trajectory of births, the rise of remote work is one factor that seems likely to help push in the other direction, at least in some subgroups of the population,” said the authors of the analysis carried out by the Economic Innovation Group, a US-based think-tank.

Increasing birth rates would give an important boost to economic growth, and counterbalance demographic changes such as an ageing population.

The study also found that unmarried remote workers were significantly more likely than those who do not work remotely to plan on getting married in the next year. This is possibly because remote workers have higher migration rates than other workers, meaning those interested in marriage may have been able to relocate closer to a potential spouse.

Federica Cocco

Britons’ approval rating of the leadership of the EU, on the rise since 2013, surpassed 50 per cent in 2022 for the first time since the survey began. At 51 per cent, this is more than the 46 per cent who approve of the UK’s leadership.

The last time a majority of Britons approved of the country’s leadership was in 2006, when Tony Blair was prime minister.

Federica Cocco

The majority of Britons support strikes by nurses and ambulance workers. The share has increased by 3 per cent since January, according to polling company Ipsos.

Teachers and railway workers are the next most widely supported, with sympathy also up since January, whereas support has declined for strikes in other sectors, including border and passport control staff, civil servants, university staff and driving examiners.

Talks on Thursday between ministers and health unions resulted in a promising pay offer. Substantially improved terms for nurses, ambulance staff and other NHS workers in England have raised hopes that other disputes could be resolved soon.

The RMT has agreed to ballot members on an improved offer from Network Rail and teaching unions began talks on pay, conditions and workload on Friday.

Serena Chan

The European energy crisis has not put customers off big cars.

In January, total sport utility vehicle sales grew 14 per cent year on year to 464,000 units — a record 51 per cent share of new car registrations in the EU, according to market researcher Jato Dynamics.

While petrol guzzling and diesel models remained the most popular choice, accounting for about three-quarters of new SUV sales, the figures show demand for plug-in hybrid and pure electric versions of the “Chelsea Tractor” are gaining ground.

Despite the launch of greener electric models SUV’s continue to be hugely popular. Plug-in hybrid SUVs, which offer a compromise between more polluting internal combustion engines and costly pure electric vehicles, have experienced particularly high interest.

Patrick Mathurin

Welcome to Datawatch — regular readers of the print edition of the Financial Times might recognise it from its weekday home on the front page.

Do you have thoughts on any of the charts featured this week — or any other data that has caught your eye in the past seven days? Let us know in the comments.

Keep up to date with the latest visual and data journalism from the Financial Times:

-

Data Points. The weekly column from the FT’s chief data reporter John Burn-Murdoch.

-

Climate Graphic of the Week is published every week on our Climate Capital hub page.

-

Sign up to The Climate Graphic: Explained newsletter, free for FT subscribers. Sent out every Sunday, a behind the scenes look at the most topical climate data of the week from our specialist climate reporting and data visualisation team.

-

Follow the Financial Times on Instagram for charts and visuals from significant stories.

-

Follow FT Data on Twitter for news graphics and data-driven stories from across the FT.

[ad_2]

Source link